JWL Share Price Target Tomorrow 2025 To 2030

Jupiter Wagons Limited (JWL) is a key player in the railway and transportation sector, specializing in manufacturing railway wagons, components, and automotive solutions. The company’s growth is driven by strong demand for railway infrastructure and government investments in transportation. JWL’s stock attracts investors due to its potential in the railway and logistics industry. JWL Share Price on NSE as of 22 March 2025 is 347.30 INR.

Current Market overview of JWL Share Price

- Open: 313.90

- High: 362.80

- Low: 312.05

- Previous Close: 313.50

- Volume: 32,984,200

- Value (Lacs): 114,752.03

- VWAP: 349.02

- Mkt Cap (Rs. Cr.): 14,768

- Face Value: 10

- UC Limit: 376.20

- LC Limit: 250.80

- 52 Week High: 748.10

- 52 Week Low: 270.05

JWL Share Price Target Tomorrow 2025 To 2030

| JWL Share Price Target Years | JWL Share Price |

| 2025 | INR 750 |

| 2026 | INR 850 |

| 2027 | INR 950 |

| 2028 | INR 1050 |

| 2029 | INR 1150 |

| 2030 | INR 1250 |

JWL Share Price Chart

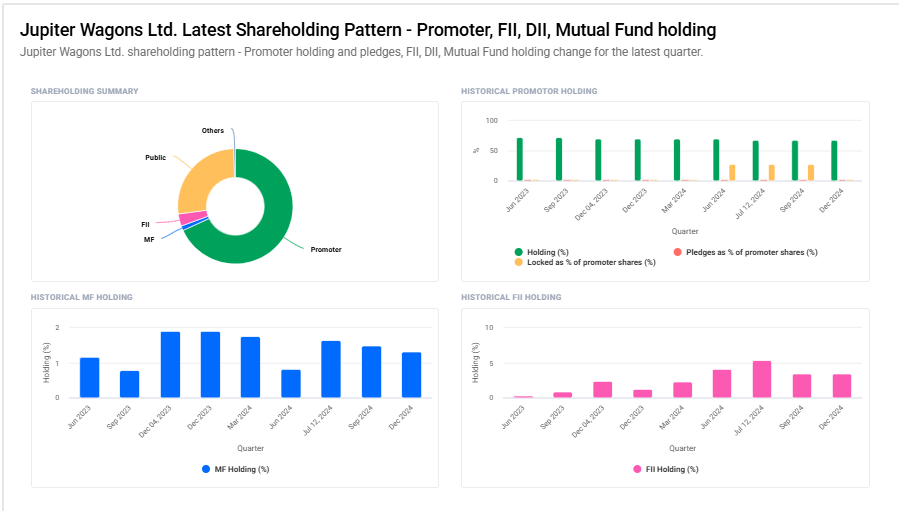

JWL Shareholding Pattern

- Promoter: 68.1%

- FII: 3.4%

- DII: 1.7%

- Public: 26.7%

Key Factors Affecting JWL Share Price Growth

-

Growth in the Auto Sector

JWL (Jupiter Wagons Limited) is involved in manufacturing railway wagons and automotive components. If the automobile and railway sectors perform well, demand for JWL’s products increases, leading to potential share price growth. -

Government Investments in Railways

Since JWL supplies wagons and rail-related equipment, government spending on railway infrastructure and freight corridor projects can boost its revenue, positively impacting stock performance. -

Order Book Strength

A strong and growing order book from Indian Railways and private companies ensures stable revenue flow. Large contracts and repeat orders indicate business stability, which can drive the share price up. -

Expansion and New Business Ventures

If JWL expands its production capacity or enters new business segments like electric mobility or defense, it could create additional revenue streams, leading to higher stock valuation. -

Raw Material Prices

The cost of raw materials like steel and aluminum affects JWL’s production expenses. If prices remain stable or decrease, profit margins improve, positively influencing the share price. -

Financial Performance and Profitability

Investors closely watch JWL’s earnings reports. Rising revenue, profit growth, and strong financials attract investors, increasing demand for the stock and pushing the price higher. -

Market Sentiment and Institutional Investments

Increased interest from institutional investors and positive analyst ratings can boost confidence in JWL’s stock. Strong investor sentiment generally supports share price growth over time.

Risks and Challenges for JWL Share Price

-

Dependence on Government Orders

JWL relies heavily on contracts from Indian Railways and government projects. Any delay or reduction in government spending on railway infrastructure can negatively impact its revenue and stock price. -

Raw Material Price Volatility

The company requires steel and other metals for manufacturing. If raw material prices increase sharply, production costs rise, which can reduce profit margins and affect investor confidence. -

Competition from Established Players

The railway and automotive components industry is competitive, with major players like Texmaco Rail and Titagarh Wagons. Strong competition could limit JWL’s market share and affect future growth. -

Economic Slowdown or Recession

If the economy slows down, industrial production and railway expansion projects may be delayed, reducing demand for JWL’s products and potentially impacting its stock price. -

Regulatory and Policy Changes

Changes in government policies, railway regulations, or environmental laws could create operational hurdles. Stricter compliance requirements may increase costs and affect profitability. -

Limited Diversification

JWL is primarily focused on railway wagons and automotive components. A lack of diversification means any slowdown in these sectors could directly affect its business and share price. -

Stock Market Volatility

Broader market fluctuations, global uncertainties, or negative investor sentiment can impact JWL’s stock price, even if the company’s fundamentals remain strong.

Read Also:- Zomato Share Price Target Tomorrow 2025 To 2030