Shakti Pumps Share Price Target Tomorrow 2025 To 2030

Shakti Pumps is a well-known company in the renewable energy and water management sector, specializing in solar-powered and energy-efficient water pumps. The company benefits from strong government support for renewable energy and agricultural initiatives like PM-KUSUM. Its shares attract investors due to growth in the clean energy sector, increasing demand for sustainable irrigation solutions, and expanding global exports. Shakti Pumps Share Price on NSE as of 31 March 2025 is 977.00 INR.

Current Market overview of Shakti Pumps Share Price

- Open: 984.80

- High: 1,030.00

- Low: 965.25

- Previous Close: 981.65

- Volume: 413,173

- Value (Lacs): 4,051.57

- VWAP: 994.29

- Mkt Cap (Rs. Cr.): 11,787

- Face Value: 10

- UC Limit: 1,030.70

- LC Limit: 932.60

- 52 Week High: 1,387.00

- 52 Week Low: 222.50

Shakti Pumps Share Price Target Tomorrow 2025 To 2030

| Shakti Pumps Share Price Target Years | Shakti Pumps Share Price |

| 2025 | INR 1390 |

| 2026 | INR 2000 |

| 2027 | INR 2500 |

| 2028 | INR 3000 |

| 2029 | INR 3500 |

| 2030 | INR 4000 |

Shakti Pumps Share Price Chart

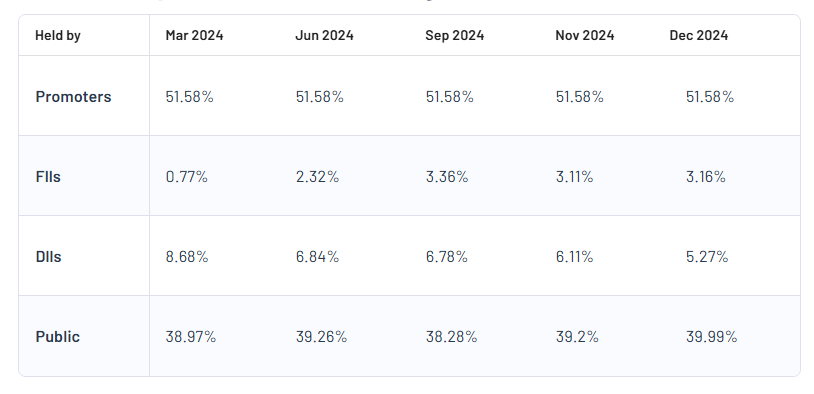

Shakti Pumps Shareholding Pattern

- Promoter: 51.58%

- FII: 3.16%

- DII: 5.27%

- Public: 39.99%

Key Factors Affecting Shakti Pumps Share Price Growth

-

Rising Demand for Solar Pumps

Shakti Pumps specializes in solar-powered water pumps, and with increasing focus on renewable energy, government subsidies, and rural electrification, the demand for these products is expected to grow, positively impacting the company’s revenue and stock price. -

Government Policies and Subsidies

The Indian government promotes solar irrigation through various schemes like PM-KUSUM, providing financial aid for solar pumps. Favorable policies and subsidies can drive sales, boosting investor confidence in Shakti Pumps. -

Export Market Expansion

Shakti Pumps exports its products to multiple countries. Growth in international markets, increasing partnerships, and higher exports can improve the company’s financials and drive stock price growth. -

Financial Performance

Strong revenue growth, higher profit margins, and cost efficiency are key factors for stock appreciation. If Shakti Pumps continues to report positive earnings, it can attract more investors and enhance share price performance. -

Innovation and New Product Development

The company invests in R&D to develop advanced and energy-efficient pumping solutions. New product launches and improved technology can give it a competitive edge, driving long-term share price growth. -

Expansion in Domestic Market

The increasing need for efficient water management solutions in agriculture, industries, and households presents growth opportunities. Expanding its domestic presence and capturing more market share can positively influence stock prices. -

Stock Market Sentiment and Investor Confidence

General market trends, investor sentiment in the renewable energy sector, and institutional investments play a crucial role in stock price movements. Positive analyst ratings and increased interest from big investors can push the share price higher.

Risks and Challenges for Shakti Pumps Share Price

-

Dependence on Government Policies

A significant portion of Shakti Pumps’ revenue depends on government subsidies and schemes like PM-KUSUM. Any reduction, delay, or withdrawal of these incentives can negatively impact sales and stock performance. -

Raw Material Price Volatility

The company relies on metals like stainless steel and copper for manufacturing pumps. Fluctuations in raw material prices can increase production costs, affecting profit margins and impacting investor sentiment. -

Competition from Local and Global Players

The pump manufacturing industry is highly competitive, with both domestic and international companies offering similar products. Increased competition can lead to pricing pressure and lower market share. -

Export Market Risks

A portion of Shakti Pumps’ revenue comes from exports. Economic slowdowns, trade restrictions, or currency fluctuations in key international markets could negatively impact earnings and stock performance. -

Working Capital and Debt Management

The company requires a strong cash flow to support manufacturing, R&D, and expansion. High working capital requirements and debt obligations could affect its financial stability and put pressure on the share price. -

Technological Advancements and Innovation Challenges

The pump industry is evolving with newer, more efficient technologies. If Shakti Pumps fails to keep up with innovations or develop cost-effective solutions, it may lose its competitive edge, affecting its future growth. -

Stock Market and Economic Conditions

Broader economic factors such as inflation, interest rate hikes, or a downturn in the stock market can affect investor sentiment. Any negative trends in the economy or renewable energy sector may lead to volatility in Shakti Pumps’ share price.

Read Also:- Mcx Share Price Target Tomorrow 2025 To 2030