SJVN Share Price Target Tomorrow 2025 To 2030

SJVN (Satluj Jal Vidyut Nigam) is a government-backed company engaged in power generation, mainly through hydroelectric projects. It plays a key role in India’s renewable energy sector and is expanding into wind, solar, and thermal energy. SJVN shares attract investors due to its stable government support, long-term growth plans, and increasing focus on clean energy. SJVN Share Price on NSE as of 13 March 2025 is 86.25 INR.

Current Market overview of SJVN Share Price

- Open: 86.70

- High: 87.44

- Low: 86.00

- Previous Close: 86.34

- Volume: 2,484,261

- Value (Lacs): 2,143.17

- VWAP: 86.57

- Mkt Cap (Rs. Cr.): 33,902

- Face Value: 10

- UC Limit: 94.97

- LC Limit: 77.70

- 52 Week High: 159.65

- 52 Week Low: 80.54

SJVN Share Price Target Tomorrow 2025 To 2030

| SJVN Share Price Target Years | SJVN Share Price |

| 2025 | INR 160 |

| 2026 | INR 180 |

| 2027 | INR 200 |

| 2028 | INR 220 |

| 2029 | INR 240 |

| 2030 | INR 270 |

SJVN Share Price Chart

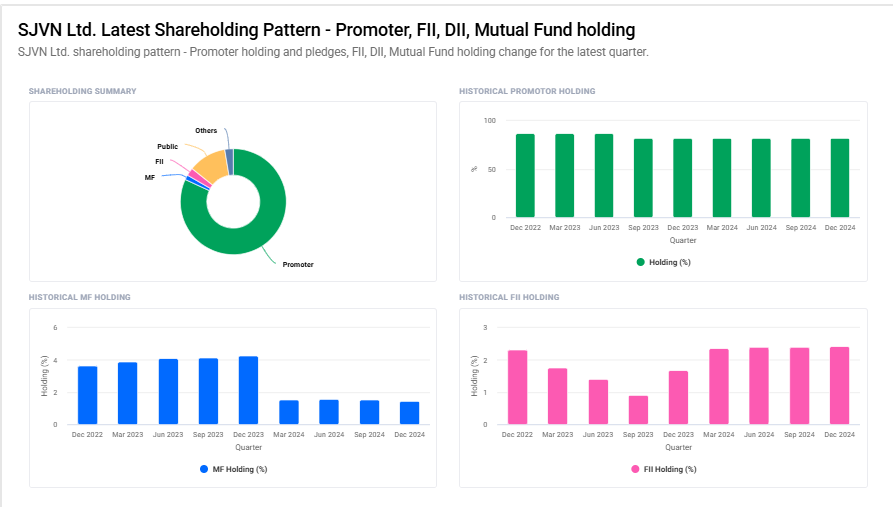

SJVN Shareholding Pattern

- Promoter: 81.9%

- FII: 2.4%

- DII: 4.1%

- Public: 11.6%

Key Factors Affecting SJVN Share Price Growth

-

Government Support for Renewable Energy – As SJVN focuses on hydro, wind, and solar power, strong government policies and subsidies for clean energy projects can boost the company’s revenue and share price.

-

Expansion of Power Generation Capacity – SJVN is continuously working on increasing its energy production through new projects. Successful execution of these projects can positively impact its stock performance.

-

Rising Demand for Electricity – India’s growing population and industrial expansion are driving higher energy consumption. SJVN, being a key player in power generation, stands to benefit from this increasing demand.

-

Long-Term Power Purchase Agreements (PPAs) – Secure PPAs with state governments and private players provide a steady revenue stream for SJVN, reducing market risks and ensuring stable earnings.

-

Financial Performance & Debt Management – A strong balance sheet with good profitability, manageable debt, and efficient cost control can enhance investor confidence and drive share price growth.

-

Technological Advancements & Modernization – Adoption of modern and efficient power generation technologies can improve productivity, reduce costs, and make SJVN more competitive in the energy sector.

-

Global and Domestic Economic Conditions – Economic stability, interest rates, and inflation levels impact the company’s investment capacity and overall market sentiment, influencing SJVN’s stock price movement.

Risks and Challenges for SJVN Share Price

-

Regulatory and Policy Changes – SJVN operates in a highly regulated power sector, and any unfavorable changes in government policies, tariffs, or subsidies can impact its revenue and profitability.

-

Project Delays and Cost Overruns – Large infrastructure projects often face delays due to environmental clearances, land acquisition issues, or supply chain disruptions, leading to increased costs and financial strain.

-

Dependence on Hydropower – A significant portion of SJVN’s power generation comes from hydroelectric plants, making it vulnerable to seasonal fluctuations, reduced water availability, and climate change effects.

-

Competition from Private Players – With increasing private sector participation in renewable energy and power generation, SJVN faces growing competition, which can impact its market share and profitability.

-

Fluctuations in Power Demand and Tariffs – If industrial or domestic electricity consumption slows down due to economic downturns or alternative energy sources, SJVN’s earnings could be negatively affected.

-

High Capital Investment Requirements – Power generation projects require massive investments, and SJVN must consistently secure funding. High debt levels or rising interest rates can put pressure on its financial health.

-

Environmental and Social Challenges – Hydropower projects can face opposition from local communities and environmental activists due to displacement, ecological concerns, and biodiversity impacts, potentially delaying project execution.

Read Also:- Bajaj Housing Finance Share Price Target Tomorrow 2025 To 2030