Jaiprakash Power Share Price Target Tomorrow 2025 To 2030

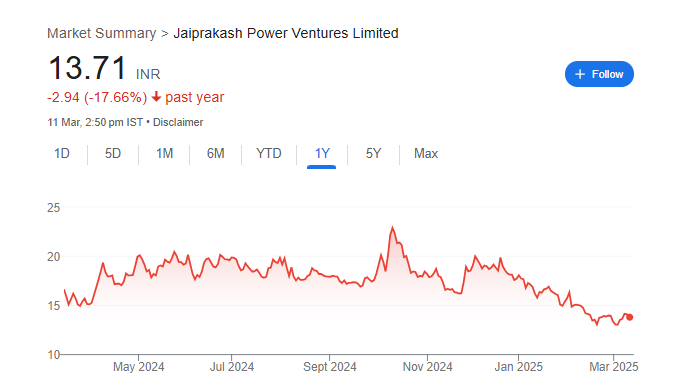

Jaiprakash Power Ventures Ltd. is an Indian company engaged in power generation, primarily through thermal and hydroelectric projects. It operates multiple power plants and supplies electricity to various regions. The company has faced financial challenges due to high debt but continues efforts to improve efficiency and reduce costs. Jaiprakash Power Share Price on NSE as of 11 March 2025 is 13.71 INR.

Current Market overview of Jaiprakash Power Share Price

- Open: 13.98

- High: 13.98

- Low: 13.52

- Previous Close: 14.10

- Volume: 23,909,713

- Value (Lacs): 3,275.63

- VWAP: 13.69

- Mkt Cap (Rs. Cr.): 9,389

- Face Value: 10

- UC Limit: 16.92

- LC Limit: 11.28

- 52 Week High: 23.77

- 52 Week Low: 12.36

Jaiprakash Power Share Price Target Tomorrow 2025 To 2030

| Jaiprakash Power Share Price Target Years | Jaiprakash Power Share Price |

| 2025 | ₹25 |

| 2026 | ₹30 |

| 2027 | ₹35 |

| 2028 | ₹40 |

| 2029 | ₹45 |

| 2030 | ₹50 |

Jaiprakash Power Share Price Chart

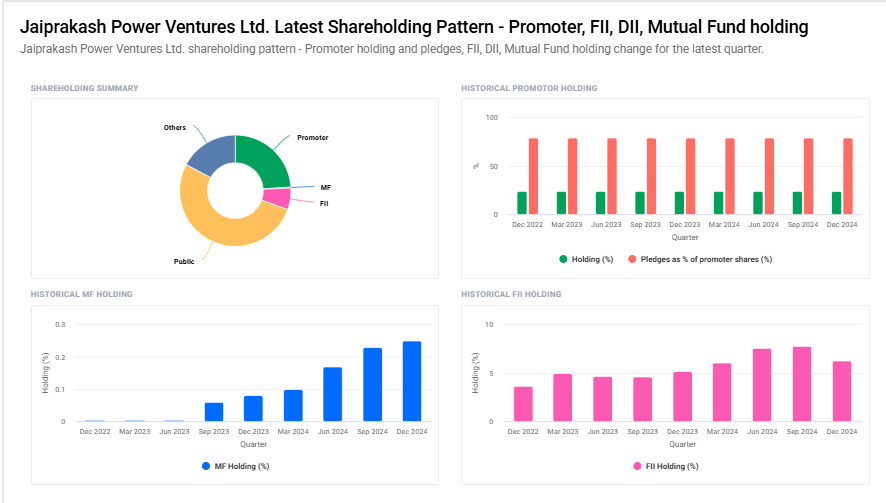

Jaiprakash Power Shareholding Pattern

- Promoter: 24%

- FII: 6.3%

- DII: 17.5%

- Public: 52.3%

Key Factors Affecting Jaiprakash Power Share Price Growth

Here are seven key factors affecting Jaiprakash Power share price growth:

-

Power Demand in India – Rising electricity consumption due to industrialization and urban expansion can boost the company’s revenue, leading to potential share price growth.

-

Government Policies and Sector Reforms – Supportive policies like power sector reforms, improved coal allocation, and favorable electricity tariffs can positively impact profitability and investor confidence.

-

Debt Restructuring and Financial Stability – Jaiprakash Power has a history of high debt. Successful debt reduction, refinancing, or restructuring can improve financial health and attract more investors.

-

Operational Efficiency and Cost Management – Enhancing plant efficiency, reducing production costs, and ensuring uninterrupted power generation can strengthen profitability and support stock price growth.

-

Coal and Fuel Supply Stability – Since the company relies on coal for power generation, a stable and affordable fuel supply is crucial. Lower coal prices or long-term supply agreements can improve margins.

-

Expansion into Renewable Energy – If Jaiprakash Power diversifies into solar, wind, or hydro energy, it can tap into new growth opportunities and align with India’s clean energy transition, attracting investors.

-

Stock Market Trends and Investor Sentiment – Overall market trends, investor confidence in the power sector, and positive news about the company’s financials or operations can drive share price growth.

Risks and Challenges for Jaiprakash Power Share Price

Here are seven key risks and challenges for Jaiprakash Power share price:

-

High Debt Burden – The company has a history of high debt, leading to financial stress. Difficulty in repaying or restructuring debt can negatively impact investor confidence and stock performance.

-

Coal Supply and Price Volatility – Since Jaiprakash Power depends on coal for power generation, any disruption in supply or rising fuel costs can increase operational expenses, reducing profit margins.

-

Regulatory and Policy Uncertainty – Changes in government regulations, electricity tariffs, and environmental policies can affect the company’s operations and revenue, creating uncertainty for investors.

-

Operational and Infrastructure Risks – Power plants require continuous maintenance and upgrades. Unexpected breakdowns, inefficiencies, or delays in repairs can disrupt power generation and impact earnings.

-

Competition from Renewable Energy – With the growing focus on clean energy, solar and wind power projects are gaining preference over coal-based plants. This shift could limit the company’s long-term growth potential.

-

Power Demand and Tariff Fluctuations – Lower electricity demand or unfavorable power purchase agreements could affect revenue generation. Inconsistent tariffs may also impact the company’s profitability.

-

Stock Market Volatility and Investor Sentiment – Negative news, poor financial performance, or unfavorable market conditions can lead to fluctuations in share price, making it risky for investors.

Read Also:- IRFC Share Price Target Tomorrow 2025 To 2030