Reliance Share Price Target Tomorrow 2025 To 2030

Reliance Industries Limited (RIL) is one of India’s largest and most valuable companies, with a strong presence in telecom, retail, petrochemicals, and renewable energy. Its share price is influenced by business growth, oil price trends, competition, and market conditions. Reliance has shown strong financial performance over the years, attracting both domestic and global investors. Reliance Share Price on NSE as of 21 March 2025 is 1,277.40 INR.

Current Market overview of Reliance Share Price

- Open: 1,275.00

- High: 1,280.55

- Low: 1,270.10

- Previous Close: 1,269.15

- Volume: 3,623,229

- Value (Lacs): 46,295.81

- VWAP: 1,276.55

- Mkt Cap (Rs. Cr.): 1,729,098

- Face Value: 10

- UC Limit: 1,396.05

- LC Limit: 1,142.25

- 52 Week High: 1,608.80

- 52 Week Low: 1,156.00

Reliance Share Price Target Tomorrow 2025 To 2030

| Reliance Share Price Target Years | Reliance Share Price |

| 2025 | INR 1610 |

| 2026 | INR 2040 |

| 2027 | INR 2435 |

| 2028 | INR 2814 |

| 2029 | INR 3243 |

| 2030 | INR 3652 |

Reliance Share Price Chart

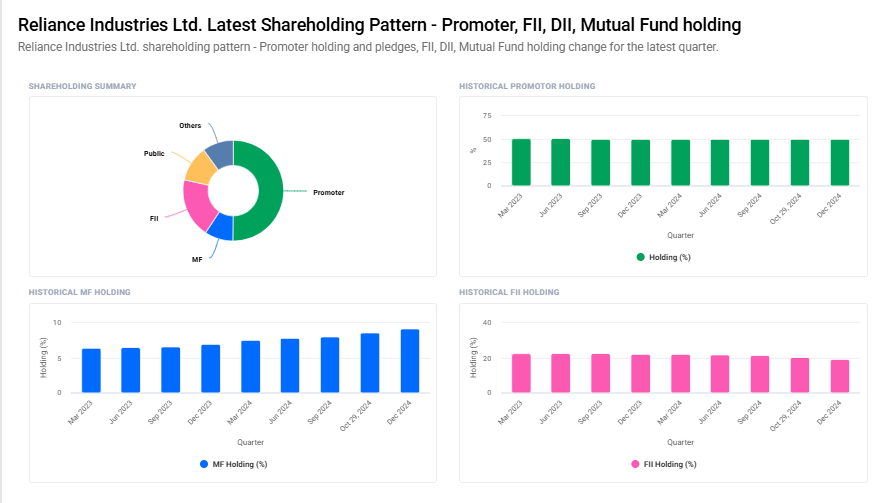

Reliance Shareholding Pattern

- Promoter: 50.1%

- FII: 19.2%

- DII: 19.2%

- Public: 11.5%

Key Factors Affecting Reliance Share Price Growth

-

Strong Performance of Jio & Digital Business

Reliance Jio continues to dominate the telecom sector, attracting millions of users. Growth in 5G services, digital expansion, and partnerships in tech can boost the company’s revenue, positively impacting its share price. -

Expansion in Retail Business

Reliance Retail is growing rapidly with store expansions, e-commerce ventures, and strategic acquisitions. As India’s retail market expands, Reliance’s strong presence can drive revenue and investor confidence. -

Oil & Gas Segment Profitability

The company’s traditional oil and refining business remains a key revenue source. High global crude oil prices and efficient refining operations contribute to steady earnings, supporting share price growth. -

Green Energy Investments

Reliance is aggressively investing in renewable energy, including solar, hydrogen, and battery storage projects. As the world moves towards clean energy, these initiatives can attract new investors and drive long-term growth. -

Strategic Acquisitions & Partnerships

Reliance regularly acquires promising businesses and partners with global giants in telecom, retail, and energy. These moves enhance its market position and contribute to future growth potential. -

Government Policies & Regulations

Favorable government policies, subsidies for green energy, and ease of doing business can benefit Reliance. Any regulatory changes in telecom, retail, or energy sectors can also impact its share price. -

Market Sentiment & Global Economic Conditions

Reliance’s stock performance is influenced by overall market trends, global economic conditions, and foreign investments. A positive economic environment boosts investor confidence, leading to share price growth.

Risks and Challenges for Reliance Share Price

-

Regulatory & Policy Risks

Reliance operates in multiple sectors like telecom, energy, and retail, which are subject to government regulations. Any unfavorable policy changes, such as telecom spectrum pricing or retail FDI restrictions, could impact business operations and profitability. -

High Competition Across Segments

In telecom, Jio faces competition from Bharti Airtel and Vodafone-Idea. In retail, online giants like Amazon and Flipkart are strong competitors. The company must continuously innovate to maintain its market leadership, or it may lose market share. -

Volatility in Crude Oil Prices

Reliance’s oil refining and petrochemical business is heavily affected by crude oil price fluctuations. A sharp decline in oil prices can reduce refining margins, while a steep rise can increase input costs, impacting profitability. -

Debt Levels & Capital Expenditure

Although Reliance has reduced its debt significantly, ongoing investments in 5G, renewable energy, and retail expansion require large capital. If these investments do not generate expected returns, it could put financial pressure on the company. -

Global Economic Slowdown

If global economic conditions worsen due to inflation, geopolitical tensions, or a financial crisis, investor sentiment may weaken, leading to a decline in Reliance’s stock price. Reduced consumer spending could also impact its retail and telecom businesses. -

Disruptions in Supply Chain & Operations

Reliance relies on a vast supply chain for its oil refining, telecom, and retail businesses. Disruptions due to geopolitical conflicts, pandemics, or logistics issues can affect business operations and revenue growth. -

Stock Market Volatility & Investor Sentiment

Reliance’s share price is influenced by overall stock market trends, foreign institutional investor (FII) movements, and macroeconomic conditions. Any negative sentiment or profit-booking by large investors can lead to short-term stock price declines.

Read Also:- Reliance Power Share Price Target Tomorrow 2025 To 2030