AWL Share Price Target Tomorrow 2025 To 2030

Adani Wilmar Limited (AWL) is a leading FMCG company in India, primarily known for its edible oils, including the popular “Fortune” brand. The company also deals in packaged foods, personal care products, and industrial essentials. AWL operates in a highly competitive market but benefits from strong brand recognition, an extensive distribution network, and support from the Adani Group. AWL Share Price on NSE as of 27 March 2025 is 248.99 INR.

Current Market overview of AWL Share Price

- Open: 250.68

- High: 252.70

- Low: 248.60

- Previous Close: 250.81

- Volume: 1,171,254

- Value (Lacs): 2,915.84

- VWAP: 250.74

- Mkt Cap (Rs. Cr.): 32,355

- Face Value: 1

- UC Limit: 275.89

- LC Limit: 225.72

- 52 Week High: 403.95

- 52 Week Low: 231.55

AWL Share Price Target Tomorrow 2025 To 2030

| AWL Share Price Target Years | AWL Share Price |

| 2025 | INR 405 |

| 2026 | INR 455 |

| 2027 | INR 500 |

| 2028 | INR 550 |

| 2029 | INR 600 |

| 2030 | INR 650 |

AWL Share Price Chart

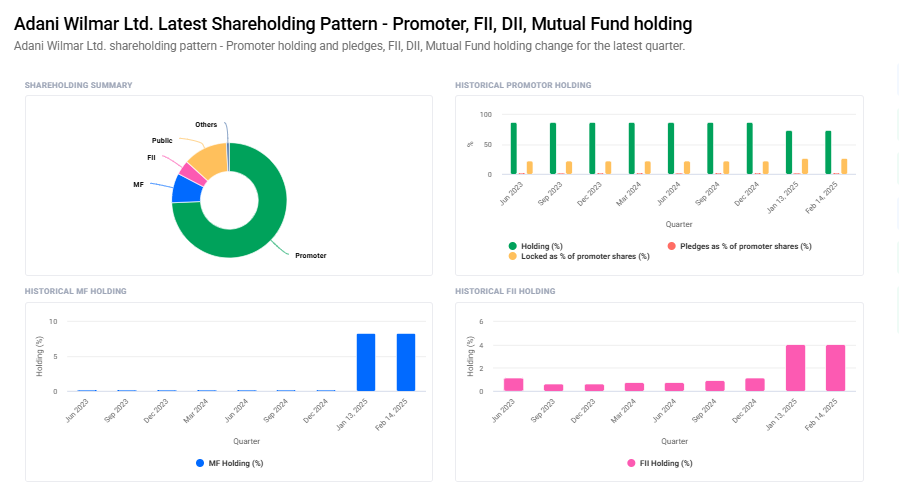

AWL Shareholding Pattern

- Promoter: 74.4%

- FII: 4.1%

- DII: 8.8%

- Public: 12.9%

Key Factors Affecting AWL Share Price Growth

-

Growth in FMCG and Edible Oil Market

Adani Wilmar is a leading player in the edible oil and FMCG sector. Increasing demand for packaged food, cooking oils, and consumer essentials can drive the company’s revenue, positively impacting its share price. -

Raw Material Price Fluctuations

AWL relies on commodities like palm oil, soybean oil, and wheat. If raw material prices stabilize or decrease, profit margins improve, leading to share price growth. -

Expansion in Rural and Urban Markets

AWL is focusing on deeper market penetration, especially in rural areas. A wider distribution network and strong branding can contribute to revenue growth and higher stock valuation. -

Diversification and New Product Launches

The company is expanding beyond edible oils into packaged foods, personal care, and staples like rice and flour. Diversification reduces dependence on a single segment and creates new revenue streams. -

Government Policies and Import Regulations

Favorable policies, such as reduced import duties on edible oils or government support for agriculture, can boost AWL’s business, positively influencing its stock price. -

Financial Performance and Profitability

Strong quarterly earnings, revenue growth, and controlled expenses increase investor confidence. Consistently good financial results can push the share price higher. -

Market Sentiment and Adani Group Influence

Being part of the Adani Group, AWL’s stock is affected by the overall performance of the group’s companies. Positive developments in the Adani Group can improve investor sentiment toward AWL’s shares.

Risks and Challenges for AWL Share Price

-

Fluctuations in Raw Material Prices

AWL depends heavily on commodities like palm oil, soybean oil, and wheat. Any sudden increase in raw material costs can reduce profit margins and negatively affect the share price. -

Government Regulations and Policies

Changes in import duties, restrictions on edible oil imports, or new taxation policies can impact the company’s cost structure and profitability, creating uncertainty for investors. -

High Competition in FMCG and Edible Oil Industry

AWL faces strong competition from other established brands like Patanjali, Fortune (by Adani Wilmar itself), and multinational FMCG companies. Increased competition can affect pricing power and market share. -

Dependence on Global Supply Chains

Since AWL imports a significant portion of its raw materials, any disruptions in global supply chains due to geopolitical tensions, shipping delays, or currency fluctuations can impact business operations. -

Adani Group-Related Market Volatility

As part of the Adani Group, AWL’s share price is sometimes affected by broader market movements and controversies related to the group. Any negative news about Adani companies could create volatility in AWL’s stock. -

Changing Consumer Preferences

Shifting consumer trends towards healthier alternatives, locally sourced oils, or private-label brands could affect AWL’s market demand, posing a long-term challenge to its business growth. -

Economic Slowdowns and Inflation

In times of economic uncertainty or high inflation, consumers may cut back on discretionary spending, affecting AWL’s sales and profitability. A weaker economy could lead to lower investor confidence in the stock.

Read Also:- HBL Power Share Price Target Tomorrow 2025 To 2030