Varun Beverages Share Price Target Tomorrow 2025 To 2030

Varun Beverages is one of the largest bottlers of PepsiCo products, operating in India and several international markets. The company produces and distributes a wide range of soft drinks, juices, and packaged water under popular brands like Pepsi, Mountain Dew, Tropicana, and Aquafina. Varun Beverages Share Price on NSE as of 11 March 2025 is 487.00 INR.

Current Market overview of Varun Beverages Share Price

- Open: 477.80

- High: 487.60

- Low: 470.50

- Previous Close: 481.90

- Volume: 5,774,609.00

- Value (Lacs): 28,018.40

- VWAP: 479.95

- Mkt Cap (Rs. Cr.): 164,083

- Face Value: 2.00

- UC Limit: 530.05

- LC Limit: 433.75

- 52 Week High: 681.12

- 52 Week Low: 419.55

Varun Beverages Share Price Target Tomorrow 2025 To 2030

| Varun Beverages Share Price Target Years | Varun Beverages Share Price |

| 2025 | ₹685 |

| 2026 | ₹730 |

| 2027 | ₹770 |

| 2028 | ₹810 |

| 2029 | ₹850 |

| 2030 | ₹900 |

Varun Beverages Share Price Chart

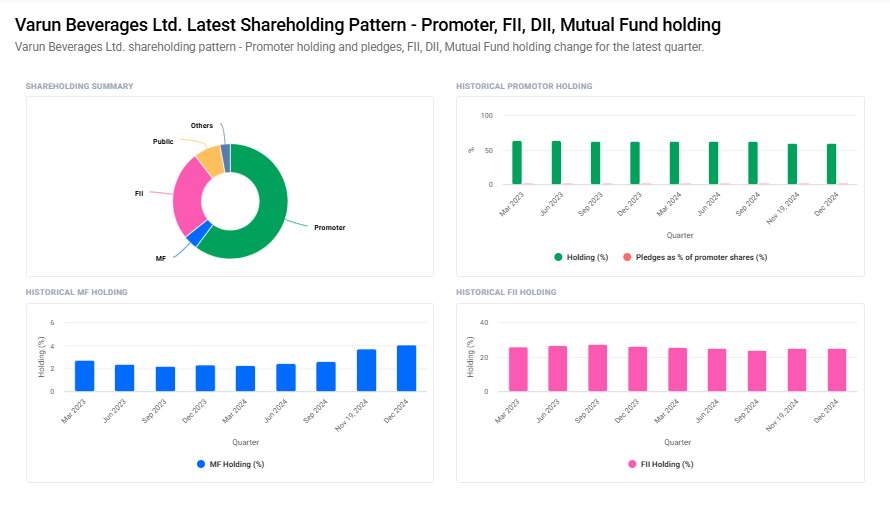

Varun Beverages Shareholding Pattern

- Promoter: 60.2%

- FII: 25.3%

- DII: 7%

- Public: 7.5%

Key Factors Affecting Varun Beverages Share Price Growth

-

Strong Market Position and PepsiCo Partnership – As one of the largest bottlers for PepsiCo, Varun Beverages benefits from a strong brand association and access to a well-established distribution network, helping drive revenue growth.

-

Expansion in Domestic and International Markets – The company is consistently expanding its presence in India and other global markets. New territories and increased production capacity can enhance sales and profitability.

-

Growing Demand for Non-Alcoholic Beverages – With rising urbanization, changing consumer preferences, and increasing demand for packaged beverages, Varun Beverages has a strong opportunity to grow its market share.

-

Operational Efficiency and Cost Management – Effective supply chain management, production efficiency, and cost control measures help maintain profit margins, which can positively impact the stock’s performance.

-

Seasonal Demand and Sales Growth – The company’s sales peak during summer months, and strong performance during peak seasons can boost annual revenue and attract investor confidence.

-

Innovation and Product Diversification – Introducing new products, healthier beverage options, and energy drinks in response to evolving consumer trends can support long-term growth and brand loyalty.

-

Financial Performance and Investor Confidence – Strong revenue growth, profitability, and consistent dividend payouts can attract more investors, driving the share price higher over time.

Risks and Challenges for Varun Beverages Share Price

-

Dependence on PepsiCo – Since Varun Beverages is a key bottler for PepsiCo, any changes in their agreement, pricing terms, or brand performance could impact the company’s revenue and profitability.

-

Seasonal Demand Fluctuations – The company’s sales are highly dependent on summer seasons. A weak summer or unexpected weather conditions can lower demand and affect overall revenue.

-

Raw Material Price Volatility – The cost of key inputs like sugar, packaging materials, and energy can fluctuate due to inflation or supply chain disruptions, impacting profit margins.

-

Regulatory and Taxation Risks – Changes in government policies, increased taxation on sugary drinks, or stricter health regulations can negatively affect demand and business operations.

-

Competition from Other Beverage Brands – The company faces strong competition from domestic and international players like Coca-Cola and local brands. Intense competition can affect pricing power and market share.

-

Economic Slowdown and Consumer Spending – If economic conditions weaken, consumers may reduce spending on discretionary items like soft drinks, leading to slower sales growth.

-

Foreign Exchange and Global Market Risks – Since the company operates in multiple countries, currency fluctuations and geopolitical issues can impact revenue from international markets.

Read Also:- Reliance Power Share Price Target Tomorrow 2025 To 2030