Bharat Dynamics Share Price Target Tomorrow 2025 To 2030

Bharat Dynamics Limited (BDL) is a key defense company in India, specializing in manufacturing missiles and other advanced defense equipment. As a government-owned entity, it plays a vital role in India’s defense sector, securing large contracts from the armed forces. The company’s share price is influenced by government defense spending, technological advancements, and export opportunities. Bharat Dynamics Share Price on NSE as of 15 March 2025 is 1,106.00 INR.

Current Market overview of Bharat Dynamics Share Price

- Open: 1,106.85

- High: 1,152.40

- Low: 1,088.00

- Previous Close: 1,093.70

- Volume: 1,806,544

- Value (Lacs): 20,021.02

- VWAP: 1,122.59

- Mkt Cap (Rs. Cr.): 40,624

- Face Value: 5

- UC Limit: 1,312.40

- LC Limit: 875.00

- 52 Week High: 1,794.70

- 52 Week Low: 776.05

Bharat Dynamics Share Price Target Tomorrow 2025 To 2030

| Bharat Dynamics Share Price Target Years | Bharat Dynamics Share Price |

| 2025 | INR 1800 |

| 2026 | INR 2100 |

| 2027 | INR 2400 |

| 2028 | INR 2700 |

| 2029 | INR 3000 |

| 2030 | INR 3300 |

Bharat Dynamics Share Price Chart

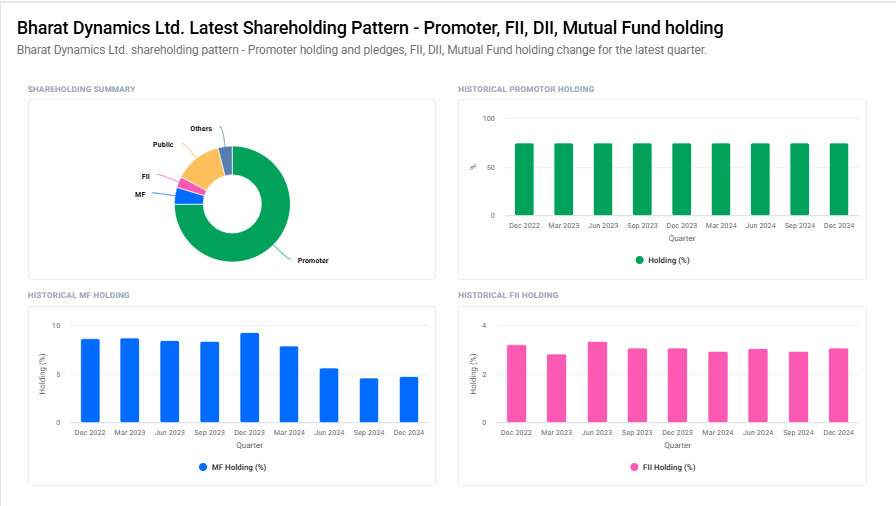

Bharat Dynamics Shareholding Pattern

- Promoter: 74.9%

- FII: 3.1%

- DII: 8.7%

- Public: 13.3%

Key Factors Affecting Bharat Dynamics Share Price Growth

-

Strong Defense Sector Demand – Bharat Dynamics, being a key supplier of missiles and defense equipment, benefits from rising defense spending by the Indian government, which drives its revenue growth and supports its share price.

-

Government Policies & Contracts – As a government-owned company, BDL’s growth depends on defense contracts and policy decisions. Increased orders from the Ministry of Defence and export opportunities can positively impact its stock performance.

-

Make in India & Indigenous Production – The government’s push for self-reliance in defense manufacturing boosts BDL’s long-term prospects, as it receives priority in domestic defense contracts over foreign competitors.

-

Technological Advancements & R&D – Continuous investment in research and development for advanced missile systems enhances the company’s product portfolio and competitiveness, leading to potential share price appreciation.

-

Global Expansion & Exports – BDL’s increasing focus on exporting defense equipment to friendly nations contributes to revenue diversification and reduces dependence on domestic contracts, supporting long-term growth.

-

Financial Performance & Order Book – A strong order book and improving financials, such as revenue growth, profitability, and return on investment, directly influence investor confidence and stock valuation.

-

Geopolitical Factors & Defense Needs – Rising geopolitical tensions and security threats can lead to higher defense spending, increasing demand for BDL’s products and boosting its stock performance.

Risks and Challenges for Bharat Dynamics Share Price

-

Dependence on Government Contracts – Bharat Dynamics relies heavily on orders from the Indian government. Any delays or reductions in defense spending can impact its revenue and stock performance.

-

Regulatory & Policy Changes – Changes in defense procurement policies, privatization initiatives, or increased competition from private players could reduce BDL’s market share and affect future growth.

-

Technological Competition – The defense sector is evolving rapidly with advanced technologies. If BDL fails to innovate or keep up with global standards, it may lose competitive advantage, impacting investor confidence.

-

Geopolitical Risks & Export Restrictions – While expanding into exports, BDL faces challenges such as international trade restrictions, diplomatic tensions, and regulatory approvals that may limit its global market reach.

-

Cost & Supply Chain Issues – Fluctuations in raw material prices, delays in the supply chain, or reliance on foreign components could increase costs and affect production timelines, impacting profitability.

-

Financial Risks & Order Execution – Any delays in executing large orders or cost overruns can affect financial stability. Investors closely watch revenue consistency and margins, making execution risks a key concern.

-

Market Volatility & Investor Sentiment – The defense sector is sensitive to political and economic changes. Stock prices may fluctuate based on investor perception, global conflicts, or policy decisions beyond BDL’s control.

Read Also:- Alok Industries Share Price Target Tomorrow 2025 To 2030