NHPC Share Price Target Tomorrow 2025 To 2030

NHPC (National Hydroelectric Power Corporation) is a leading public sector company in India focused on hydroelectric power generation. It plays a key role in India’s renewable energy sector, operating multiple hydropower projects across the country. NHPC’s share price is influenced by factors like government policies, water availability, project expansions, and renewable energy competition. NHPC Share Price on NSE as of 19 March 2025 is 80.21 INR.

Current Market overview of NHPC Share Price

- Open: 79.30

- High: 80.60

- Low: 79.06

- Previous Close: 79.13

- Volume: 7,078,820

- Value (Lacs): 5,679.34

- VWAP: 79.96

- Mkt Cap (Rs. Cr.): 80,591

- Face Value: 10

- UC Limit: 87.04

- LC Limit: 71.21

- 52 Week High: 118.40

- 52 Week Low: 71.00

NHPC Share Price Target Tomorrow 2025 To 2030

| NHPC Share Price Target Years | NHPC Share Price |

| 2025 | INR 120 |

| 2026 | INR 130 |

| 2027 | INR 140 |

| 2028 | INR 150 |

| 2029 | INR 160 |

| 2030 | INR 170 |

NHPC Share Price Chart

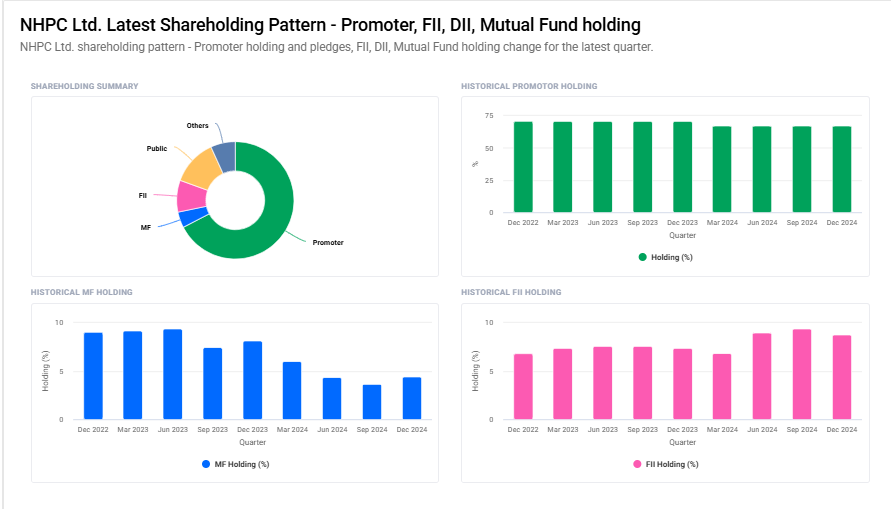

NHPC Shareholding Pattern

- Promoter: 67.4%

- FII: 8.8%

- DII: 11.2%

- Public: 12.7%

Key Factors Affecting NHPC Share Price Growth

-

Government Policies and Support

NHPC, being a government-owned entity, benefits from policies promoting hydro and renewable energy. Favorable regulations, subsidies, and incentives for clean energy can positively impact its growth and stock price. -

Expansion in Hydropower Projects

NHPC’s share price is influenced by its ability to develop and commission new hydropower projects. Successful execution of planned projects can boost revenue and investor confidence. -

Renewable Energy Shift

As India pushes for more clean energy, NHPC’s investments in solar and wind projects can create new revenue streams, supporting long-term stock price appreciation. -

Power Purchase Agreements (PPAs)

NHPC’s financial stability depends on long-term power purchase agreements with states and utilities. Secure contracts ensure steady revenue, reducing risks and improving stock performance. -

Operational Efficiency and Profitability

Lower operational costs, better water flow for hydropower generation, and effective project execution can lead to higher profitability, making NHPC shares more attractive to investors. -

Market Demand for Electricity

Rising energy consumption in India increases the demand for reliable power sources. A strong demand for hydroelectric power enhances NHPC’s revenue potential and stock value. -

Interest Rates and Economic Conditions

NHPC’s capital-intensive projects rely on borrowing. Lower interest rates reduce financing costs, positively impacting profits and share price, while economic slowdowns can have the opposite effect.

Risks and Challenges for NHPC Share Price

-

Regulatory and Policy Risks

As a government-owned company, NHPC’s operations are influenced by policy changes and regulations. Any unfavorable shifts in environmental laws, water usage policies, or energy tariffs could impact its profitability and stock price. -

Delays in Project Execution

Hydropower projects require extensive planning, environmental clearances, and land acquisition. Delays due to regulatory approvals, protests, or technical issues can lead to cost overruns and negatively affect NHPC’s growth and share price. -

Dependence on Monsoon and Water Availability

NHPC relies on consistent water flow for power generation. Poor monsoons, climate change effects, or water disputes between states can impact power production and revenue, affecting stock performance. -

Rising Competition in Renewable Energy

With solar and wind energy becoming more cost-effective and gaining preference, NHPC faces competition from private renewable energy players. This could reduce its market share and slow down stock growth. -

Financial Risks and Debt Burden

Hydropower projects require heavy investments, leading to significant debt. If interest rates rise or project costs increase, NHPC may face financial pressure, affecting its profitability and share price. -

Power Purchase Agreement (PPA) Risks

NHPC’s revenue depends on long-term power purchase agreements with state utilities. If states delay payments or renegotiate tariffs, it could impact cash flow and investor confidence in the company. -

Global and Economic Uncertainty

Economic downturns, inflation, or geopolitical risks can reduce investments in infrastructure and energy projects. If India’s energy demand slows down, NHPC’s growth prospects and stock performance could be affected.

Read Also:- UPL Share Price Target Tomorrow 2025 To 2030