BPCL Share Price Target Tomorrow 2025 To 2030

Bharat Petroleum Corporation Limited (BPCL) is one of India’s leading oil and gas companies, engaged in refining, marketing, and distribution of petroleum products. As a government-backed entity, BPCL plays a crucial role in the country’s energy sector. The share price of BPCL is influenced by global crude oil prices, government policies, refining margins, and fuel demand. Investors also keep an eye on developments related to its privatization plans. BPCL Share Price on NSE as of 29 March 2025 is 278.35 INR.

Current Market overview of BPCL Share Price

- Open: 276.99

- High: 284.33

- Low: 276.30

- Previous Close: 276.06

- Volume: 12,687,883

- Value (Lacs): 35,331.95

- VWAP: 280.73

- Mkt Cap (Rs. Cr.): 120,814

- Face Value: 10

- UC Limit: 303.66

- LC Limit: 248.45

- 52 Week High: 376.00

- 52 Week Low: 234.01

BPCL Share Price Target Tomorrow 2025 To 2030

| BPCL Share Price Target Years | BPCL Share Price |

| 2025 | INR 380 |

| 2026 | INR 410 |

| 2027 | INR 440 |

| 2028 | INR 470 |

| 2029 | INR 500 |

| 2030 | INR 530 |

BPCL Share Price Chart

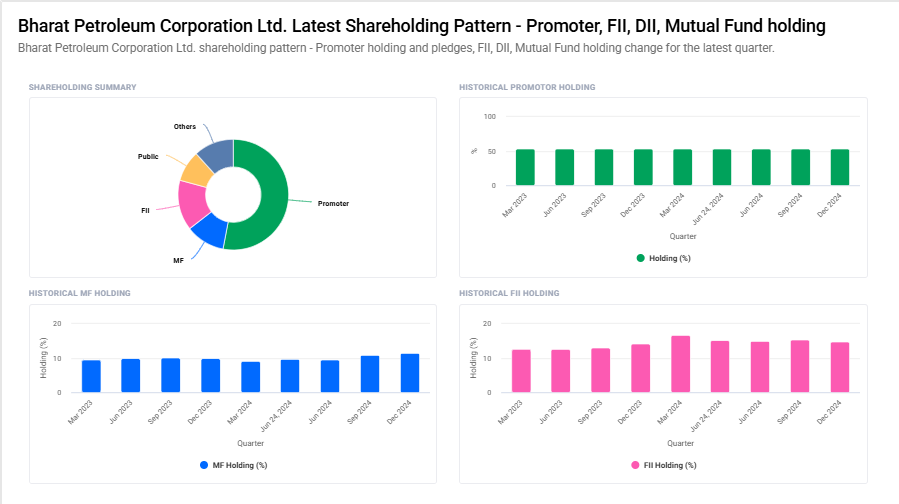

BPCL Shareholding Pattern

- Promoter: 53%

- FII: 14.7%

- DII: 23.2%

- Public: 9.1%

Key Factors Affecting BPCL Share Price Growth

-

Crude Oil Prices

BPCL’s share price is highly influenced by global crude oil prices. If oil prices rise, the company’s costs increase, affecting profit margins. On the other hand, lower crude prices can improve profitability and boost investor confidence. -

Government Policies and Subsidies

As a public sector company, BPCL is affected by government policies related to fuel pricing, subsidies, and taxation. Any changes in these policies can impact revenue and investor sentiment. -

Refining Margins (GRMs)

The company’s Gross Refining Margins (GRMs) indicate how profitable its refining operations are. Higher margins mean better earnings, which can lead to positive stock movement. -

Expansion and Investments

BPCL’s investments in refining capacity, petrochemicals, and fuel retailing impact long-term growth. Any new projects or strategic expansions can attract investors and drive share price growth. -

Divestment and Privatization News

Market speculation or government decisions regarding BPCL’s privatization significantly affect its share price. Any updates on stake sales to private investors can cause volatility in the stock. -

Global and Domestic Demand for Fuel

The demand for petroleum products in India and globally influences BPCL’s revenue. Higher fuel consumption due to economic growth or increased travel can positively impact the company’s earnings and stock price. -

Foreign Exchange (Forex) Rates

Since BPCL imports a large portion of its crude oil, exchange rate fluctuations between the Indian Rupee and the US Dollar affect costs. A stronger rupee benefits the company, while a weaker rupee increases import expenses, impacting profitability.

Risks and Challenges for BPCL Share Price

-

Crude Oil Price Volatility

BPCL relies on crude oil imports, and fluctuations in global oil prices can impact its costs. A sharp rise in oil prices can reduce profit margins and negatively affect the share price. -

Government Regulations and Policies

Since BPCL is a public sector company, changes in government policies related to fuel pricing, subsidies, and taxation can impact its profitability. Sudden policy shifts may create uncertainty for investors. -

Privatization Uncertainty

Speculation around BPCL’s privatization affects investor sentiment. Delays, cancellations, or changes in government plans regarding divestment can cause share price volatility. -

Refining and Marketing Margins

The company’s earnings depend on refining margins (GRMs) and marketing margins. If refining profits decline due to lower global demand or rising input costs, BPCL’s overall profitability can take a hit. -

Foreign Exchange (Forex) Risk

Since BPCL imports a significant amount of crude oil, fluctuations in the Indian Rupee against the US Dollar impact costs. A weaker rupee increases import expenses, putting pressure on earnings. -

Environmental and ESG Concerns

With the global shift toward renewable energy and stricter environmental regulations, BPCL faces challenges in adapting to sustainable energy solutions. Increased carbon taxes or restrictions on fossil fuels can impact long-term growth. -

Competition from Private Players

The rise of private fuel retailers, such as Reliance and Nayara Energy, along with competition from alternative energy sources, may reduce BPCL’s market share. This could affect future revenue growth and investor confidence.

Read Also:- ITDCEM Share Price Target Tomorrow 2025 To 2030