UPL Share Price Target Tomorrow 2025 To 2030

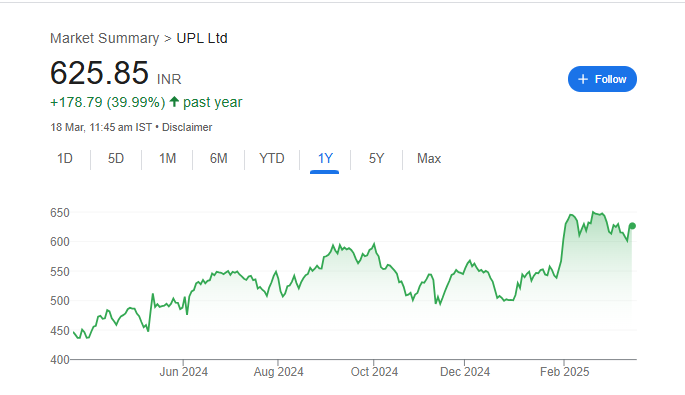

UPL Limited is a global agrochemical company that provides crop protection solutions, seeds, and specialty chemicals. It operates in multiple countries and competes with major international players in the agricultural sector. The company’s share price is influenced by factors such as global demand for agrochemicals, raw material costs, regulatory changes, and weather conditions affecting farming. UPL Share Price on NSE as of 18 March 2025 is 625.85 INR.

Current Market overview of UPL Share Price

- Open: 630.00

- High: 630.65

- Low: 623.15

- Previous Close: 626.15

- Volume: 784,483

- Value (Lacs): 4,910.08

- VWAP: 626.19

- Mkt Cap (Rs. Cr.): 48,448

- Face Value: 2

- UC Limit: 688.75

- LC Limit: 563.55

- 52 Week High: 658.25

- 52 Week Low: 449.25

UPL Share Price Target Tomorrow 2025 To 2030

| UPL Share Price Target Years | UPL Share Price |

| 2025 | INR 660 |

| 2026 | INR 840 |

| 2027 | INR 1000 |

| 2028 | INR 1200 |

| 2029 | INR 1400 |

| 2030 | INR 1600 |

UPL Share Price Chart

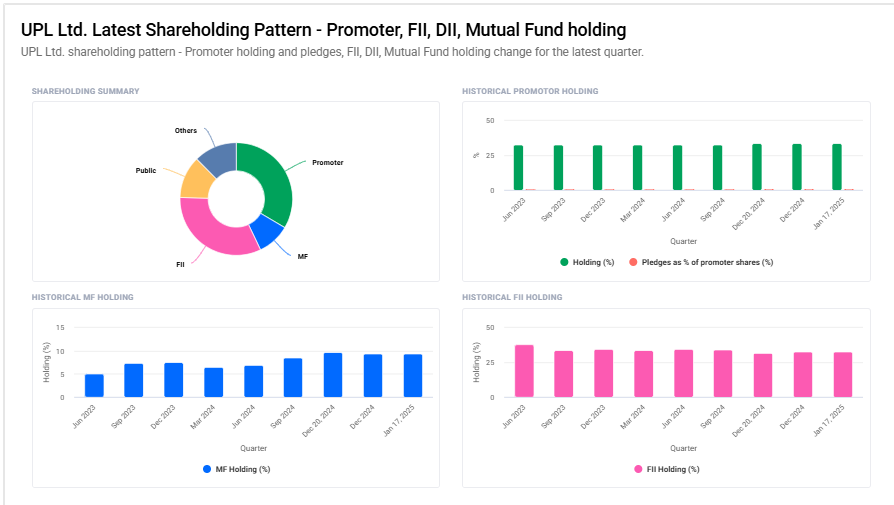

UPL Shareholding Pattern

- Promoter: 33.5%

- FII: 32.5%

- DII: 21.8%

- Public: 12.2%

Key Factors Affecting UPL Share Price Growth

-

Global Demand for Agrochemicals

UPL is a major player in the agrochemical industry, and its share price is influenced by global demand for pesticides, herbicides, and fertilizers. A rise in agricultural activities and food production boosts sales, positively impacting the stock. -

Expansion in International Markets

UPL has a strong global presence, and its efforts to expand into new markets drive revenue growth. Increased sales from regions like Latin America, North America, and Europe support stock price appreciation. -

Innovation and Product Development

The company invests in research and development to introduce eco-friendly and advanced agricultural solutions. New product launches that enhance farm productivity can improve market position and stock performance. -

Government Policies and Regulations

Policies related to agriculture, environmental safety, and chemical usage affect UPL’s operations. Favorable regulations or subsidies for agrochemical companies can benefit its business and share price. -

Raw Material Costs and Supply Chain Efficiency

The prices of key raw materials, such as chemical ingredients, impact production costs. Efficient supply chain management and cost control measures help maintain profitability, influencing stock value. -

Financial Performance and Profit Margins

Consistent revenue growth, healthy profit margins, and strong financial reports attract investor confidence. Quarterly and annual earnings directly affect UPL’s stock movement. -

Sustainability and ESG Initiatives

UPL’s commitment to sustainability and environmental, social, and governance (ESG) practices enhances its brand reputation. Companies focusing on green agriculture solutions are increasingly preferred by investors, which can drive long-term share price growth.

Risks and Challenges for UPL Share Price

-

Fluctuations in Raw Material Prices

UPL depends on various chemicals and raw materials for production. If the prices of these materials rise due to supply chain disruptions or inflation, it can increase costs and reduce profit margins, negatively affecting the stock. -

Regulatory and Compliance Risks

Agrochemical companies are subject to strict environmental and safety regulations worldwide. Any changes in government policies, bans on certain chemicals, or legal issues can impact UPL’s business operations and investor confidence. -

Competition from Global and Local Players

UPL competes with global giants like Bayer, Syngenta, and Corteva, along with regional agrochemical companies. Increased competition can put pressure on pricing and market share, affecting revenue growth and share price. -

Foreign Exchange and Global Market Risks

Since UPL has a strong presence in international markets, fluctuations in foreign currency exchange rates can impact earnings. Economic slowdowns or geopolitical tensions in key regions may also affect its sales and profits. -

Weather and Climate Uncertainties

Agriculture is highly dependent on weather conditions. Unfavorable climatic changes, droughts, or floods can reduce the demand for agrochemicals, affecting UPL’s revenue and stock performance. -

Debt and Interest Rate Pressure

If UPL has high debt levels, rising interest rates can increase borrowing costs. This may lead to reduced profitability and concerns among investors, putting downward pressure on the share price. -

Market Volatility and Investor Sentiment

Stock markets can be unpredictable due to economic downturns, political instability, or global crises. If investors lose confidence in the agrochemical sector or UPL’s growth prospects, it may lead to increased volatility in the share price.

Read Also:- Piramal Pharma Share Price Target Tomorrow 2025 To 2030