RVNL Share Price Target Tomorrow 2025 To 2030

RVNL (Rail Vikas Nigam Limited) is a government-owned company that develops railway infrastructure projects in India. It handles tasks like track construction, electrification, and modernization of rail networks. Being a PSU, its growth depends largely on government contracts and railway expansion plans. RVNL shares have gained investor attention due to India’s increasing focus on railway development and infrastructure projects. RVNL Share Price on NSE as of 19 March 2025 is 349.90 INR.

Current Market overview of RVNL Share Price

- Open: 334.60

- High: 352.80

- Low: 334.00

- Previous Close: 333.15

- Volume: 8,268,361

- Value (Lacs): 28,922.73

- VWAP: 344.08

- Mkt Cap (Rs. Cr.): 72,934

- Face Value: 10

- UC Limit: 399.75

- LC Limit: 266.55

- 52 Week High: 647.00

- 52 Week Low: 237.50

RVNL Share Price Target Tomorrow 2025 To 2030

| RVNL Share Price Target Years | RVNL Share Price |

| 2025 | INR 650 |

| 2026 | INR 750 |

| 2027 | INR 850 |

| 2028 | INR 950 |

| 2029 | INR 1050 |

| 2030 | INR 1150 |

RVNL Share Price Chart

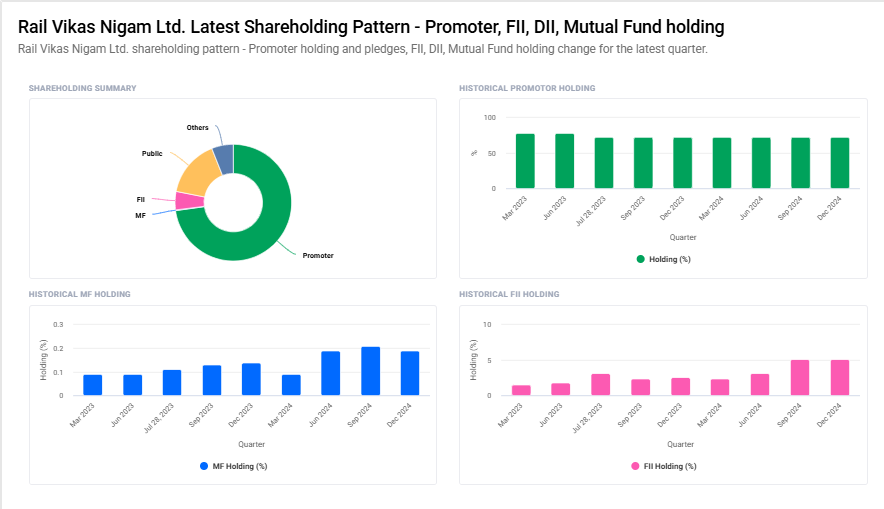

RVNL Shareholding Pattern

- Promoter: 72.8%

- FII: 5.1%

- DII: 6.2%

- Public: 15.9%

Key Factors Affecting RVNL Share Price Growth

-

Government Contracts and Policies

RVNL (Rail Vikas Nigam Limited) is a government-owned company responsible for railway infrastructure development. Its share price is directly influenced by new government contracts, budget allocations, and railway expansion policies. More projects mean more revenue, boosting investor confidence. -

Railway Infrastructure Growth

India’s focus on improving railway infrastructure, including electrification, new railway lines, and high-speed trains, plays a major role in RVNL’s growth. Increased investment in these areas drives the company’s financial performance and stock value. -

Financial Performance and Order Book

Strong quarterly results, revenue growth, and a healthy order book positively impact the share price. Investors closely monitor RVNL’s project execution and profitability, as consistent financial performance attracts more investment. -

Government Stake and Disinvestment Plans

Since RVNL is a public sector undertaking (PSU), any government decision to reduce its stake or privatize some operations can affect stock prices. A lower government holding may increase investor participation but also raise concerns about stability. -

Competition from Private Players

With India opening up railway infrastructure development to private players, competition is increasing. If private companies win major contracts, it could slow RVNL’s growth and impact its stock performance. -

Macroeconomic and Market Trends

Economic factors like inflation, interest rates, and overall market sentiment impact RVNL’s stock. A strong economy and government spending on infrastructure generally support the company’s growth, while economic slowdowns can reduce project funding. -

Foreign Investments and Partnerships

Collaborations with global firms for railway modernization, foreign direct investments (FDI), or joint ventures can boost RVNL’s technological capabilities and revenue streams, positively influencing the share price.

Risks and Challenges for RVNL Share Price

-

Dependence on Government Projects

RVNL (Rail Vikas Nigam Limited) relies heavily on government contracts for revenue. Any delays in government approvals, budget cuts, or changes in railway infrastructure policies can impact its earnings and share price negatively. -

Project Execution Delays

Railway projects are complex and can face delays due to land acquisition issues, environmental clearances, or logistical challenges. Slow project completion affects revenue realization and can create uncertainty among investors. -

Funding and Budget Constraints

Since RVNL is a PSU, its financial stability depends on government budget allocations. If the government reduces spending on railway projects or delays fund disbursement, it can slow down RVNL’s growth and impact investor confidence. -

Increasing Competition

With private companies entering the railway infrastructure sector, RVNL faces growing competition for new contracts. If private players win large projects, RVNL’s market share and future earnings may be affected. -

Stock Volatility and PSU Perception

PSU stocks often experience high volatility due to policy changes, disinvestment plans, or investor concerns about government influence on business decisions. This uncertainty can lead to fluctuations in RVNL’s stock price. -

Economic Slowdowns and Market Risks

A weak economy, high inflation, or rising interest rates can affect infrastructure spending, reducing demand for railway projects. A slowdown in government investments can negatively impact RVNL’s future growth. -

Disinvestment and Stake Sale Risks

The government’s plan to reduce its stake in PSUs like RVNL can create short-term stock price fluctuations. While it may attract private investors, it also raises concerns about future strategic direction and stability.

Read Also:- UPL Share Price Target Tomorrow 2025 To 2030