Borosil Renewables Share Price Target Tomorrow 2025 To 2030

Borosil Renewables is India’s leading solar glass manufacturer, playing a key role in the renewable energy sector. The company benefits from the rising demand for solar power and government support for clean energy initiatives. Its share price is influenced by factors like solar industry growth, raw material costs, competition, and global market trends. Borosil Renewables Share Price on NSE as of 25 March 2025 is 514.00 INR.

Current Market overview of Borosil Renewables Share Price

- Open: 531.00

- High: 531.00

- Low: 500.35

- Previous Close: 526.65

- Volume: 115,790

- Value (Lacs): 592.03

- VWAP: 513.05

- Mkt Cap (Rs. Cr.): 6,773

- Face Value: 1

- UC Limit: 552.95

- LC Limit: 500.35

- 52 Week High: 643.90

- 52 Week Low: 402.80

Borosil Renewables Share Price Target Tomorrow 2025 To 2030

| Borosil Renewables Share Price Target Years | Borosil Renewables Share Price |

| 2025 | INR 650 |

| 2026 | INR 700 |

| 2027 | INR 750 |

| 2028 | INR 800 |

| 2029 | INR 850 |

| 2030 | INR 900 |

Borosil Renewables Share Price Chart

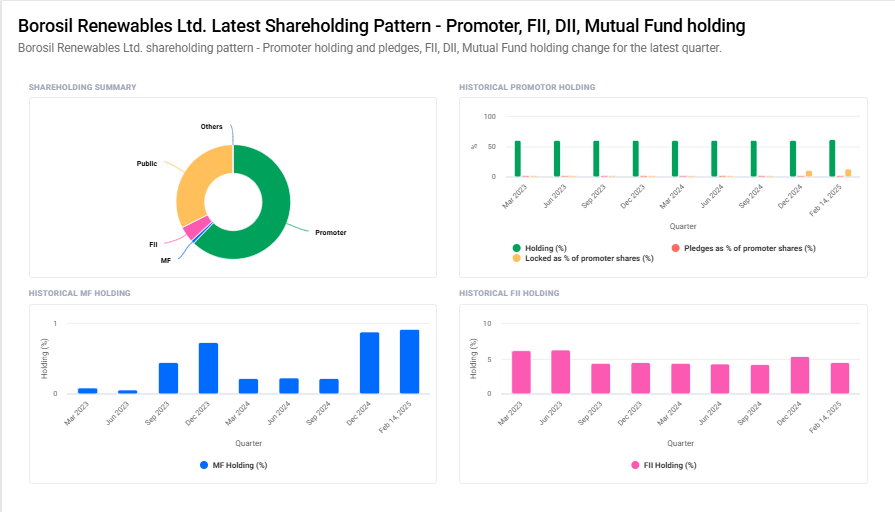

Borosil Renewables Shareholding Pattern

- Promoter: 62.2%

- FII: 4.5%

- DII: 1.1%

- Public: 32.2%

Key Factors Affecting Borosil Renewables Share Price Growth

-

Growing Demand for Solar Energy

As the world moves towards renewable energy, the demand for solar panels is rising. Borosil Renewables, being India’s only solar glass manufacturer, benefits directly from this trend, positively impacting its share price. -

Government Policies & Incentives

Supportive government policies, such as subsidies and tax benefits for renewable energy projects, help the company grow. Favorable regulations boost investor confidence, leading to potential share price appreciation. -

Expansion and Capacity Growth

Borosil Renewables is expanding its manufacturing capacity to meet rising demand. Increased production can lead to higher revenue and better profitability, which can support share price growth. -

Global Market Presence

The company is strengthening its presence in international markets. Growth in exports and entry into new regions can drive revenue, making it an attractive investment option. -

Technological Innovations

Advancements in solar glass technology and energy-efficient solutions give Borosil a competitive edge. Innovations improve product quality and cost efficiency, enhancing its market position and share price prospects. -

Raw Material Cost & Supply Chain Stability

Lower raw material costs and a stable supply chain improve profitability. If the company manages these factors well, it can maintain strong margins and support its stock growth. -

Investor Sentiment & Market Trends

Positive sentiment towards renewable energy stocks and ESG (Environmental, Social, and Governance) investing trends can increase demand for Borosil shares, driving their value higher.

Risks and Challenges for Borosil Renewables Share Price

-

Fluctuations in Raw Material Prices

The cost of raw materials used in solar glass production can vary. If prices increase, it may affect profit margins, impacting the company’s earnings and share price. -

Intense Market Competition

Borosil Renewables faces competition from global players in the solar glass industry. If international competitors offer lower prices or better-quality products, it could impact the company’s market share and revenue. -

Regulatory & Policy Risks

Government policies and subsidies play a crucial role in the renewable energy sector. Any unfavorable policy changes, such as reduced incentives for solar projects, could slow down growth and affect the stock price. -

Dependence on Solar Industry Growth

The company’s success is directly linked to the growth of the solar energy sector. If the demand for solar panels slows down due to economic or policy changes, Borosil’s revenue may decline, affecting investor confidence. -

Foreign Exchange Fluctuations

Since Borosil Renewables exports its products, currency fluctuations can impact earnings. A weaker Indian rupee may benefit exports, but a stronger rupee can reduce profitability from international sales. -

Supply Chain Disruptions

Any disruption in the supply chain, whether due to geopolitical issues, logistical challenges, or a shortage of key materials, can delay production and impact revenue, leading to stock price volatility. -

Economic Slowdowns & Market Sentiment

During economic downturns, investments in renewable energy projects may slow down. Additionally, if investor sentiment towards renewable stocks weakens, Borosil’s share price could face pressure.

Read Also:- IOC Share Price Target Tomorrow 2025 To 2030