PC Jewellers Share Price Target Tomorrow 2025 To 2030

PC Jeweller is a well-known jewellery brand in India, offering a wide range of gold, diamond, and silver jewellery. Its shares are listed on the stock market and have seen fluctuations due to factors like gold price movements, market competition, and consumer demand. The company’s expansion plans and financial performance influence its stock price. PC Jewellers Share Price on NSE as of 17 March 2025 is 13.68 INR.

Current Market overview of PC Jewellers Share Price

- Open: 14.20

- High: 14.29

- Low: 13.60

- Previous Close: 13.97

- Volume: 12,612,008

- Value (Lacs): 1,725.32

- VWAP: 13.88

- Mkt Cap (Rs. Cr.): 7,986

- Face Value: 1

- UC Limit: 15.36

- LC Limit: 12.57

- 52 Week High: 19.30

- 52 Week Low: 4.41

PC Jewellers Share Price Target Tomorrow 2025 To 2030

| PC Jewellers Share Price Target Years | PC Jewellers Share Price |

| 2025 | INR 20 |

| 2026 | INR 27 |

| 2027 | INR 34 |

| 2028 | INR 40 |

| 2029 | INR 46 |

| 2030 | INR 52 |

PC Jewellers Share Price Chart

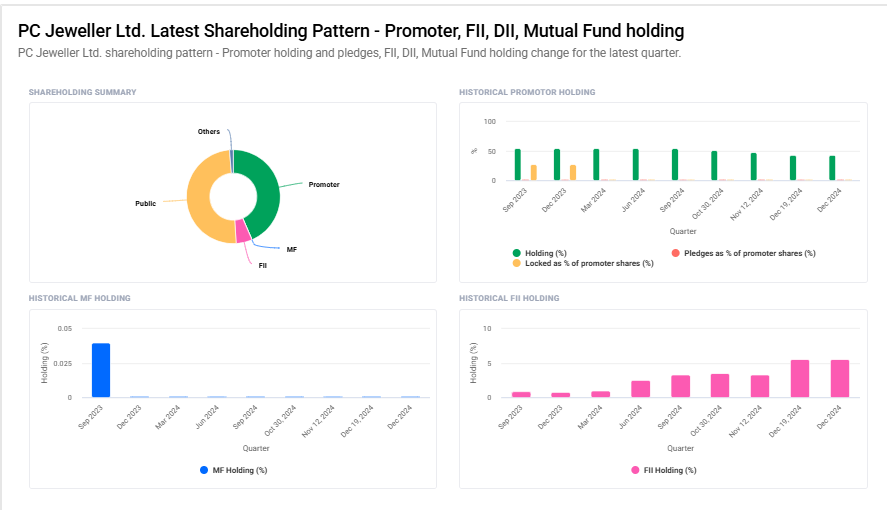

PC Jewellers Shareholding Pattern

- Promoter: 43.5%

- FII: 5.6%

- DII: 1.3%

- Public: 49.7%

Key Factors Affecting PC Jewellers Share Price Growth

-

Gold Price Fluctuations

Since PC Jeweller is in the jewellery business, its sales and profit margins depend heavily on gold prices. A rise in gold prices may impact demand, while stable or lower prices can boost sales. -

Festive and Wedding Season Demand

Jewellery sales increase during festive and wedding seasons in India. Strong demand in these periods can lead to higher revenue, positively affecting the share price. -

Expansion and Store Network

Opening new stores in key locations and strengthening the online presence can attract more customers, leading to business growth and higher investor confidence. -

Government Policies and Import Duties

Regulations on gold imports, taxation policies like GST, and other government rules can impact the jewellery sector’s profitability, influencing PC Jeweller’s stock performance. -

Brand Image and Customer Trust

A strong reputation for quality and trust in jewellery can enhance customer loyalty and sales. Any controversies or trust issues may negatively impact the share price. -

E-commerce and Digital Growth

With more customers preferring online shopping, a strong digital presence and e-commerce sales growth can drive revenues and improve market value. -

Overall Market and Economic Conditions

A strong economy with rising disposable income leads to higher spending on jewellery. However, economic slowdowns, inflation, or financial crises can affect consumer purchasing power and impact stock growth.

Risks and Challenges for PC Jewellers Share Price

-

Gold Price Volatility

The company’s business is highly dependent on gold prices. If gold prices rise sharply, it may reduce consumer demand, impacting sales and profitability. -

Regulatory and Taxation Changes

Government policies on gold imports, GST rates, and other regulations can affect operational costs and profit margins, influencing the share price. -

Competitive Market

The jewellery industry is highly competitive, with strong players like Titan and Malabar Gold. If PC Jeweller fails to innovate or expand effectively, it may lose market share. -

Liquidity and Debt Issues

If the company faces financial stress, including high debt levels or liquidity crunches, investor confidence may decline, leading to a drop in share price. -

Consumer Trust and Brand Reputation

Jewellery purchases rely heavily on trust. Any controversy, legal issue, or negative customer feedback can impact brand value and affect the stock price. -

Economic Slowdown and Inflation

In tough economic conditions, people tend to reduce spending on luxury items like jewellery. High inflation can also reduce customers’ purchasing power, affecting sales. -

Stock Market Fluctuations

Broader market trends, investor sentiment, and global financial conditions can impact the company’s stock performance, even if the business fundamentals remain strong.

Read Also:- Bharat Dynamics Share Price Target Tomorrow 2025 To 2030