GVK Power Share Price Target Tomorrow 2025 To 2030

GVK Power & Infrastructure Ltd is a company involved in power generation, infrastructure development, and transportation. It operates thermal and hydroelectric power projects in India. The company’s share price is influenced by factors like project execution, financial performance, government policies, and energy demand. GVK Power Share Price on NSE as of 26 March 2025 is 3.24 INR.

Current Market overview of GVK Power Share Price

- Open: 3.24

- High: 3.31

- Low: 3.24

- Previous Close: 3.31

- Volume: 470,307

- Value (Lacs): 15.24

- VWAP: 3.24

- Mkt Cap (Rs. Cr.): 511

- Face Value: 1

- UC Limit: 3.37

- LC Limit: 3.24

- 52 Week High: 12.00

- 52 Week Low: 3.24

GVK Power Share Price Target Tomorrow 2025 To 2030

| GVK Power Share Price Target Years | GVK Power Share Price |

| 2025 | INR 12 |

| 2026 | INR 16 |

| 2027 | INR 20 |

| 2028 | INR 24 |

| 2029 | INR 28 |

| 2030 | INR 32 |

GVK Power Share Price Chart

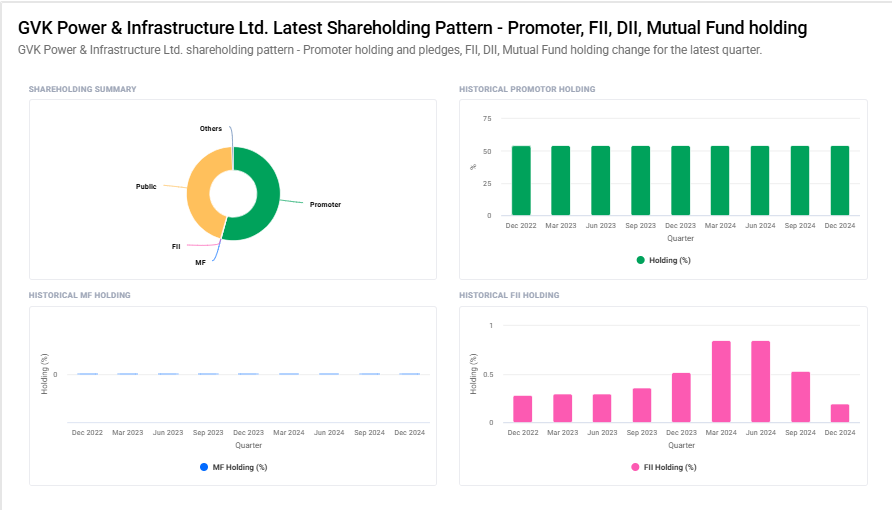

GVK Power Shareholding Pattern

- Promoter: 54.3%

- FII: 0.2%

- DII: 0.5%

- Public: 45.1%

Key Factors Affecting GVK Power Share Price Growth

-

Rising Electricity Demand:- As industries, businesses, and households require more power, companies like GVK Power benefit from increased consumption. Higher demand can boost revenue, leading to potential stock price growth.

-

Government Policies and Support:- Policies related to power generation, infrastructure investment, and renewable energy incentives can impact GVK Power’s growth. Favorable regulations can drive expansion and improve investor confidence.

-

Financial Stability and Debt Management:- The company’s ability to manage its debt and maintain strong financial performance is crucial. Lower debt and better cash flow can improve profitability, attracting more investors to its shares.

-

Investment in Renewable Energy:- As the world moves towards clean energy, companies investing in solar, wind, and hydro projects see better growth potential. If GVK Power expands in renewables, it can gain long-term benefits and market value.

-

Operational Efficiency and Cost Control:- Efficient power generation, lower maintenance costs, and improved plant utilization help increase profits. Investors prefer companies with strong operational performance, which can positively affect stock prices.

-

Competitive Position in the Market:- GVK Power competes with companies like NTPC, Tata Power, and Adani Power. Its ability to secure contracts, expand capacity, and maintain competitive pricing will impact its share price performance.

-

Overall Market and Economic Conditions:- Inflation, interest rates, and global energy trends influence stock prices. A strong economy and stable energy policies can support GVK Power’s growth, leading to potential appreciation in its stock value.

Risks and Challenges for GVK Power Share Price

-

High Debt Levels:- GVK Power has significant debt, and high interest payments can impact profitability. If the company struggles to manage its debt, it may affect investor confidence and share price.

-

Regulatory and Policy Risks:- Changes in government policies, environmental regulations, or licensing issues can affect power companies. Stricter norms or delays in approvals may create hurdles for GVK Power’s growth.

-

Fluctuating Power Tariffs:- The company’s revenue depends on power tariffs, which can be influenced by government decisions and market conditions. If tariffs fall or remain stagnant, it can impact earnings and share price.

-

Operational Challenges:- Power plants require high maintenance and efficiency to remain profitable. Technical failures, outages, or rising fuel costs can increase operational expenses, reducing profits.

-

Competition from Large Players:- GVK Power competes with bigger companies like NTPC, Tata Power, and Adani Power. If competitors expand faster or offer better pricing, GVK may struggle to maintain market share.

-

Dependence on Fuel Supply:- Availability and pricing of coal, gas, and other fuels affect power generation costs. Any disruptions in supply or price hikes can increase expenses, reducing profitability.

-

Economic and Market Uncertainty:- Stock prices are influenced by overall market conditions. Economic slowdowns, rising interest rates, or global uncertainties can reduce investor confidence, impacting GVK Power’s share price.

Read Also:- Inox Wind Share Price Target Tomorrow 2025 To 2030