Vikas Lifecare Share Price Target Tomorrow 2025 To 2030

Vikas Lifecare is a company engaged in the business of plastic recycling, sustainable packaging, and FMCG products. The company focuses on eco-friendly solutions, contributing to the circular economy. Its share price is influenced by factors like demand for sustainable products, raw material costs, government policies, and overall market trends. Vikas Lifecare Share Price on NSE as of 29 March 2025 is 2.68 INR.

Current Market overview of Vikas Lifecare Share Price

- Open: 2.73

- High: 2.82

- Low: 2.67

- Previous Close: 2.68

- Volume: 13,523,120

- Value (Lacs): 362.42

- VWAP: 2.70

- Mkt Cap (Rs. Cr.): 497

- Face Value: 1

- UC Limit: 3.21

- LC Limit: 2.14

- 52 Week High: 6.03

- 52 Week Low: 2.67

Vikas Lifecare Share Price Target Tomorrow 2025 To 2030

| Vikas Lifecare Share Price Target Years | Vikas Lifecare Share Price |

| 2025 | INR 7 |

| 2026 | INR 10 |

| 2027 | INR 13 |

| 2028 | INR 16 |

| 2029 | INR 19 |

| 2030 | INR 22 |

Vikas Lifecare Share Price Chart

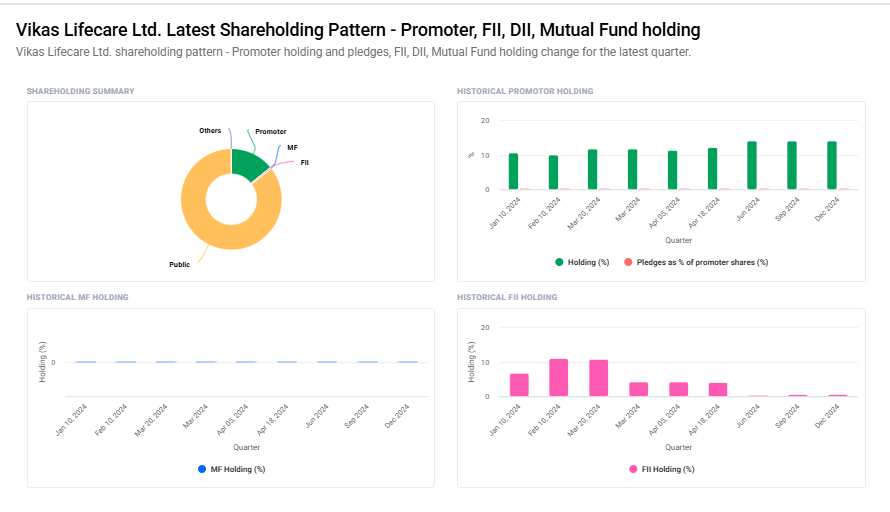

Vikas Lifecare Shareholding Pattern

- Promoter: 14.2%

- FII: 0.5%

- DII: 0%

- Public: 85.3%

Key Factors Affecting Vikas Lifecare Share Price Growth

-

Business Expansion & New Projects

-

Vikas Lifecare is expanding its presence in key sectors like FMCG, agriculture, and recycled plastics. New projects and investments in innovative products can boost investor confidence and drive share price growth.

-

-

Revenue Growth & Profitability

-

Consistent growth in revenue and profits plays a crucial role in attracting investors. If the company maintains strong financial performance, it can positively impact the stock price.

-

-

Raw Material Prices & Supply Chain

-

Since Vikas Lifecare deals in plastic and chemical-based products, fluctuations in raw material costs can affect profit margins. Efficient supply chain management can help improve financial stability.

-

-

Government Policies & Regulations

-

Supportive policies related to plastic recycling, sustainable products, and agriculture can benefit the company. However, stricter environmental regulations may require additional investments, impacting short-term profits.

-

-

Market Demand & Consumer Trends

-

Increasing demand for eco-friendly and sustainable products benefits Vikas Lifecare. If the company successfully meets consumer needs, its market position and stock value may strengthen.

-

-

Strategic Partnerships & Acquisitions

-

Collaborations with major companies or acquisitions of smaller firms can enhance business operations, leading to better growth prospects and a potential rise in share price.

-

-

Overall Stock Market & Economic Conditions

-

Broader economic trends, inflation rates, and stock market movements also influence Vikas Lifecare’s stock performance. A strong economic environment can support long-term growth.

-

Risks and Challenges for Vikas Lifecare Share Price

-

Fluctuations in Raw Material Prices

-

Vikas Lifecare depends on raw materials like plastics and chemicals. If prices of these materials rise due to global supply issues, the company’s costs may increase, affecting profitability and share price.

-

-

Regulatory & Environmental Challenges

-

The company operates in industries that are subject to strict environmental laws and government regulations. Any changes in policies, especially related to plastic use and waste management, may impact its operations and growth.

-

-

Market Competition

-

Vikas Lifecare competes with large players in the FMCG, plastic recycling, and agriculture sectors. Strong competition can limit pricing power and reduce the company’s market share, affecting revenue growth.

-

-

Dependence on Consumer Demand

-

The company’s performance is linked to demand for sustainable products and recycled materials. If market trends shift or consumer interest declines, sales may drop, leading to lower investor confidence.

-

-

Global Economic Conditions

-

Economic slowdowns, inflation, or changes in currency exchange rates can impact both production costs and consumer spending, indirectly affecting the company’s growth and stock price.

-

-

Stock Market Volatility

-

Like all stocks, Vikas Lifecare’s share price is affected by overall market conditions. Any major corrections or negative investor sentiment can lead to sudden price fluctuations.

-

-

Operational & Management Risks

-

The company’s ability to manage expansion, supply chain disruptions, and operational efficiency plays a crucial role in its success. Poor decision-making or management issues can slow down growth and affect stock performance.

-

Read Also:- BOB Share Price Target Tomorrow 2025 To 2030