Zomato Share Price Target Tomorrow 2025 To 2030

Zomato is one of India’s leading food delivery and restaurant discovery platforms. Its shares are listed on the stock market and have gained attention due to the company’s strong market presence and growth potential. Zomato’s stock performance depends on factors like order volumes, profitability, competition, and industry trends. Zomato Share Price on NSE as of 21 March 2025 is 226.32 INR.

Current Market overview of Zomato Share Price

- Open: 220.00

- High: 226.79

- Low: 220.00

- Previous Close: 224.47

- Volume: 32,241,380

- Value (Lacs): 72,946.12

- VWAP: 223.21

- Mkt Cap (Rs. Cr.): 218,339

- Face Value: 1

- UC Limit: 246.91

- LC Limit: 202.02

- 52 Week High: 304.70

- 52 Week Low: 146.30

Zomato Share Price Target Tomorrow 2025 To 2030

| Zomato Share Price Target Years | Zomato Share Price |

| 2025 | INR 305 |

| 2026 | INR 370 |

| 2027 | INR 430 |

| 2028 | INR 490 |

| 2029 | INR 550 |

| 2030 | INR 610 |

Zomato Share Price Chart

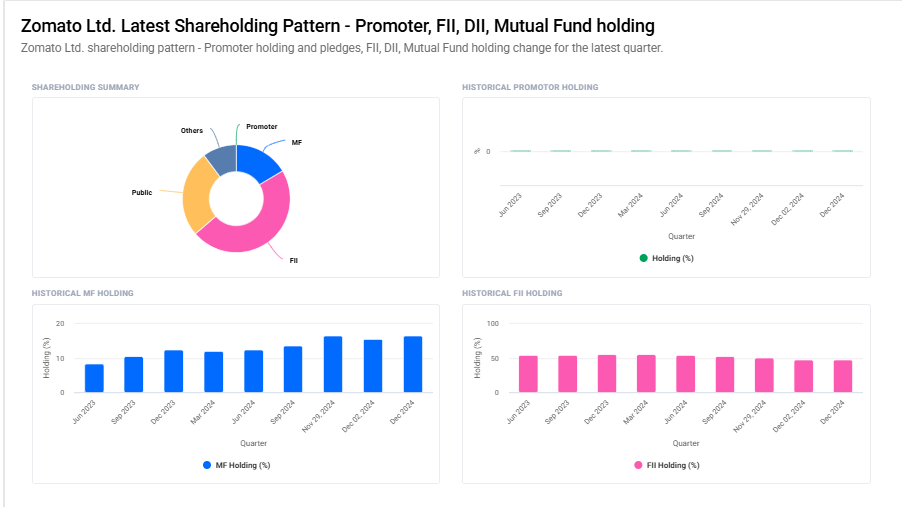

Zomato Shareholding Pattern

- Promoter: 0%

- FII: 47.3%

- DII: 26.6%

- Public: 26.1%

Key Factors Affecting Zomato Share Price Growth

-

Revenue Growth & Profitability

Zomato’s share price depends on its ability to increase revenue and achieve profitability. Strong order volume, higher average order value, and reduced operational losses can drive investor confidence. -

User Base Expansion

Growth in the number of active users and customers who frequently order through Zomato is crucial. A larger customer base ensures consistent revenue and strengthens market dominance. -

Food Delivery Demand & Market Trends

Changing consumer behavior, urbanization, and increasing online food delivery adoption play a major role in Zomato’s growth. A rise in demand for convenience and quick deliveries can positively impact its stock. -

Competition in the Food Tech Industry

The presence of strong competitors like Swiggy and new entrants can influence Zomato’s market share. The company’s ability to offer better discounts, services, and customer experience is key to maintaining its position. -

Partnerships & Business Expansion

Zomato’s collaborations with restaurants, cloud kitchens, grocery delivery, and new ventures like quick commerce (Blinkit) contribute to its revenue streams. Expanding into new areas can help drive future growth. -

Regulatory & Policy Changes

Government regulations on food delivery platforms, labor laws, taxation, and service charges can impact Zomato’s profitability. Favorable policies can support long-term growth, while strict regulations may slow it down. -

Investor Sentiment & Market Trends

The stock market’s overall condition, foreign investment in the tech sector, and global economic factors can affect Zomato’s share price. Positive news, strong quarterly results, and industry growth trends can attract investors.

Risks and Challenges for Zomato Share Price

-

High Competition in the Food Delivery Market

Zomato faces tough competition from Swiggy and new players in the industry. Aggressive discounting and better service by rivals can reduce Zomato’s market share, affecting its growth and stock performance. -

Profitability Challenges

Despite strong revenue growth, achieving long-term profitability remains a concern. High operational costs, delivery expenses, and restaurant commissions impact the company’s bottom line, which may affect investor confidence. -

Regulatory & Legal Risks

Government regulations on food delivery services, labor laws, and taxation policies can increase costs for Zomato. Any unfavorable changes in policies may lead to higher operational expenses or legal complications. -

Changing Consumer Preferences

Customer behavior in food ordering is unpredictable. If users prefer home-cooked meals, dine-in experiences, or switch to competitors, Zomato’s order volumes could decline, impacting revenue and stock performance. -

Economic Slowdown & Market Conditions

Economic downturns, inflation, and reduced consumer spending on online food orders can negatively affect Zomato’s growth. A weak stock market or investor caution towards tech stocks can also impact its share price. -

Dependence on Restaurant & Delivery Partners

Zomato relies heavily on restaurant partnerships and delivery executives for smooth operations. If restaurants reduce their commissions or delivery partners demand better wages, Zomato’s profit margins may shrink. -

Cybersecurity & Data Privacy Issues

As a digital platform, Zomato handles large amounts of user data. Any cybersecurity breach, hacking incident, or data privacy concerns can damage the company’s reputation and lead to regulatory fines, affecting investor trust.

Read Also:- Reliance Share Price Target Tomorrow 2025 To 2030