RCOM Share Price Target Tomorrow 2025 To 2030

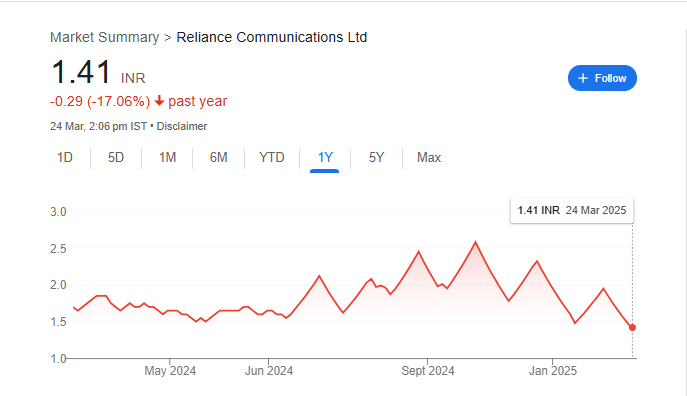

RCOM (Reliance Communications) was once a major telecom player in India but faced financial troubles due to heavy debt and stiff competition. The company is currently undergoing insolvency proceedings, and its business operations are almost non-existent. RCOM shares are highly volatile, mainly influenced by speculation and legal developments. RCOM Share Price on NSE as of 24 March 2025 is 1.41 INR.

Current Market overview of RCOM Share Price

- Open: 1.41

- High: 1.45

- Low: 1.41

- Previous Close: 1.49

- Volume: 2,094,435

- Value (Lacs): 29.53

- VWAP: 1.41

- Mkt Cap (Rs. Cr.): 389

- Face Value: 5

- UC Limit: 1.56

- LC Limit: 1.41

- 52 Week High: 2.58

- 52 Week Low: 1.41

RCOM Share Price Target Tomorrow 2025 To 2030

| RCOM Share Price Target Years | RCOM Share Price |

| 2025 | INR 3 |

| 2026 | INR 4 |

| 2027 | INR 5 |

| 2028 | INR 6 |

| 2029 | INR 7 |

| 2030 | INR 8 |

RCOM Share Price Chart

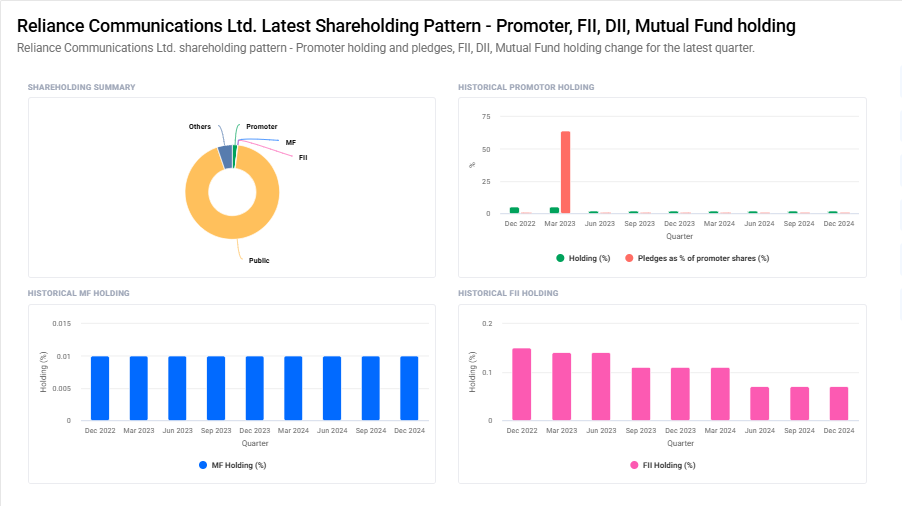

RCOM Shareholding Pattern

- Promoter: 1.9%

- FII: 1.5%

- DII: 4.6%

- Public: 92.9%

Key Factors Affecting RCOM Share Price Growth

-

Debt Restructuring and Financial Health

RCOM has been struggling with heavy debt, and any progress in debt restructuring or settlements with lenders can impact investor confidence. A successful resolution could boost the stock, while delays may keep it under pressure. -

Legal and Regulatory Developments

Ongoing legal battles, insolvency proceedings, and regulatory decisions play a big role in RCOM’s future. Any positive court ruling or government intervention in its favor could push the stock up, while adverse outcomes may limit growth. -

Business Revival Plans

If RCOM finds new business opportunities, partnerships, or a revival strategy, it can create positive market sentiment. Investors look for signs of operational improvements or fresh investments that may bring stability. -

Industry and Market Trends

The telecom sector in India is evolving rapidly, with 5G expansion and digital growth. If RCOM finds a way to re-enter the sector or capitalize on industry trends, it could benefit its share price. -

Asset Monetization and Fundraising

Selling assets like telecom infrastructure, spectrum, or real estate to generate cash can help RCOM reduce liabilities. A successful asset sale or new funding sources could act as a catalyst for share price growth. -

Investor Sentiment and Market Speculation

RCOM stock is often driven by speculation, with investors reacting to news, rumors, and expectations. Any positive buzz about revival plans, restructuring, or new deals can lead to sudden price spikes. -

Macroeconomic and Government Policies

Changes in government policies regarding telecom, taxation, and debt resolution can impact RCOM’s financial standing. Supportive policies or relief measures could provide a growth opportunity, while stricter regulations may add challenges.

Risks and Challenges for RCOM Share Price

-

High Debt Burden

RCOM has been struggling with a massive debt load, which has significantly impacted its financial health. Any delays in debt resolution or failure to repay creditors could put downward pressure on the share price. -

Ongoing Legal and Insolvency Issues

The company is facing multiple legal battles, including insolvency proceedings. Any negative court ruling or legal hurdle could further damage investor confidence and restrict the stock’s growth potential. -

No Active Business Operations

RCOM has almost no telecom operations left after exiting the mobile services market. Without a solid revenue-generating business, the company’s ability to revive and grow remains uncertain, making its stock highly risky. -

Uncertain Asset Monetization

The company has been trying to sell its assets, including telecom towers, spectrum, and real estate, to repay its debt. However, delays or failure in these asset sales could make financial recovery difficult, affecting the stock price. -

Regulatory and Government Risks

Telecom regulations, spectrum-related dues, and policy changes can further complicate RCOM’s financial troubles. Any unfavorable ruling from the government or telecom authorities could increase liabilities and weaken investor sentiment. -

Market Volatility and Speculation

RCOM shares are highly volatile and often move based on market speculation rather than fundamentals. This makes the stock unpredictable, with sudden price spikes and crashes, creating risks for investors. -

Lack of Investor Confidence

Due to past financial struggles and bankruptcy proceedings, many institutional investors and long-term traders avoid RCOM shares. Low investor trust can result in limited demand for the stock, keeping its price unstable.

Read Also:- TTML Share Price Target Tomorrow 2025 To 2030