Va Tech Share Price Target Tomorrow 2025 To 2030

Va Tech Wabag is a leading water treatment company specializing in wastewater management, desalination, and recycling solutions. Its share price is influenced by infrastructure projects, government policies, and global demand for clean water solutions. The company benefits from strong expertise and international presence but faces challenges like competition, regulatory hurdles, and raw material cost fluctuations. Va Tech Share Price on NSE as of 25 March 2025 is 1,502.40 INR.

Current Market overview of Va Tech Share Price

- Open: 1,574.45

- High: 1,576.65

- Low: 1,489.55

- Previous Close: 1,565.40

- Volume: 543,609

- Value (Lacs): 8,162.02

- VWAP: 1,510.15

- Mkt Cap (Rs. Cr.): 9,337

- Face Value: 2

- UC Limit: 1,878.45

- LC Limit: 1,252.35

- 52 Week High: 1,944.00

- 52 Week Low: 709.80

Va Tech Share Price Target Tomorrow 2025 To 2030

| Va Tech Share Price Target Years | Va Tech Share Price |

| 2025 | INR 1950 |

| 2026 | INR 2500 |

| 2027 | INR 3200 |

| 2028 | INR 3800 |

| 2029 | INR 4500 |

| 2030 | INR 5200 |

Va Tech Share Price Chart

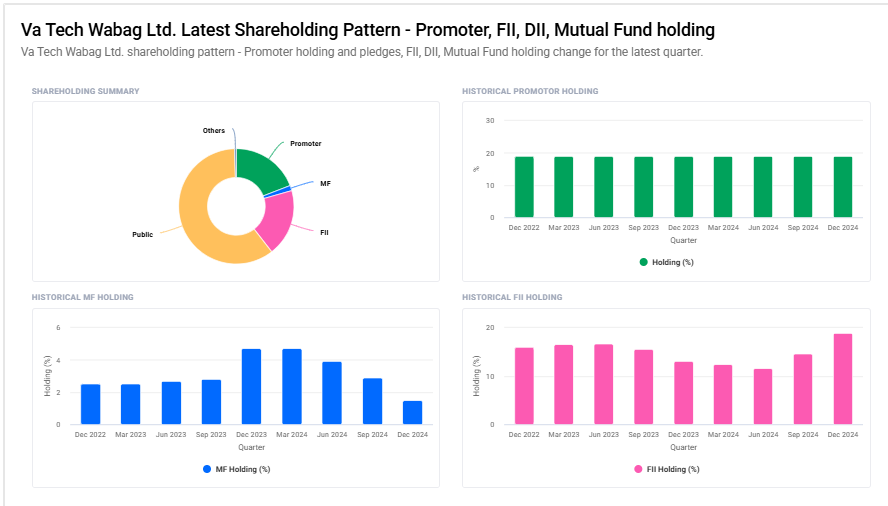

Va Tech Shareholding Pattern

- Promoter: 19.1%

- FII: 18.9%

- DII: 2%

- Public: 60%

Key Factors Affecting Va Tech Share Price Growth

-

Strong Demand for Water Management Solutions

Va Tech Wabag specializes in water treatment and wastewater management, a growing industry due to increasing urbanization and water scarcity. The rising need for clean water solutions can drive business growth, positively impacting its share price. -

Government Policies and Infrastructure Projects

Supportive government policies, smart city initiatives, and large-scale water infrastructure projects can boost the company’s order book, leading to revenue growth and better investor confidence. -

Expansion into International Markets

The company’s ability to secure contracts from foreign markets, especially in regions facing water shortages, can enhance its revenue streams and diversify risks, supporting share price growth. -

Financial Performance and Profitability

Consistent revenue growth, strong profit margins, and efficient cost management play a crucial role in attracting investors and keeping the stock price on an upward trend. -

Technological Advancements and Innovation

Investing in new water treatment technologies and sustainable solutions can give Va Tech a competitive edge, helping it win more contracts and expand its market presence. -

Strategic Partnerships and Collaborations

Tie-ups with government bodies, private players, and international organizations can help the company secure large projects, boosting its financial health and share price performance. -

Debt Levels and Fund Management

Efficient debt management and a healthy cash flow position can increase investor confidence, ensuring steady growth in the company’s valuation and stock price.

Risks and Challenges for Va Tech Share Price

-

Dependence on Government Contracts

A significant portion of Va Tech Wabag’s revenue comes from government projects. Any delays in approvals, payments, or changes in policies can impact the company’s cash flow and share price. -

High Competition in the Industry

The water treatment sector has many local and international players. Increased competition can lead to pricing pressure, lower profit margins, and difficulty in securing new contracts. -

Fluctuations in Raw Material Costs

Rising costs of materials like steel, chemicals, and equipment used in water treatment projects can affect the company’s profitability, which may negatively impact investor sentiment. -

Regulatory and Environmental Challenges

Strict environmental regulations, compliance requirements, and legal challenges can slow down project execution, increasing costs and affecting financial performance. -

Foreign Exchange Risks

Since the company operates in international markets, fluctuations in foreign currency exchange rates can impact revenue and profits, especially if the Indian Rupee weakens against other currencies. -

Debt and Liquidity Issues

If the company takes on excessive debt or faces cash flow issues due to delayed payments from clients, it may struggle with financial stability, leading to concerns among investors. -

Global Economic Uncertainty

Economic slowdowns, geopolitical tensions, and disruptions in global supply chains can affect infrastructure spending and delay water projects, posing a challenge for the company’s growth and stock performance.

Read Also:- TTML Share Price Target Tomorrow 2025 To 2030