BHEL Share Price Target Tomorrow 2025 To 2030

Bharat Heavy Electricals Limited (BHEL) is a leading Indian government-owned engineering and manufacturing company. It specializes in power generation equipment, industrial systems, and infrastructure projects. BHEL’s share price is influenced by government contracts, growth in the power sector, and its ability to compete with private and global players. BHEL Share Price on NSE as of 19 March 2025 is 207.45 INR.

Current Market overview of BHEL Share Price

- Open: 206.00

- High: 207.58

- Low: 204.56

- Previous Close: 203.88

- Volume: 5,302,661

- Value (Lacs): 10,996.13

- VWAP: 205.84

- Mkt Cap (Rs. Cr.): 72,207

- Face Value: 2

- UC Limit: 224.26

- LC Limit: 183.49

- 52 Week High: 335.35

- 52 Week Low: 176.00

BHEL Share Price Target Tomorrow 2025 To 2030

| BHEL Share Price Target Years | BHEL Share Price |

| 2025 | INR 340 |

| 2026 | INR 370 |

| 2027 | INR 400 |

| 2028 | INR 430 |

| 2029 | INR 460 |

| 2030 | INR 490 |

BHEL Share Price Chart

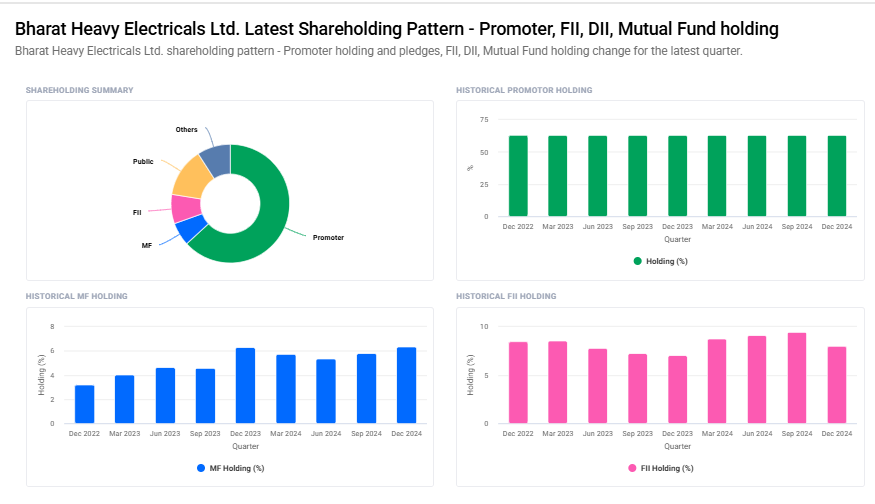

BHEL Shareholding Pattern

- Promoter: 63.2%

- FII: 8%

- DII: 15.4%

- Public: 13.4%

Key Factors Affecting BHEL Share Price Growth

-

Government Projects and Orders

BHEL (Bharat Heavy Electricals Limited) depends heavily on government contracts, especially in power and infrastructure sectors. A rise in new orders from government projects can positively impact its share price. -

Renewable Energy Expansion

As India shifts towards clean energy, BHEL’s involvement in solar, wind, and hydro projects can drive its future growth. More investments in renewable energy can strengthen its market position and stock value. -

Financial Performance

Consistent revenue growth, profit margins, and debt management play a crucial role in determining BHEL’s stock movement. Investors closely watch quarterly results to assess the company’s financial health. -

Make in India and Atmanirbhar Bharat Initiatives

Government policies promoting local manufacturing and self-reliance in heavy industries support BHEL’s business growth. Increased focus on domestic production can boost investor confidence. -

Technological Advancements and Modernization

Adoption of new technologies in power generation, automation, and industrial equipment manufacturing can improve efficiency and profitability, leading to a positive impact on share prices. -

Order Execution and Project Timelines

Timely completion of projects without delays ensures smooth cash flow and profitability. Delays or cost overruns in major projects can negatively affect investor sentiment and stock performance. -

Global and Domestic Economic Conditions

Infrastructure development, power sector growth, and overall economic stability influence BHEL’s business. A strong economy encourages new investments and project approvals, benefiting its stock price.

Risks and Challenges for BHEL Share Price

-

Dependence on Government Orders

BHEL relies heavily on government contracts for its revenue. Any reduction in government spending or delays in project approvals can negatively impact its business and stock price. -

Slow Growth in Power Sector

Since BHEL is a major player in power equipment manufacturing, any slowdown in India’s power sector or lack of new thermal power projects can limit its growth and affect its share performance. -

Competition from Private and Global Players

Increasing competition from private Indian companies and global manufacturers in power, infrastructure, and industrial equipment sectors can put pressure on BHEL’s market share and pricing power. -

Project Delays and Cost Overruns

Large infrastructure and power projects often face execution delays, rising costs, and financial constraints. If BHEL struggles with timely completion, it could impact profitability and investor confidence. -

Shift Towards Renewable Energy

The declining demand for thermal power and a shift towards renewable energy sources like solar and wind can reduce demand for BHEL’s traditional products, affecting future revenue and stock performance. -

Financial Performance and Profitability Issues

BHEL’s earnings can be affected by factors like rising raw material costs, operational inefficiencies, and payment delays from clients. Any dip in profitability can lead to negative sentiment among investors. -

Global Economic and Policy Risks

Economic downturns, changes in trade policies, currency fluctuations, and geopolitical tensions can impact BHEL’s export business and overall growth, posing risks to its stock price stability.

Read Also:- Tata Motors Share Price Target Tomorrow 2025 To 2030