Tata Steel Share Price Target Tomorrow 2025 To 2030

Tata Steel is one of the largest and most trusted steel companies in India and globally. It plays a key role in infrastructure, construction, and automotive industries. The company has a strong presence in both domestic and international markets, including Europe and Southeast Asia. Tata Steel’s share price is influenced by factors like steel demand, raw material costs, global economic trends, and government policies. Tata Steel Share Price on NSE as of 13 March 2025 is 151.04 INR.

Current Market overview of Tata Steel Share Price

- Open: 152.00

- High: 153.56

- Low: 150.02

- Previous Close: 150.30

- Volume: 39,781,386

- Value (Lacs): 60,069.89

- VWAP: 151.58

- Mkt Cap (Rs. Cr.): 188,501

- Face Value: 1

- UC Limit: 165.33

- LC Limit: 135.27

- 52 Week High: 184.60

- 52 Week Low: 122.62

Tata Steel Share Price Target Tomorrow 2025 To 2030

| Tata Steel Share Price Target Years | Tata Steel Share Price |

| 2025 | INR 190 |

| 2026 | INR 200 |

| 2027 | INR 210 |

| 2028 | INR 220 |

| 2029 | INR 230 |

| 2030 | INR 240 |

Tata Steel Share Price Chart

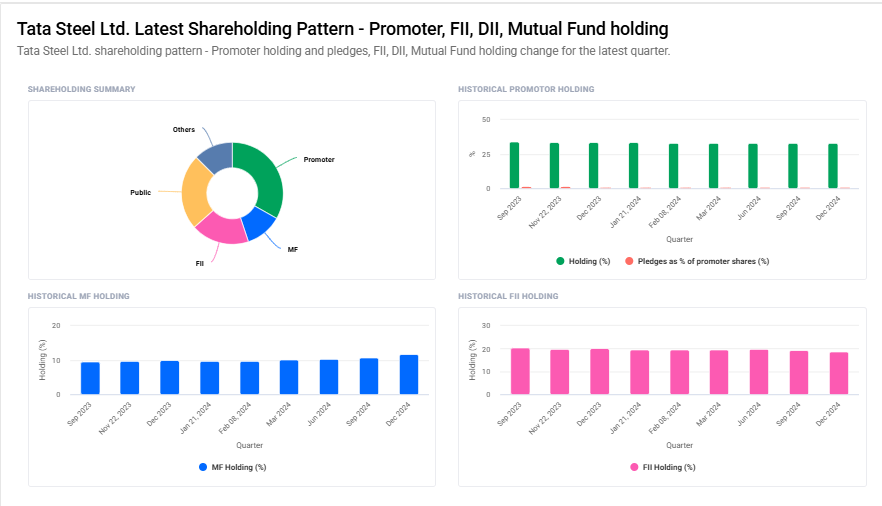

Tata Steel Shareholding Pattern

- Promoter: 33.2%

- FII: 18.5%

- DII: 24.2%

- Public: 24.1%

Key Factors Affecting Tata Steel Share Price Growth

-

Global Steel Demand – The share price of Tata Steel is significantly influenced by global steel demand, especially from sectors like construction, infrastructure, and automotive. Rising demand leads to higher sales and profitability, positively impacting the stock price.

-

Raw Material Prices – The cost of raw materials such as iron ore and coking coal affects Tata Steel’s production costs. If raw material prices remain stable or decline, it can improve profit margins, supporting share price growth.

-

Expansion and Capacity Utilization – Tata Steel’s expansion projects and efficient use of its production capacity can drive revenue growth. New plants and modernization efforts help improve efficiency and increase output, strengthening the company’s market position.

-

Government Policies and Infrastructure Push – Supportive government policies, such as infrastructure development, affordable housing, and industrial growth, boost steel demand. Favorable regulations and incentives can help Tata Steel maintain steady growth.

-

Export Market Performance – Tata Steel’s presence in international markets affects its revenue. Higher exports and strong global trade relations can enhance the company’s profitability and drive its share price upward.

-

Debt Reduction and Financial Health – Managing debt levels and improving financial stability is crucial for investor confidence. If Tata Steel successfully reduces debt and maintains strong cash flows, it can positively influence the stock price.

-

Technological Advancements and Sustainability Efforts – Tata Steel’s investment in technology, automation, and sustainable practices, such as green steel production, enhances its long-term competitiveness. Investors prefer companies focused on innovation and sustainability, which can contribute to future share price growth.

Risks and Challenges for Tata Steel Share Price

-

Fluctuating Steel Prices – The steel industry is highly cyclical, and price fluctuations can impact Tata Steel’s revenue and profitability. A decline in steel prices due to oversupply or weak demand can put pressure on its share price.

-

Raw Material Cost Volatility – The prices of essential raw materials like iron ore and coking coal are unpredictable. A rise in costs without a proportional increase in steel prices can squeeze profit margins and negatively affect the stock.

-

Global Economic Slowdown – Economic downturns or recessions reduce industrial activity and infrastructure investments, leading to lower steel demand. Any slowdown in key markets, including India, Europe, or China, can hurt Tata Steel’s growth.

-

High Debt Levels – Tata Steel has a history of high debt due to past acquisitions and expansion projects. If debt levels remain high or interest costs increase, it could limit future growth and impact investor confidence.

-

Trade Policies and Import-Export Regulations – Government policies such as import duties, export restrictions, or anti-dumping measures in major markets can affect Tata Steel’s global operations. Any unfavorable trade regulations could impact sales and profitability.

-

Competition from Domestic and Global Players – The steel industry is highly competitive, with major domestic and international companies like JSW Steel, SAIL, and ArcelorMittal vying for market share. Increased competition can affect Tata Steel’s pricing power and profit margins.

-

Environmental and Sustainability Challenges – The steel industry faces strict environmental regulations related to carbon emissions and pollution control. Compliance with these regulations requires significant investments, and failure to meet sustainability goals can lead to penalties, affecting Tata Steel’s financial performance.

Read Also:- IDFC First Bank Share Price Target Tomorrow 2025 To 2030