Raitel Share Price Target Tomorrow 2025 To 2030

RailTel Corporation of India Ltd. is a government-owned company that provides telecom, IT, and digital services, mainly to Indian Railways and other sectors. It plays a key role in expanding broadband and digital connectivity across India. RailTel’s share price is influenced by government contracts, digital infrastructure projects, and industry competition. Raitel Share Price on NSE as of 31 March 2025 is 303.75 INR.

Current Market overview of Raitel Share Price

- Open: 307.00

- High: 318.75

- Low: 301.50

- Previous Close: 308.10

- Volume: 2,651,784

- Value (Lacs): 8,022.97

- VWAP: 309.29

- Mkt Cap (Rs. Cr.): 9,709

- Face Value: 10

- UC Limit: 369.70

- LC Limit: 246.50

- 52 Week High: 617.80

- 52 Week Low: 265.50

Raitel Share Price Target Tomorrow 2025 To 2030

| Raitel Share Price Target Years | Raitel Share Price |

| 2025 | INR 620 |

| 2026 | INR 680 |

| 2027 | INR 740 |

| 2028 | INR 800 |

| 2029 | INR 860 |

| 2030 | INR 920 |

Raitel Share Price Chart

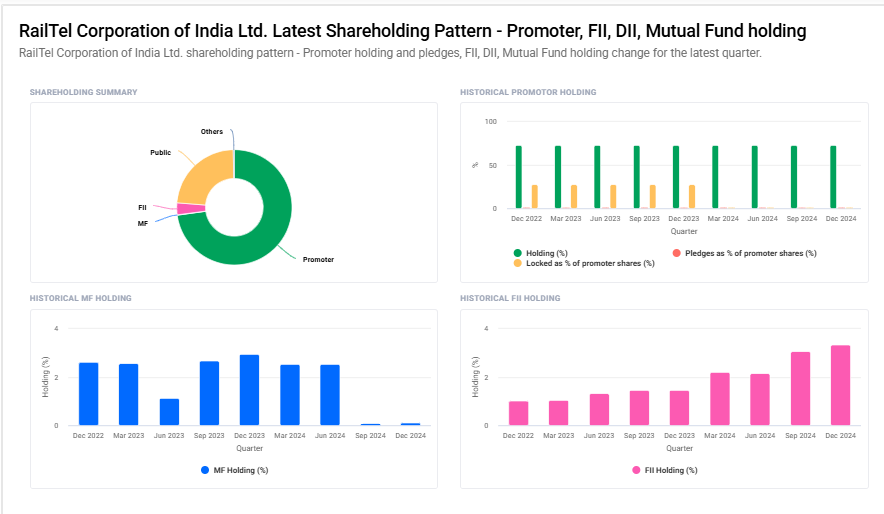

Raitel Shareholding Pattern

- Promoter: 72.8%

- FII: 3.3%

- DII: 0.4%

- Public: 23.5%

Key Factors Affecting Raitel Share Price Growth

RailTel Corporation of India Limited (RailTel) is a “Navratna” public sector enterprise specializing in telecom infrastructure and digital services. Several factors influence the growth of its share price:

-

Financial Performance

-

Consistent growth in revenue and profitability enhances investor confidence. For instance, RailTel’s total revenue increased by 22.99% in FY 2023 compared to the previous year.

-

-

Order Book Strength

-

A robust order book indicates future revenue potential. As of August 2023, RailTel’s order book stood at ₹4,800 crore, reflecting its strong market position.

-

-

Government Initiatives

-

RailTel benefits from government projects aimed at digital transformation and infrastructure development, such as the Kerala Fibre Optic Network (KFON) project.

-

-

Technological Advancements

-

Investments in advanced technologies and expansion of service offerings, including data centers and integrated IT solutions, can drive growth and positively impact the share price.

-

-

Dividend Policy

-

A consistent dividend payout can attract investors seeking regular income. RailTel’s dividend growth of approximately 9.3% annually over the past four years demonstrates its commitment to shareholder returns.

-

-

Market Sentiment

-

Positive news, such as securing significant contracts, can boost investor sentiment. For example, winning a ₹1625.9 crore order from IRCON positively influenced RailTel’s stock performance.

-

-

Macroeconomic Factors

-

Economic conditions, including interest rates and inflation, affect overall market performance and investor behavior, thereby influencing RailTel’s share price.

-

Risks and Challenges for Raitel Share Price

-

Dependence on Government Projects

-

A significant portion of RailTel’s revenue comes from government contracts. Any delay or reduction in government spending on digital infrastructure can impact the company’s growth and, in turn, its share price.

-

-

Intense Competition

-

RailTel faces competition from private telecom and IT service providers, which may offer better pricing or advanced technology. This could affect RailTel’s market share and profitability over time.

-

-

Regulatory Challenges

-

As a public sector enterprise, RailTel must comply with strict government regulations and policies. Changes in telecom regulations, taxation, or bidding processes could create operational hurdles.

-

-

Execution and Project Delays

-

Large infrastructure projects often face execution delays due to factors like approvals, funding issues, and logistical challenges. Any significant delay in project completion could impact revenue realization.

-

-

Cybersecurity Risks

-

Being a major provider of IT and digital services, RailTel is exposed to cybersecurity threats. A data breach or cyberattack could not only lead to financial losses but also damage the company’s reputation and stock value.

-

-

Market Volatility and Economic Slowdowns

-

Fluctuations in the stock market, interest rate hikes, or economic downturns can impact investor sentiment and lead to short-term price volatility in RailTel’s shares.

-

-

Limited Global Presence

-

RailTel primarily operates in India, making it vulnerable to risks associated with a single-market dependency. Unlike global tech firms, the company’s growth is limited to domestic demand and policies.

-

Read Also:- Doms Share Price Target Tomorrow 2025 To 2030