Inox Wind Share Price Target Tomorrow 2025 To 2030

Inox Wind is a leading player in India’s wind energy sector, specializing in manufacturing wind turbines and providing turnkey solutions for wind power projects. The company’s share price is influenced by factors like government policies, demand for renewable energy, and financial performance. Inox Wind Share Price on NSE as of 25 March 2025 is 169.12 INR.

Current Market overview of Inox Wind Share Price

- Open: 174.70

- High: 175.85

- Low: 167.40

- Previous Close: 172.85

- Volume: 2,022,027

- Value (Lacs): 3,414.39

- VWAP: 171.18

- Mkt Cap (Rs. Cr.): 22,015

- Face Value: 10

- UC Limit: 207.42

- LC Limit: 138.28

- 52 Week High: 261.90

- 52 Week Low: 117.54

Inox Wind Share Price Target Tomorrow 2025 To 2030

| Inox Wind Share Price Target Years | Inox Wind Share Price |

| 2025 | INR 265 |

| 2026 | INR 300 |

| 2027 | INR 340 |

| 2028 | INR 380 |

| 2029 | INR 420 |

| 2030 | INR 460 |

Inox Wind Share Price Chart

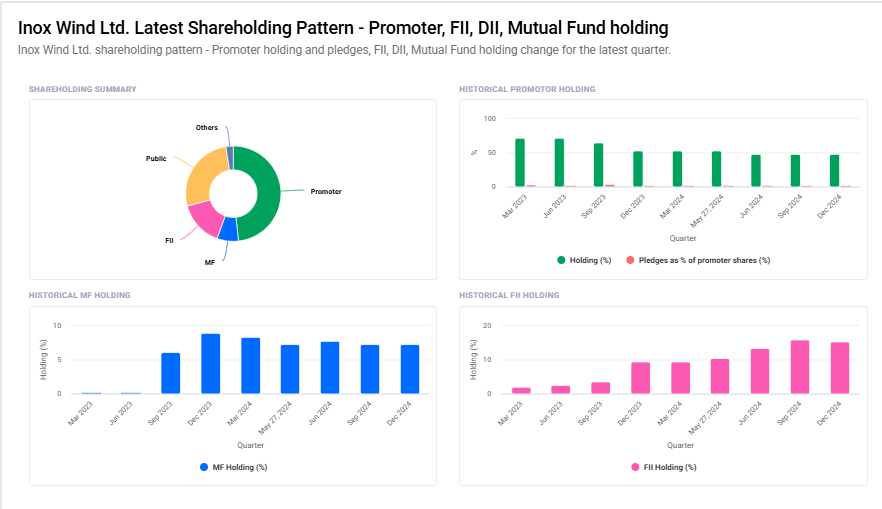

Inox Wind Shareholding Pattern

- Promoter: 48.3%

- FII: 15.3%

- DII: 9.8%

- Public: 26.7%

Key Factors Affecting Inox Wind Share Price Growth

-

Renewable Energy Demand

The global push for clean energy and government policies supporting renewable energy projects increase demand for wind power, benefiting Inox Wind’s business and stock growth. -

Government Policies & Subsidies

Supportive policies, incentives, and subsidies for wind energy projects can boost Inox Wind’s revenue, positively impacting its share price. Any policy change can also affect stock performance. -

Order Book & Project Execution

A strong order book with successful project execution enhances investor confidence. Delays or cancellations can impact revenue and the stock price. -

Technological Advancements

Innovations in wind turbine technology, efficiency improvements, and cost reductions can give Inox Wind a competitive edge, supporting long-term growth. -

Financial Performance

Strong revenue growth, profit margins, and debt management play a crucial role in attracting investors. Poor financial results can lead to a decline in share price. -

Competitive Market Landscape

Competition from domestic and international players affects market share. Inox Wind needs to maintain cost efficiency and innovation to stay ahead. -

Global Energy Trends & Climate Goals

Growing corporate and government commitments to carbon neutrality can increase wind energy investments, boosting Inox Wind’s business and share value.

Risks and Challenges for Inox Wind Share Price

-

Policy & Regulatory Changes

Inox Wind’s business depends on government policies and incentives for renewable energy. Any reduction in subsidies, policy shifts, or delays in approvals can negatively impact growth and stock performance. -

High Competition

The wind energy sector has strong competition from domestic and global players. If Inox Wind fails to innovate or offer competitive pricing, it may lose market share, affecting its revenue and stock price. -

Project Delays & Execution Risks

Delays in project execution due to supply chain disruptions, land acquisition issues, or regulatory hurdles can impact revenue flow and investor confidence. -

Financial Health & Debt Levels

If the company has high debt or struggles with profitability, it may face financial stress. Investors closely watch debt-to-equity ratios and cash flow, which can affect stock valuation. -

Dependence on Raw Materials & Supply Chain

The company relies on raw materials like steel and components for wind turbines. Any price fluctuations, shortages, or import restrictions can increase costs and reduce profitability. -

Global Economic Conditions

Economic downturns, rising interest rates, or inflation can reduce investments in renewable energy projects, slowing growth and affecting share performance. -

Technology & Efficiency Risks

Rapid advancements in renewable energy technology can make older wind turbines less competitive. Inox Wind must continuously invest in R&D to stay relevant; otherwise, its market position and stock price may decline.

Read Also:- Maharashtra Bank Share Price Target Tomorrow 2025 To 2030