Waaree Energies Share Price Target Tomorrow 2025 To 2030

Waaree Energies is one of India’s leading solar panel manufacturers and a key player in the renewable energy sector. Founded in 1989, the company specializes in producing high-quality solar modules and providing solar solutions for homes, businesses, and large-scale projects. With a strong focus on innovation and sustainability, Waaree Energies is expanding its presence in both domestic and international markets. Waaree Energies Share Price on NSE as of 10 March 2025 is 2,171.00 INR.

Current Market overview of Waaree Energies Share Price

- Open: 2,237.80

- High: 2,250.00

- Low: 2,168.00

- Previous Close: 2,226.10

- Volume: 433,082

- Value (Lacs): 9,403.94

- VWAP: 2,197.21

- Mkt Cap (Rs. Cr.): 62,380

- Face Value: 10

- UC Limit: 2,671.30

- LC Limit: 1,780.90

- 52 Week High: 3,743.00

- 52 Week Low: 2,026.00

Waaree Energies Share Price Target Tomorrow 2025 To 2030

| Waaree Energies Share Price Target Years | Waaree Energies Share Price |

| 2025 | ₹3750 |

| 2026 | ₹4130 |

| 2027 | ₹4675 |

| 2028 | ₹5049 |

| 2029 | ₹5467 |

| 2030 | ₹6000 |

Waaree Energies Share Price Chart

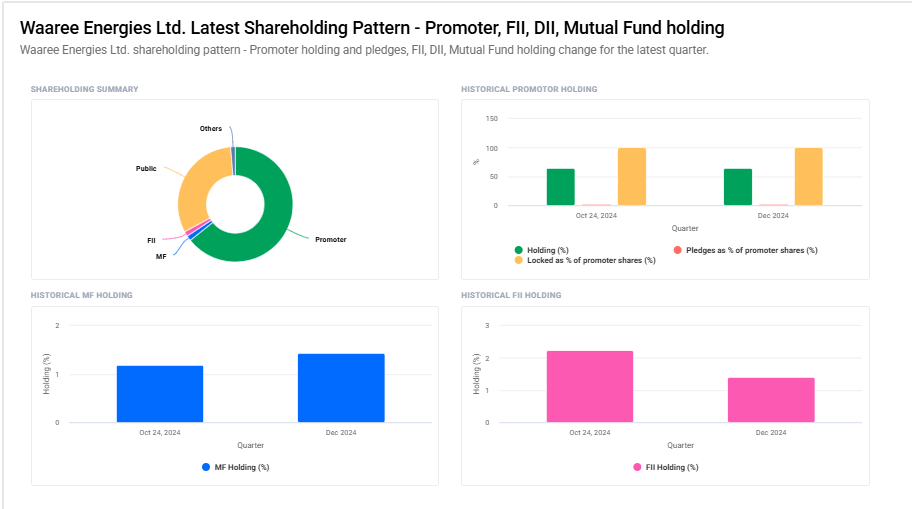

Waaree Energies Shareholding Pattern

- Promoter: 64.3%

- FII: 1.4%

- DII: 2.7%

- Public: 31.6%

Key Factors Affecting Waaree Energies Share Price Growth

Here are seven key factors affecting Waaree Energies’ share price growth:

-

Growing Demand for Solar Energy – As the world shifts toward renewable energy, the demand for solar power is rising. Waaree Energies, being a leading solar panel manufacturer, can benefit from this increasing demand, driving its revenue and stock price higher.

-

Government Policies and Incentives – Supportive government policies, subsidies, and incentives for renewable energy projects can boost Waaree’s business growth, leading to positive stock performance.

-

Expansion of Manufacturing Capacity – If Waaree Energies expands its production facilities and increases its solar panel output, it can capture a larger market share and improve its financial performance.

-

Technological Advancements – Investing in new and more efficient solar technologies can help Waaree stay competitive and attract more customers, positively influencing its stock price.

-

Export and International Market Growth – Expanding its business beyond India and entering global markets can provide new revenue streams and drive long-term stock appreciation.

-

Partnerships and Large-Scale Projects – Securing contracts for large solar farms, corporate tie-ups, or collaborations with government agencies can improve revenue visibility and boost investor confidence.

-

Market Sentiment and ESG Investing – With increasing focus on sustainability and green energy investments, Waaree Energies may attract more interest from institutional and retail investors, supporting its share price growth.

Risks and Challenges for Waaree Energies Share Price

Here are seven key risks and challenges for Waaree Energies’ share price:

-

Competition in the Solar Industry – The solar energy sector is highly competitive, with many domestic and international players. If Waaree fails to keep up with pricing, technology, or innovation, its market share and stock price may be affected.

-

Dependence on Government Policies – Waaree benefits from subsidies, tax benefits, and government incentives for renewable energy. Any reduction or policy change in these incentives could impact its growth and financial performance.

-

Raw Material Price Volatility – The cost of raw materials like silicon, glass, and metals used in solar panels can fluctuate. If prices rise significantly, it may increase production costs and reduce profit margins.

-

Supply Chain Disruptions – Dependence on imports for critical components, logistics issues, or global trade restrictions can delay production and affect Waaree’s ability to meet demand, impacting revenue and investor confidence.

-

Technological Changes and Innovation Risk – The solar industry is evolving rapidly. If Waaree fails to adopt new, efficient, and cost-effective technologies, it may lose customers to competitors offering better products.

-

Economic Slowdowns and Market Uncertainty – A weak economy, financial crises, or reduced corporate and government spending on solar projects could slow down demand for Waaree’s products, affecting its share price.

-

Regulatory and Environmental Risks – Stricter environmental regulations, compliance costs, or changes in import/export policies could create financial burdens and limit growth opportunities for Waaree Energies.

Read Also:- Reliance Power Share Price Target Tomorrow 2025 To 2030