Rattanindia Power Share Price Target Tomorrow 2025 To 2030

RattanIndia Power is an Indian power generation company primarily focused on thermal energy production. It operates coal-based power plants and supplies electricity to various states. The company has faced financial challenges but continues to work on improving efficiency and reducing debt. With India’s growing power demand and government policies supporting the energy sector, RattanIndia Power has potential for future growth. Rattanindia Power Share Price on NSE as of 10 March 2025 is 9.87 INR.

Current Market overview of Rattanindia Power Share Price

- Open: 10.60

- High: 10.70

- Low: 9.81

- Previous Close: 10.26

- Volume: 12,898,861

- Value (Lacs): 1,273.12

- VWAP: 10.06

- Mkt Cap (Rs. Cr.): 5,300

- Face Value: 10

- UC Limit: 12.31

- LC Limit: 8.20

- 52 Week High: 21.10

- 52 Week Low: 7.90

Rattanindia Power Share Price Target Tomorrow 2025 To 2030

| Rattanindia Power Share Price Target Years | Rattanindia Power Share Price |

| 2025 | ₹22 |

| 2026 | ₹24 |

| 2027 | ₹26 |

| 2028 | ₹28 |

| 2029 | ₹30 |

| 2030 | ₹32 |

Rattanindia Power Share Price Chart

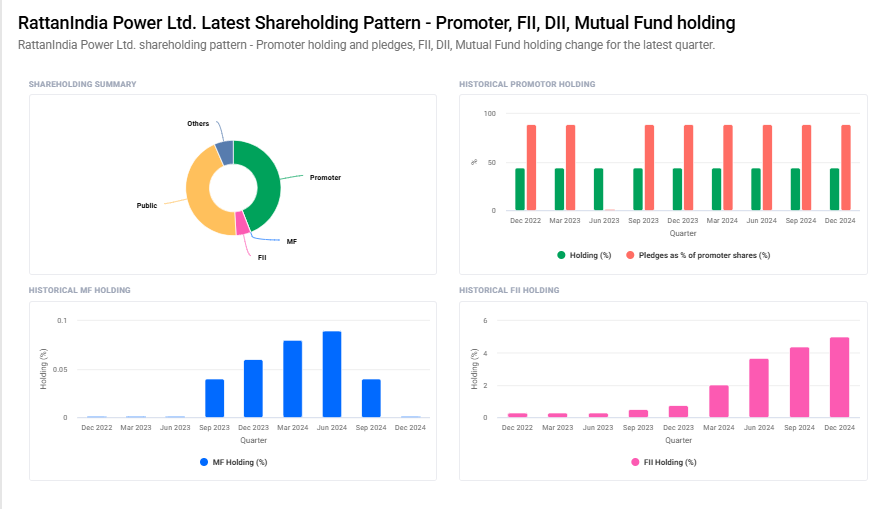

Rattanindia Power Shareholding Pattern

- Promoter: 44.1%

- FII: 5%

- DII: 6.5%

- Public: 44.4%

Key Factors Affecting Rattanindia Power Share Price Growth

Here are seven key factors affecting RattanIndia Power share price growth:

-

Power Demand and Consumption Growth – Rising electricity demand in India, driven by industrial expansion and urbanization, can increase power generation needs, benefiting RattanIndia Power’s revenue and share price.

-

Government Policies and Support – Favorable policies, subsidies, and incentives for the power sector, including reforms in coal supply and tariff regulations, can boost profitability and investor confidence.

-

Debt Reduction and Financial Stability – Lowering debt and improving financial health through restructuring or refinancing can enhance investor trust and lead to better stock performance.

-

Renewable Energy Expansion – If the company diversifies into renewable energy sources like solar or wind power, it could attract new investments and long-term growth opportunities.

-

Operational Efficiency and Cost Management – Improving fuel efficiency, reducing operational costs, and maintaining stable power plant performance can positively impact profitability and stock value.

-

Coal Availability and Fuel Costs – A steady supply of coal at reasonable prices is essential for power production. Stable fuel costs can improve margins, while shortages or rising prices can impact operations.

-

Market Sentiment and Industry Trends – Investor perception, stock market trends, and overall sentiment toward the power sector influence RattanIndia Power’s share price movement. Positive industry trends can lead to stock price appreciation.

Risks and Challenges for Rattanindia Power Share Price

Here are seven key risks and challenges for RattanIndia Power share price:

-

High Debt Burden – The company has a significant amount of debt, and high interest costs can impact profitability. Difficulty in debt repayment or refinancing could create financial stress and affect stock performance.

-

Coal Supply and Price Volatility – Since the company relies on coal for power generation, any disruption in coal supply or rising fuel prices can increase production costs, reducing profit margins.

-

Regulatory and Policy Uncertainty – Changes in government policies, environmental regulations, or electricity tariff adjustments can impact revenue and operations, making long-term planning challenging.

-

Competition from Renewable Energy – The rapid growth of renewable energy sources like solar and wind power is reducing reliance on coal-based electricity. This shift could affect the company’s future growth and market share.

-

Operational and Infrastructure Risks – Power plants require continuous maintenance, and unexpected technical failures, breakdowns, or inefficiencies could lead to production losses and increased costs.

-

Fluctuations in Power Demand and Tariffs – Lower electricity demand, excess power supply in the market, or unfavorable tariff structures can impact revenue generation and investor confidence.

-

Stock Market Volatility and Investor Sentiment – Market trends, economic conditions, and investor perception about the company’s future prospects can lead to fluctuations in its share price, making it sensitive to external factors.

Read Also:- Waaree Energies Share Price Target Tomorrow 2025 To 2030