Ola Electric Share Price Target Tomorrow 2025 To 2030

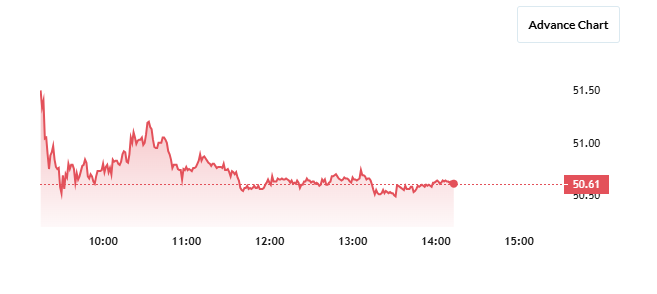

Ola Electric is a fast-growing electric vehicle (EV) company in India, known for its innovative electric scooters. The company is focused on revolutionizing the EV market with advanced technology, sustainable solutions, and an expanding charging infrastructure. With strong government support, increasing demand for electric mobility, and ambitious expansion plans, Ola Electric is attracting significant investor interest. Ola Electric Share Price on NSE as of 13 March 2025 is 50.61 INR.

Current Market overview of Ola Electric Share Price

- Open: 51.50

- High: 51.78

- Low: 50.41

- Previous Close: 51.06

- Volume: 16,962,084

- Value (Lacs): 8,576.03

- VWAP: 50.83

- Mkt Cap (Rs. Cr.): 22,301

- Face Value: 10

- UC Limit: 61.27

- LC Limit: 40.84

- 52 Week High: 157.40

- 52 Week Low: 50.41

Ola Electric Share Price Target Tomorrow 2025 To 2030

| Ola Electric Share Price Target Years | Ola Electric Share Price |

| 2025 | INR 160 |

| 2026 | INR 200 |

| 2027 | INR 250 |

| 2028 | INR 300 |

| 2029 | INR 350 |

| 2030 | INR 400 |

Ola Electric Share Price Chart

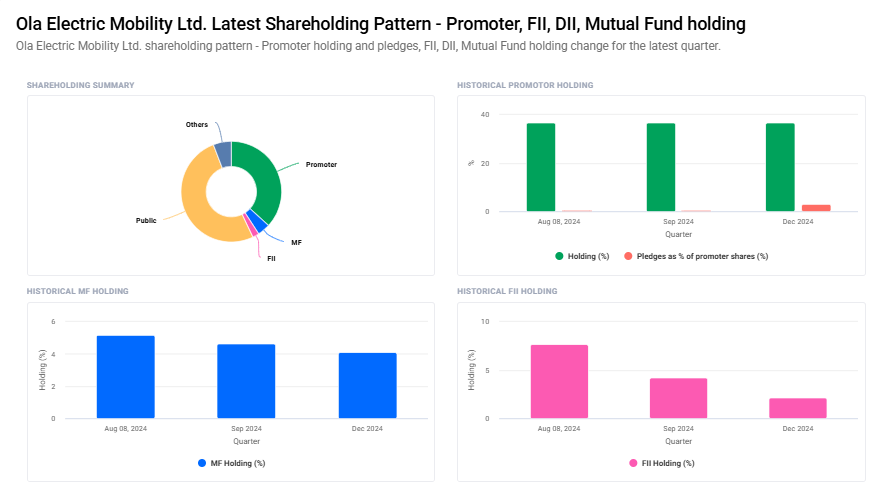

Ola Electric Shareholding Pattern

- Promoter: 36.8%

- FII: 2.1%

- DII: 4.5%

- Public: 56.6%

Key Factors Affecting Ola Electric Share Price Growth

-

Growing EV Market in India

With the rising demand for electric vehicles (EVs) and the Indian government’s push for clean mobility, Ola Electric has a strong growth opportunity. The increasing adoption of EVs can positively impact its share price. -

Government Incentives and Policies

Supportive government policies, subsidies, and incentives for EV manufacturers, such as the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme, can boost Ola Electric’s production and sales, driving its stock growth. -

Battery and Charging Infrastructure Expansion

Ola Electric is investing in battery technology and charging infrastructure, including its upcoming gigafactory for lithium-ion batteries. A strong charging network will improve EV adoption and enhance investor confidence. -

Product Innovation and New Launches

The launch of new electric scooters, bikes, and future four-wheeler EVs can increase sales and market presence. Continuous innovation in performance, design, and affordability can attract more customers and investors. -

Brand Reputation and Market Penetration

Ola Electric has built a strong brand name in the EV segment. Expanding its reach into tier-2 and tier-3 cities, along with aggressive marketing, can help in scaling sales and positively impact the stock price. -

Strategic Investments and Partnerships

Collaborations with battery suppliers, global investors, and technology firms can enhance Ola’s manufacturing capabilities and product quality. Strong financial backing and partnerships can drive long-term stock growth. -

Sustainability and ESG Trends

As global investors focus more on Environmental, Social, and Governance (ESG) factors, Ola Electric’s role in promoting clean energy and sustainability can attract institutional investments, supporting its share price growth.

Risks and Challenges for Ola Electric Share Price

-

High Competition in the EV Market

The Indian EV sector is becoming highly competitive with strong players like Tata Motors, Ather Energy, and Hero Electric. Intense competition can impact Ola Electric’s market share and profitability, affecting its stock price. -

Battery Supply and Costs

The availability and cost of lithium-ion batteries play a crucial role in EV production. Fluctuations in raw material prices or supply chain disruptions can increase production costs, impacting profit margins and share performance. -

Infrastructure and Charging Network Limitations

A lack of widespread EV charging stations in India remains a major challenge. If Ola Electric fails to expand its charging infrastructure efficiently, it may slow down EV adoption, affecting its sales and stock growth. -

Government Policy Changes

While government incentives currently support the EV industry, any reduction or withdrawal of subsidies, tax benefits, or regulatory changes could negatively impact Ola Electric’s financials and investor sentiment. -

Product Quality and Consumer Trust

Reports of technical issues, battery fires, or safety concerns in Ola’s electric scooters can damage its reputation. Poor product reliability or customer dissatisfaction could lead to reduced demand, affecting revenue and stock performance. -

Financial Stability and Profitability

Ola Electric is still in its growth phase and heavily investing in production and R&D. If the company struggles to achieve profitability or faces financial losses, investor confidence could decline, leading to stock price fluctuations. -

Global Economic and Market Uncertainties

Economic downturns, inflation, and fluctuations in fuel prices can influence consumer spending on EVs. Additionally, any major stock market volatility could impact investor sentiment towards Ola Electric’s shares.

Read Also:- IREDA Share Price Target Tomorrow 2025 To 2030