Integra Essentia Share Price Target Tomorrow 2025 To 2030

Integra Essentia is an Indian company engaged in essential goods, renewable energy, infrastructure, and sustainable solutions. The company focuses on providing eco-friendly products while expanding its business across various sectors. Its stock performance depends on market conditions, demand for sustainable solutions, and overall financial growth. Integra Essentia Share Price on NSE as of 11 March 2025 is 2.53 INR.

Current Market overview of Integra Essentia Share Price

- Open: 2.56

- High: 2.57

- Low: 2.48

- Previous Close: 2.59

- Volume: 2,104,137

- Value (Lacs): 53.02

- VWAP: 2.51

- Mkt Cap (Rs. Cr.): 269

- Face Value: 1

- UC Limit: 3.10

- LC Limit: 2.07

- 52 Week High: 5.25

- 52 Week Low: 2.26

Integra Essentia Share Price Target Tomorrow 2025 To 2030

| Integra Essentia Share Price Target Years | Integra Essentia Share Price |

| 2025 | ₹6 |

| 2026 | ₹8 |

| 2027 | ₹10 |

| 2028 | ₹12 |

| 2029 | ₹14 |

| 2030 | ₹16 |

Integra Essentia Share Price Chart

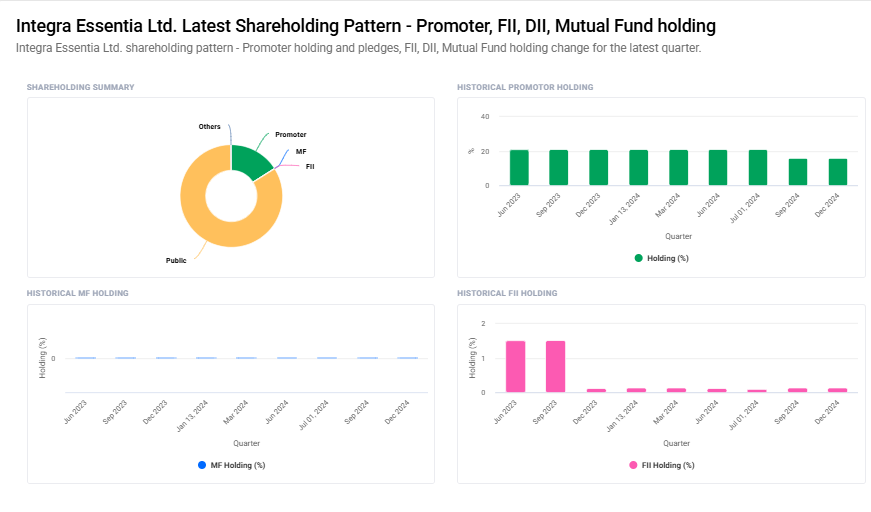

Integra Essentia Shareholding Pattern

- Promoter: 16%

- FII: 0.2%

- DII: 0.1%

- Public: 83.7%

Key Factors Affecting Integra Essentia Share Price Growth

-

Business Expansion and Diversification – Integra Essentia operates in multiple sectors, including essential goods, infrastructure, and renewable energy. Any successful expansion into new markets or product segments can boost revenue and positively impact the share price.

-

Revenue and Profitability Trends – Consistent revenue growth and improving profit margins play a crucial role in building investor confidence. If the company reports strong financial performance, its stock price is likely to grow.

-

Demand for Essential Goods and Sustainable Products – As the company focuses on essential commodities and sustainable solutions, rising consumer demand for these products could drive growth and increase investor interest.

-

Strategic Partnerships and Acquisitions – Collaborations with industry leaders or acquisitions of promising businesses can enhance market presence and operational efficiency, potentially leading to higher stock value.

-

Government Policies and Regulations – Supportive policies for renewable energy, agriculture, and infrastructure can create favorable conditions for Integra Essentia. Compliance with regulatory norms also ensures smooth business operations.

-

Market Trends and Economic Conditions – The overall economic climate, inflation, and consumer spending trends directly affect demand for the company’s products. A stable or growing economy benefits the stock price.

-

Investor Sentiment and Market Liquidity – Positive news, strong financial disclosures, and a growing investor base can improve stock liquidity and boost the share price. On the other hand, negative market sentiment could slow growth.

Risks and Challenges for Integra Essentia Share Price

-

Market Volatility – Like all stocks, Integra Essentia’s share price is affected by market fluctuations. Economic downturns, inflation, or geopolitical events can create uncertainty and impact stock performance.

-

Competitive Pressure – The company operates in sectors with strong competition. Larger and well-established players can dominate the market, making it challenging for Integra Essentia to expand its market share.

-

Regulatory and Policy Risks – Changes in government regulations, tax policies, or compliance requirements, especially in the renewable energy and infrastructure sectors, could impact operations and profitability.

-

Financial Performance and Profitability Concerns – If the company struggles to maintain stable revenue and profit margins, investor confidence may decline, leading to a potential drop in share price.

-

Supply Chain Disruptions – The company relies on raw materials and suppliers for its essential goods and infrastructure business. Disruptions due to inflation, global shortages, or logistics issues could affect production and costs.

-

Investor Sentiment and Liquidity – If investor confidence weakens due to poor financial results, negative news, or management decisions, stock liquidity may decline, making it harder for shareholders to sell their holdings at desired prices.

-

Slow Adoption of Sustainable Products – While the company focuses on sustainability, the demand for such products may take time to grow. A slower shift towards eco-friendly alternatives could delay expected revenue growth.

Read Also:- Waaree Energies Share Price Target Tomorrow 2025 To 2030