ITC Share Price Target Tomorrow 2025 To 2030

ITC is one of India’s leading conglomerates, known for its strong presence in cigarettes, FMCG, hotels, paperboards, and agri-business. While its cigarette segment contributes significantly to revenue, the company is rapidly expanding its FMCG and hospitality businesses. ITC’s stock is considered a stable investment due to its strong financials, high dividend payouts, and consistent growth strategy. ITC Share Price on NSE as of 13 March 2025 is 411.75 INR.

Current Market overview of ITC Share Price

- Open: 413.00

- High: 414.40

- Low: 408.20

- Previous Close: 412.40

- Volume: 7,807,747

- Value (Lacs): 32,121.07

- VWAP: 412.43

- Mkt Cap (Rs. Cr.): 514,803

- Face Value: 1

- UC Limit: 453.60

- LC Limit: 371.20

- 52 Week High: 528.50

- 52 Week Low: 391.20

ITC Share Price Target Tomorrow 2025 To 2030

| ITC Share Price Target Years | ITC Share Price |

| 2025 | INR 530 |

| 2026 | INR 570 |

| 2027 | INR 600 |

| 2028 | INR 640 |

| 2029 | INR 680 |

| 2030 | INR 720 |

ITC Share Price Chart

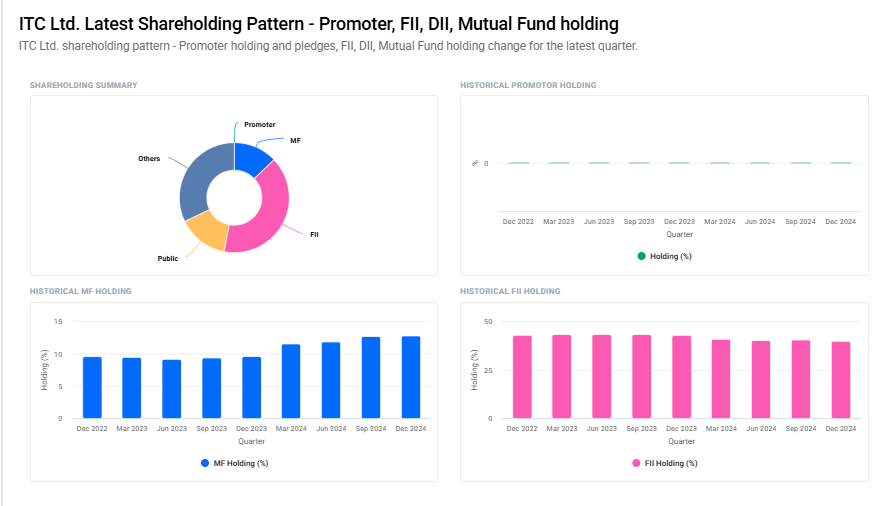

ITC Shareholding Pattern

- Promoter: 0%

- FII: 40.2%

- DII: 45%

- Public: 14.9%

Key Factors Affecting ITC Share Price Growth

-

Strong FMCG Growth

ITC is expanding its presence in the FMCG sector with successful brands in food, personal care, and household products. Continued growth in this segment can drive higher revenues and improve profitability, positively impacting the stock price. -

Tobacco Business Stability

Despite regulatory challenges, ITC’s cigarette business remains a major revenue driver. Steady demand and pricing power in this segment provide consistent cash flow, supporting the company’s overall financial health. -

Hotel and Agri-Business Expansion

ITC’s hospitality and agri-business segments are seeing strong growth due to increasing travel demand and rising agricultural exports. Expansion in these areas can contribute to overall revenue diversification and profitability. -

Sustainable Packaging and Paperboard Business

The company’s paper and packaging division is benefiting from the growing demand for eco-friendly solutions. As sustainability becomes a priority for industries, ITC’s innovative packaging solutions can drive long-term business growth. -

Dividend Payout and Strong Financials

ITC is known for its consistent dividend payouts, making it attractive to investors. Its strong balance sheet, stable cash flow, and low debt levels add to investor confidence, supporting stock price appreciation. -

Government Regulations and Taxation Policies

Changes in taxation and regulations on tobacco and FMCG products can impact ITC’s profitability. Favorable policies or stable tax rates can support stock growth, while stricter regulations may pose challenges. -

Market Sentiment and Economic Trends

ITC’s stock is influenced by overall market trends, investor sentiment, and economic conditions. A strong consumer market, rising disposable income, and positive industry trends can enhance ITC’s valuation and share price performance.

Risks and Challenges for ITC Share Price

-

Regulatory and Taxation Risks

ITC’s cigarette business, which contributes a significant portion of its revenue, is heavily regulated. Any increase in taxes, stricter regulations, or government restrictions on tobacco products can negatively impact sales and profitability. -

Slower FMCG Growth and Competition

While ITC has been expanding in the FMCG sector, it faces tough competition from established brands like HUL, Nestlé, and Dabur. If ITC struggles to gain market share or grow its margins, it may affect its stock performance. -

Volatility in Agricultural and Raw Material Prices

ITC’s agri-business and packaging divisions depend on raw materials like wheat, paper, and other agricultural products. Fluctuations in prices due to climate conditions or supply chain disruptions can impact costs and profitability. -

Cigarette Business Dependency

Although ITC is diversifying, a large portion of its revenue still comes from cigarettes. If tobacco consumption declines due to health awareness, government policies, or social changes, it could hurt the company’s financial stability. -

Economic Slowdown and Consumer Demand

If the economy faces slow growth, consumer spending may decline, affecting demand for ITC’s FMCG products, hotels, and other businesses. A weak economic environment can limit revenue growth and put pressure on the stock price. -

Foreign Institutional Investor (FII) Activity

ITC has a strong presence in foreign investment portfolios. If global investors reduce their holdings due to changing market conditions, regulatory concerns, or sector performance, it may lead to stock price volatility. -

Delays in Business Expansion and Diversification

ITC is working on expanding its non-cigarette businesses, but slower-than-expected progress in FMCG, hotels, or the agri-sector could limit overall revenue growth. Investors may become cautious if diversification efforts do not deliver strong results.

Read Also:- SJVN Share Price Target Tomorrow 2025 To 2030