Maharashtra Bank Share Price Target Tomorrow 2025 To 2030

Bank of Maharashtra (BoM) is a public sector bank in India with a strong presence in retail and corporate banking. Its share price is influenced by factors like loan growth, interest rates, government policies, and overall economic conditions. As a PSU bank, it benefits from government support but also faces competition from private and digital banks. Maharashtra Bank Share Price on NSE as of 24 March 2025 is 48.47 INR.

Current Market overview of Maharashtra Bank Share Price

- Open: 48.40

- High: 49.55

- Low: 48.31

- Previous Close: 47.98

- Volume: 11,887,973

- Value (Lacs): 5,762.10

- VWAP: 48.75

- Mkt Cap (Rs. Cr.): 37,280

- Face Value: 10

- UC Limit: 57.57

- LC Limit: 38.38

- 52 Week High: 73.50

- 52 Week Low: 43.67

Maharashtra Bank Share Price Target Tomorrow 2025 To 2030

| Maharashtra Bank Share Price Target Years | Maharashtra Bank Share Price |

| 2025 | INR 75 |

| 2026 | INR 85 |

| 2027 | INR 95 |

| 2028 | INR 105 |

| 2029 | INR 115 |

| 2030 | INR 125 |

Maharashtra Bank Share Price Chart

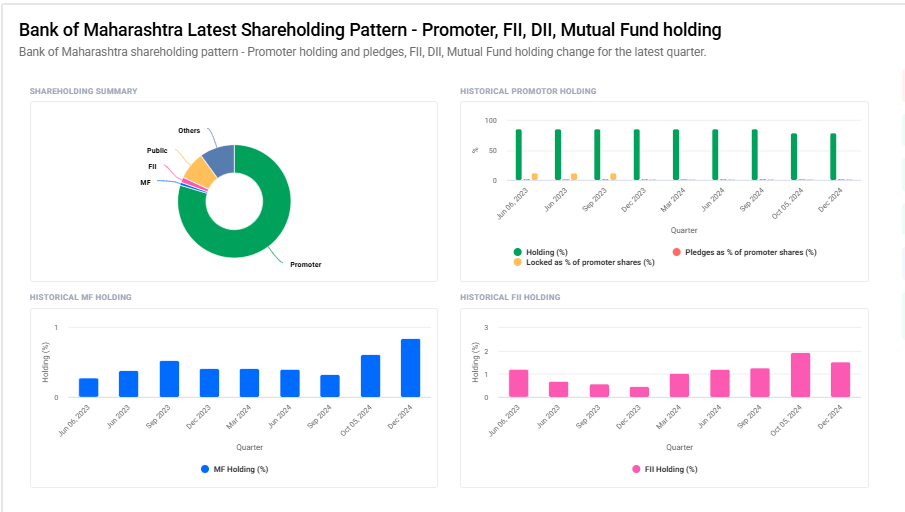

Maharashtra Bank Shareholding Pattern

- Promoter: 79.6%

- FII: 1.5%

- DII: 10.9%

- Public: 8%

Key Factors Affecting Maharashtra Bank Share Price Growth

-

Loan Growth & Credit Expansion

Maharashtra Bank’s share price depends on its ability to grow its loan book. If the bank successfully increases lending to businesses and individuals while maintaining low defaults, it can boost profitability and attract investors. -

Asset Quality & Non-Performing Assets (NPAs)

A lower percentage of bad loans (NPAs) improves investor confidence. If Maharashtra Bank effectively manages its loan recoveries and reduces NPAs, its share price is likely to grow. -

Interest Rate Movements

The bank’s earnings are influenced by RBI’s interest rate policies. Higher interest rates can improve net interest margins (NIMs), while lower rates may encourage more lending, both affecting share price growth. -

Government & RBI Policies

As a public sector bank, Maharashtra Bank’s growth depends on government policies related to banking, financial inclusion, and recapitalization plans. Favorable policies can positively impact share price growth. -

Digital Transformation & Technology Adoption

The bank’s investment in digital banking, fintech partnerships, and improved customer experience can enhance its competitiveness, leading to better earnings and share price appreciation. -

Economic Growth & Business Environment

A strong economy supports business expansion and credit demand. If India’s economy grows steadily, Maharashtra Bank may benefit from increased deposits, lending, and overall profitability, boosting its share price. -

Market Sentiment & Investor Confidence

Positive market sentiment, strong financial performance, and institutional investor interest can drive Maharashtra Bank’s stock price. Regular dividend payouts and steady earnings also attract long-term investors.

Risks and Challenges for Maharashtra Bank Share Price

-

High Non-Performing Assets (NPAs)

If the bank struggles with bad loans, it can impact profitability and investor confidence. A rising NPA ratio increases provisions, reducing earnings and affecting share price negatively. -

Interest Rate Fluctuations

Changes in RBI’s interest rates impact the bank’s net interest margin (NIM). If rates drop, lending margins shrink, affecting revenue. If rates rise too much, loan demand may decline, hurting growth. -

Regulatory & Government Policies

Being a public sector bank, Maharashtra Bank is influenced by government decisions, including loan waivers, financial regulations, and capital infusion plans. Unfavorable policies can limit profitability and stock performance. -

Economic Slowdown & Market Conditions

If India’s economy faces a slowdown, demand for loans may drop, and customers may struggle to repay existing loans. This could impact earnings and put pressure on the bank’s share price. -

Competition from Private & Digital Banks

The rise of private sector banks and fintech companies offering faster and more flexible banking solutions can reduce Maharashtra Bank’s market share, affecting its revenue and stock value. -

Cybersecurity & Technology Risks

As digital banking expands, risks of cyber fraud, data breaches, and IT system failures increase. Any major security issue can harm customer trust and lead to financial losses, impacting stock performance. -

Market Volatility & Investor Sentiment

Global financial uncertainties, banking sector trends, and investor sentiment can lead to sharp movements in Maharashtra Bank’s share price. Negative news or weak earnings reports can trigger sell-offs.

Read Also:- JWL Share Price Target Tomorrow 2025 To 2030