Samvardhana Motherson Stock Gains Momentum Before Dividend Declaration

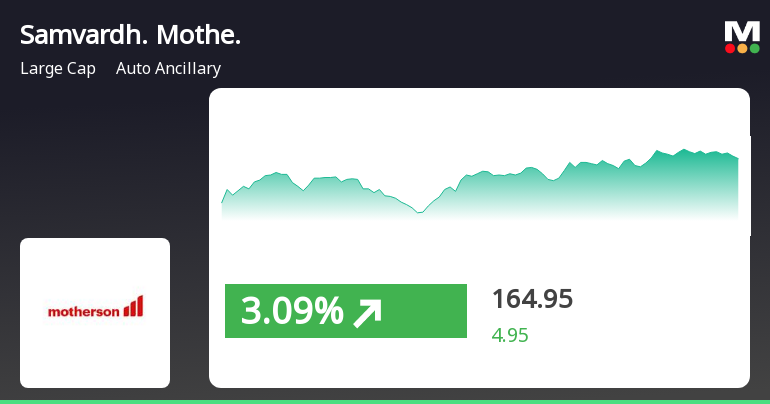

Ahead of its upcoming board meeting to consider and approve a proposal for an interim dividend for the financial year 2024-25 (FY25), shares of Samvardhana Motherson opened on a positive note in today’s trading session. The stock began the day at ₹129.99 per share on the National Stock Exchange (NSE) and quickly gained momentum, reaching an intraday high of ₹131.37 within the first few minutes after the market opened.

The company had earlier informed Indian stock market exchanges about its board meeting scheduled for March 21, 2025, where the management will deliberate on the proposal for an interim dividend for FY25. Investors and market participants are closely watching the stock, anticipating the outcome of this key meeting, which could have implications for shareholder returns.

As the date approaches, the stock’s movement reflects investor sentiment and expectations surrounding the potential dividend announcement.

Samvardhana Motherson Board Meeting to Consider Interim Dividend for FY25

Samvardhana Motherson has officially notified the Indian stock exchanges about an upcoming board meeting scheduled for Friday, March 21, 2025. The company stated that the meeting will be held at shorter notice and will primarily focus on discussing and considering the declaration of an interim dividend for its equity shareholders for the financial year 2024-25 (FY25).

This announcement indicates that the board will evaluate the company’s financial position and performance before making a decision on the potential payout. Investors and market participants are closely monitoring the development, as dividend announcements often influence stock sentiment and investor interest.

If approved, this will mark Samvardhana Motherson’s first dividend announcement for the financial year 2024-25 (FY25). The company has a track record of rewarding its shareholders, with its most recent dividend payout occurring in the previous financial year.

Before this, the stock traded ex-dividend on August 14, 2024, as part of the process to determine the eligible shareholders who would receive the final dividend of ₹0.80 per share. The ex-dividend date is crucial in dividend investing, as it marks the cutoff point for shareholders to be entitled to the payout. Investors and market participants are now awaiting the outcome of the upcoming board meeting to see if the company continues its dividend distribution trend in FY25.

Samvardhana Motherson Reports Strong Year-on-Year Profit Growth in Q3 FY25

Samvardhana Motherson posted robust financial results for the third quarter of the financial year 2024-25 (Q3 FY25), showcasing steady revenue growth and a substantial surge in profitability compared to the same period last year.

The company’s topline (total revenue) recorded a 7.66% year-on-year (YoY) increase, reaching ₹27,665.92 crore. Meanwhile, its net profit surged by an impressive 62.12% YoY, climbing to ₹878.63 crore, reflecting strong operational efficiency and financial performance.

However, on a quarter-on-quarter (QoQ) basis, revenue experienced a slight dip of 0.52%, while net profit saw a marginal decline of 0.13% compared to the previous quarter. Additionally, the company reported a rise in selling, general, and administrative (SG&A) expenses, which grew by 3.39% QoQ and 17.33% YoY, indicating increased operational costs.

Despite these cost increases, operating income showed strong momentum, rising 16.98% QoQ and 16.35% YoY, highlighting improved efficiency in core business operations.

Furthermore, earnings per share (EPS) for Q3 FY25 stood at ₹1.25, marking a significant 56.25% YoY increase. This reflects the company’s ability to generate higher profits per share, contributing to shareholder value.

As the company continues to focus on operational growth and financial stability, market participants and investors are closely monitoring its performance and strategic decisions in the upcoming quarters.