PCBL Share Price Target Tomorrow 2025 To 2030

PCBL (formerly known as Phillips Carbon Black Limited) is a leading manufacturer of carbon black, a key material used in tires, rubber, and industrial products. The company operates in both domestic and international markets, supplying its products to major tire manufacturers and other industries. PCBL’s share price is influenced by factors like raw material costs, demand from the automobile sector, global competition, and environmental regulations. PCBL Share Price on NSE as of 18 March 2025 is 377.85 INR.

Current Market overview of PCBL Share Price

- Open: 378.80

- High: 380.80

- Low: 375.40

- Previous Close: 374.35

- Volume: 552,499

- Value (Lacs): 2,086.24

- VWAP: 379.08

- Mkt Cap (Rs. Cr.): 14,252

- Face Value: 1

- UC Limit: 449.20

- LC Limit: 299.50

- 52 Week High: 584.40

- 52 Week Low: 209.00

PCBL Share Price Target Tomorrow 2025 To 2030

| PCBL Share Price Target Years | PCBL Share Price |

| 2025 | INR 590 |

| 2026 | INR 740 |

| 2027 | INR 850 |

| 2028 | INR 970 |

| 2029 | INR 1090 |

| 2030 | INR 1200 |

PCBL Share Price Chart

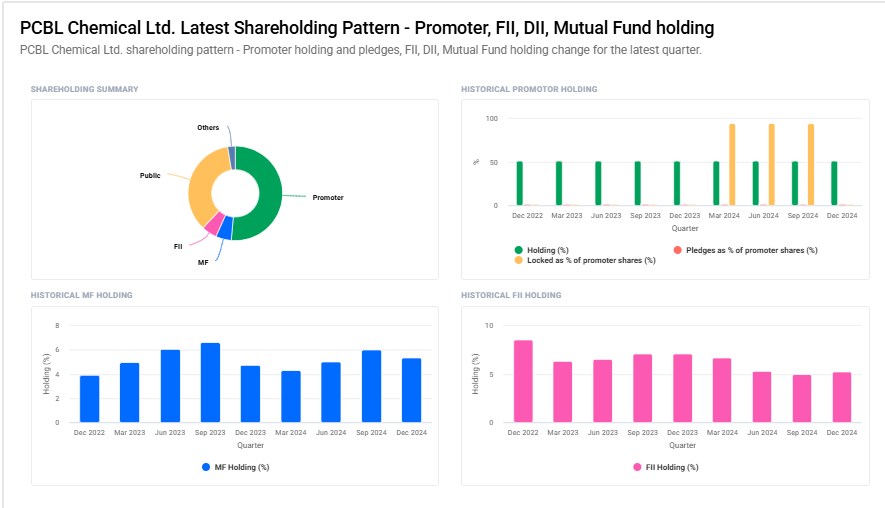

PCBL Shareholding Pattern

- Promoter: 51.4%

- FII: 5.2%

- DII: 7.9%

- Public: 35.5%

Key Factors Affecting PCBL Share Price Growth

-

Growing Demand for Carbon Black

PCBL (Phillips Carbon Black Limited) is a leading manufacturer of carbon black, a key raw material used in tires, rubber, and plastic industries. The rising demand for automobiles and industrial rubber products can drive sales and positively impact the company’s share price. -

Expansion and Capacity Growth

PCBL has been expanding its production capacity to meet increasing demand. New plants and efficiency improvements can boost revenue, leading to stronger investor confidence and potential stock price growth. -

Raw Material Price Trends

The cost of raw materials, such as crude oil derivatives, significantly affects PCBL’s profitability. If raw material costs remain stable or decline, profit margins can improve, supporting share price growth. -

Global and Domestic Tire Industry Performance

Since carbon black is a crucial component in tire manufacturing, the performance of tire companies, both in India and globally, directly affects PCBL’s revenue. A strong automotive sector can lead to higher sales and better stock performance. -

Export Market Growth

PCBL exports its products to multiple countries. An increase in global demand and a favorable exchange rate can enhance export earnings, which could positively impact the company’s stock price. -

Technological Advancements and Innovation

PCBL’s focus on innovation, such as developing advanced grades of carbon black for specialized applications, can help it gain a competitive edge. Investors often look favorably on companies investing in R&D, which may drive share price appreciation. -

Government Policies and Environmental Regulations

Regulations around pollution control and carbon emissions can impact PCBL’s operations. Supportive government policies, such as incentives for sustainable manufacturing, can benefit the company, while stricter regulations may increase compliance costs.

Risks and Challenges for PCBL Share Price

-

Raw Material Price Volatility

PCBL relies on crude oil derivatives for carbon black production. Any sharp increase in crude oil prices can raise production costs, affecting profit margins and potentially leading to stock price fluctuations. -

Slowdown in Automotive and Tire Industries

Since PCBL supplies carbon black primarily to the tire and rubber industries, a slowdown in the automotive sector can reduce demand for its products. Lower sales could negatively impact revenue and stock performance. -

Global Competition

PCBL faces competition from both domestic and international carbon black manufacturers. If global players offer lower prices or better quality, PCBL may struggle to maintain market share, which could impact investor confidence. -

Environmental Regulations and Compliance Costs

The carbon black industry is subject to strict environmental norms. Any new regulations or penalties related to emissions and pollution control could increase operational costs, affecting profitability and share price. -

Currency Fluctuations

Since PCBL exports a significant portion of its products, exchange rate fluctuations can impact revenue. A strong Indian Rupee against other currencies may reduce export earnings, which could affect overall financial performance. -

Cyclic Nature of the Industry

The demand for carbon black is closely linked to economic cycles. During an economic slowdown, industries like automobile manufacturing and construction may reduce production, leading to lower demand for carbon black and impacting PCBL’s revenue. -

Supply Chain Disruptions

Any disruption in the supply of raw materials, transportation issues, or geopolitical conflicts affecting global trade routes can impact PCBL’s ability to meet customer demands. Such risks may cause temporary business slowdowns and impact investor sentiment.

Read Also:- Adani Energy Solution Share Price Target Tomorrow 2025 To 2030