Vodafone Idea Share Price Target Tomorrow 2025 To 2030

Vodafone Idea (Vi) is one of India’s leading telecom companies, formed by the merger of Vodafone India and Idea Cellular. The company’s shares are listed on Indian stock exchanges and attract investor interest due to its potential turnaround plans. However, it faces challenges like high debt, intense competition, and the need for fresh funding. Vodafone Idea Share Price on NSE as of 24 March 2025 is 7.43 INR.

Current Market overview of Vodafone Idea Share Price

- Open: 7.72

- High: 7.74

- Low: 7.43

- Previous Close: 7.62

- Volume: 331,238,850

- Value (Lacs): 24,644.17

- VWAP: 7.55

- Mkt Cap (Rs. Cr.): 53,116

- Face Value: 10

- UC Limit: 8.38

- LC Limit: 6.85

- 52 Week High: 19.18

- 52 Week Low: 6.61

Vodafone Idea Share Price Target Tomorrow 2025 To 2030

| Vodafone Idea Share Price Target Years | Vodafone Idea Share Price |

| 2025 | INR 20 |

| 2026 | INR 25 |

| 2027 | INR 30 |

| 2028 | INR 35 |

| 2029 | INR 40 |

| 2030 | INR 45 |

Vodafone Idea Share Price Chart

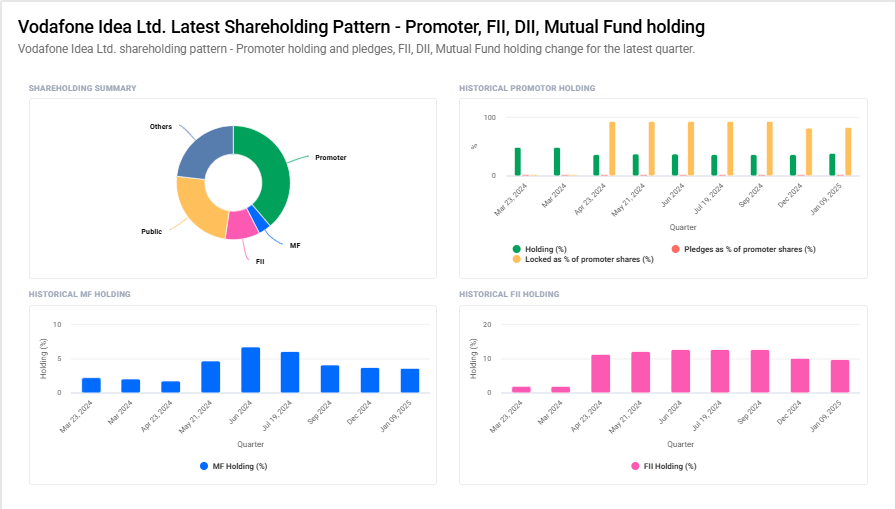

Vodafone Idea Shareholding Pattern

- Promoter: 38.8%

- FII: 9.9%

- DII: 26.8%

- Public: 24.5%

Key Factors Affecting Vodafone Idea Share Price Growth

Risks and Challenges for Vodafone Idea Share Price

-

High Debt Burden

Vodafone Idea has a massive debt load, including AGR dues and spectrum liabilities. If the company struggles to manage repayments, it may face financial stress, impacting investor confidence and share prices. -

Subscriber Losses

The company has been continuously losing customers to competitors like Jio and Airtel. A declining user base affects revenue generation, which can lead to lower market valuation and a drop in share price. -

Liquidity & Fundraising Challenges

Vodafone Idea needs significant funds for operations, network expansion, and 5G rollout. If it fails to raise capital through investors or banks, its financial condition may worsen, affecting share performance. -

Competitive Pressure

The Indian telecom market is highly competitive, with Jio and Airtel dominating. Vodafone Idea needs to improve service quality and pricing to compete. If it fails to do so, it risks further market share erosion. -

Regulatory & Policy Risks

Any unfavorable government policies, tax changes, or legal battles related to AGR dues or spectrum charges can negatively impact Vodafone Idea’s business and share price stability. -

Limited 5G Readiness

While competitors are aggressively rolling out 5G, Vodafone Idea has financial constraints that delay its expansion. A slower 5G rollout may reduce its ability to compete, affecting long-term stock growth. -

Operational & Service Quality Issues

Network issues, customer dissatisfaction, or disruptions in services can further damage the company’s reputation. If Vodafone Idea fails to improve its service quality, investors may lose confidence, leading to a decline in share prices.

Read Also:- IFCI Share Price Target Tomorrow 2025 To 2030