HUL Share Price Target Tomorrow 2025 To 2030

Hindustan Unilever Limited (HUL) is one of India’s leading FMCG companies, known for brands like Lux, Dove, Surf Excel, and Horlicks. It operates in personal care, home care, and food & beverages segments. HUL has a strong market presence, wide distribution network, and consistent revenue growth. The company benefits from India’s growing consumer demand, but faces challenges like rising raw material costs and competition. HUL Share Price on NSE as of 26 March 2025 is 2,261.65 INR.

Current Market overview of HUL Share Price

- Open: 2,272.00

- High: 2,279.90

- Low: 2,257.25

- Previous Close: 2,271.30

- Volume: 744,134

- Value (Lacs): 16,833.06

- VWAP: 2,268.82

- Mkt Cap (Rs. Cr.): 531,501

- Face Value: 1

- UC Limit: 2,498.40

- LC Limit: 2,044.20

- 52 Week High: 3,035.00

- 52 Week Low: 2,136.00

HUL Share Price Target Tomorrow 2025 To 2030

| HUL Share Price Target Years | HUL Share Price |

| 2025 | INR 3,035 |

| 2026 | INR 3,540 |

| 2027 | INR 4,050 |

| 2028 | INR 4,545 |

| 2029 | INR 5,074 |

| 2030 | INR 5,750 |

HUL Share Price Chart

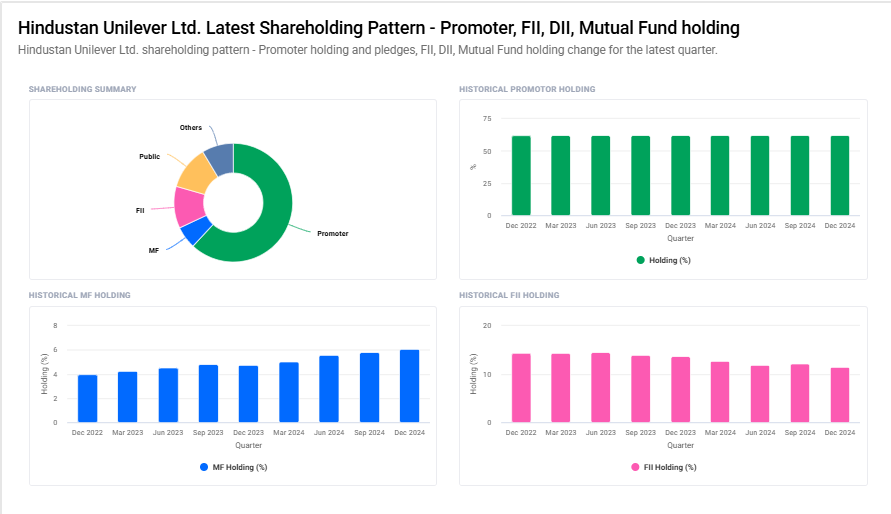

HUL Shareholding Pattern

- Promoter: 61.9%

- FII: 11.4%

- DII: 14.7%

- Public: 11.9%

Key Factors Affecting HUL Share Price Growth

-

Strong Brand Portfolio

Hindustan Unilever Limited (HUL) owns well-known brands in categories like personal care, home care, and food & beverages. Its strong market presence and trusted products help drive consistent revenue growth. -

Rising Consumer Demand

As India’s population and middle class grow, so does the demand for everyday essentials. HUL benefits from this trend, leading to steady sales and positive investor sentiment. -

Innovation & New Product Launches

HUL continuously introduces new products and improves existing ones to stay ahead of competitors. Innovations in premium, sustainable, and health-focused products attract more customers and boost sales. -

Expansion in Rural Markets

The company has been expanding its reach in rural India, where demand for consumer goods is rising. Improved distribution and marketing strategies help HUL tap into this growing market segment. -

Cost Efficiency & Supply Chain Strength

Efficient supply chain management and cost control strategies help HUL maintain profitability even during economic challenges. This stability makes it a strong stock for long-term investors. -

Sustainability & ESG Initiatives

Investors are increasingly focusing on companies with strong environmental, social, and governance (ESG) practices. HUL’s commitment to sustainability and responsible business practices enhances its long-term growth prospects. -

Macroeconomic Conditions & Government Policies

Factors like inflation, taxation, import/export policies, and overall economic stability affect consumer spending. Favorable government policies and economic growth support HUL’s business expansion and share price growth.

Risks and Challenges for HUL Share Price

-

Rising Raw Material Costs

HUL depends on raw materials like palm oil, chemicals, and packaging materials. Any increase in these costs can reduce profit margins, impacting earnings and share price performance. -

Intense Market Competition

The FMCG sector is highly competitive, with strong rivals like ITC, Nestlé, and Procter & Gamble. Price wars and aggressive marketing strategies by competitors could affect HUL’s market share and growth. -

Regulatory & Taxation Policies

Government regulations on product pricing, advertising, and environmental policies can impact operations. Changes in GST rates or other taxation policies may also affect profitability. -

Changing Consumer Preferences

Shifts in consumer trends, such as a growing preference for organic or local brands, can reduce demand for HUL’s traditional products. Failure to adapt quickly may lead to a loss of market share. -

Economic Slowdowns & Inflation

Economic downturns or high inflation can reduce consumer spending, particularly on premium and discretionary products. This could affect HUL’s revenue growth and investor confidence. -

Dependence on Rural Demand Growth

While rural expansion is a key driver, factors like poor monsoons, low agricultural income, or government subsidy cuts can weaken rural demand, slowing HUL’s sales growth. -

Currency Fluctuations & Global Uncertainty

HUL imports some raw materials and exports certain products. A weak rupee or global trade disruptions can increase costs, impacting earnings and share price stability.

Read Also:- Persistent Systems Share Price Target Tomorrow 2025 To 2030