TTML Share Price Target Tomorrow 2025 To 2030

Tata Teleservices (Maharashtra) Limited (TTML) is a part of the Tata Group and operates in the telecom sector, primarily providing business communication solutions. While it has a strong brand backing, TTML has faced financial challenges, including high debt and losses over the years. The company is focusing on digital transformation services to improve its business prospects. TTML Share Price on NSE as of 22 March 2025 is 61.50 INR.

Current Market overview of TTML Share Price

- Open: 61.00

- High: 62.45

- Low: 60.55

- Previous Close: 61.10

- Volume: 5,016,025

- Value (Lacs): 3,087.86

- VWAP: 61.73

- Mkt Cap (Rs. Cr.): 12,034

- Face Value: 10

- UC Limit: 73.32

- LC Limit: 48.88

- 52 Week High: 111.40

- 52 Week Low: 54.00

TTML Share Price Target Tomorrow 2025 To 2030

| TTML Share Price Target Years | TTML Share Price |

| 2025 | INR 115 |

| 2026 | INR 125 |

| 2027 | INR 135 |

| 2028 | INR 150 |

| 2029 | INR 160 |

| 2030 | INR 170 |

TTML Share Price Chart

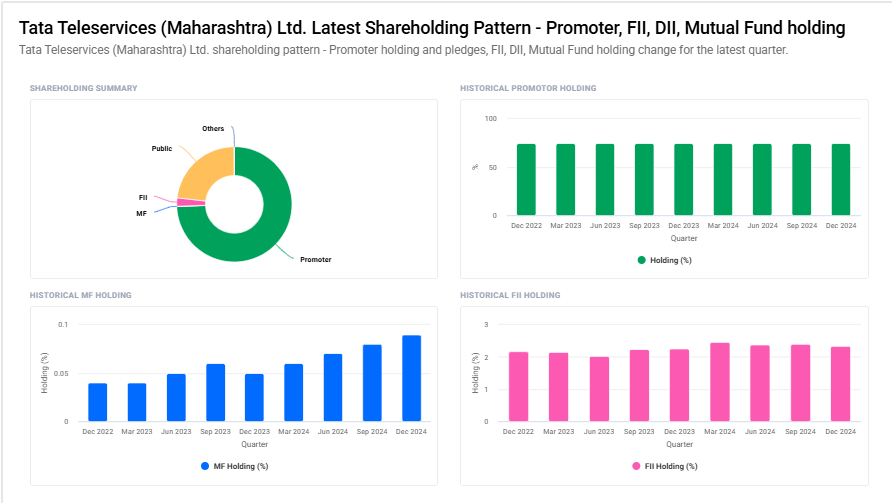

TTML Shareholding Pattern

- Promoter: 74.4%

- FII: 2.3%

- DII: 0.1%

- Public: 23.2%

Key Factors Affecting TTML Share Price Growth

-

Expansion in Telecom Services

Tata Teleservices (Maharashtra) Limited (TTML) is focusing on expanding its telecom and digital services for businesses. If the company successfully grows its customer base and service offerings, its share price may see positive movement. -

5G and Digital Transformation

The rollout of 5G and increased digital adoption in India present opportunities for TTML. If the company effectively integrates new technologies, it could boost investor confidence and drive share price growth. -

Revenue Growth and Profitability

Investors closely monitor TTML’s financial health. Consistent revenue growth, reduction in losses, and improved profitability can positively impact its stock performance over time. -

Debt Reduction and Financial Stability

High debt levels have been a concern for TTML. Any successful efforts to reduce debt and strengthen its balance sheet will be seen as a positive sign for long-term growth. -

Support from Tata Group

TTML is part of the reputed Tata Group, which enhances its credibility. Any strategic investments or support from the parent company could help boost investor sentiment and improve the stock’s outlook. -

Government Policies and Regulations

Changes in telecom policies, spectrum pricing, and regulatory norms can impact TTML’s operations. Favorable policies can create growth opportunities, while stricter regulations may pose challenges. -

Market Sentiment and Investor Interest

TTML’s share price is influenced by overall market trends, investor sentiment, and demand for telecom-related stocks. If investors show strong interest in the company’s future growth potential, its stock may gain momentum.

Risks and Challenges for TTML Share Price

-

High Debt Levels

TTML has a significant amount of debt, which puts pressure on its financials. If the company struggles to repay or restructure its debt, it could negatively impact investor confidence and its share price. -

Lack of Profitability

The company has been reporting losses for a long time. If it fails to turn profitable, investors may lose interest, leading to downward pressure on the stock price. -

Intense Competition in the Telecom Sector

TTML faces stiff competition from larger telecom players like Jio, Airtel, and Vodafone Idea. This makes it difficult to increase market share and improve revenue, which can impact stock performance. -

Regulatory and Government Policies

The telecom sector is highly regulated, and any changes in government policies, spectrum costs, or licensing rules can pose challenges for TTML. Adverse regulations could impact its operations and profitability. -

Limited Market Presence

Unlike major telecom players, TTML has a limited presence in the market, focusing mainly on business solutions rather than individual consumers. This restricts its growth potential and limits investor enthusiasm. -

Volatility in Share Price

TTML’s stock has shown high volatility, with sudden price fluctuations. This makes it a risky investment for many investors, leading to uncertainty in long-term stock performance. -

Dependence on Parent Group Support

While TTML benefits from being part of the Tata Group, over-reliance on its parent company for financial stability and strategic direction could be a concern. If Tata Group shifts focus to other ventures, TTML may struggle to sustain its growth.

Read Also:- LIC Share Price Target Tomorrow 2025 To 2030