Mcx Share Price Target Tomorrow 2025 To 2030

Multi Commodity Exchange (MCX) is India’s leading commodity exchange, allowing traders to buy and sell commodities like gold, silver, crude oil, and metals. The company’s stock performance depends on trading volumes, commodity price trends, regulatory policies, and competition from other exchanges. MCX benefits from a strong market position and growing investor interest in commodities. Mcx Share Price on NSE as of 31 March 2025 is 5,303.00 INR.

Current Market overview of Mcx Share Price

- Open: 5,300.00

- High: 5,491.00

- Low: 5,267.75

- Previous Close: 5,245.85

- Volume: 811,402

- Value (Lacs): 43,099.65

- VWAP: 5,384.56

- Mkt Cap (Rs. Cr.): 27,089

- Face Value: 10

- UC Limit: 5,770.40

- LC Limit: 4,721.30

- 52 Week High: 7,048.60

- 52 Week Low: 2,917.85

Mcx Share Price Target Tomorrow 2025 To 2030

| Mcx Share Price Target Years | Mcx Share Price |

| 2025 | INR 7050 |

| 2026 | INR 9000 |

| 2027 | INR 11000 |

| 2028 | INR 13000 |

| 2029 | INR 15000 |

| 2030 | INR 17000 |

Mcx Share Price Chart

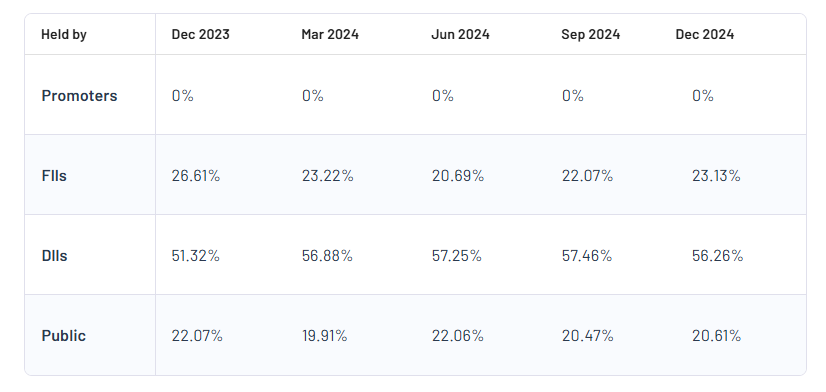

Mcx Shareholding Pattern

- Promoter: 0%

- FII: 23.13%

- DII: 56.26%

- Public: 20.61%

Key Factors Affecting Mcx Share Price Growth

-

Trading Volume Growth

MCX (Multi Commodity Exchange) earns revenue from trading activities. If more traders participate in commodities like gold, silver, crude oil, and natural gas, the exchange’s income rises, positively impacting its share price. -

Regulatory Policies

Government and SEBI regulations play a crucial role in MCX’s business. Favorable policies, such as allowing new commodity derivatives or expanding trading hours, can drive growth, while strict rules may limit opportunities. -

Commodity Market Trends

MCX’s performance is linked to global and domestic commodity prices. If commodities see high demand and volatility, trading activity increases, benefiting the company’s revenue and share price. -

New Product Launches

Introducing innovative contracts, indices, and new commodities for trading can attract more investors and traders. Expansion into newer segments like carbon credits or power trading can provide long-term growth. -

Technological Advancements

Upgrading trading platforms, improving speed, and launching mobile-friendly interfaces can enhance user experience. A strong digital infrastructure ensures reliability and increases participation, supporting share price growth. -

Foreign Investment and Institutional Interest

If global investors and big institutions increase their stake in MCX, it boosts market confidence. Foreign investments bring liquidity and stability, making the stock more attractive. -

Economic and Inflation Trends

Higher inflation often increases the appeal of commodities as an investment hedge, leading to more trading on MCX. A growing economy with rising disposable income can also drive trading volumes higher, positively impacting the stock.

Risks and Challenges for Mcx Share Price

-

Regulatory Uncertainty

MCX operates under strict regulations from SEBI and the government. Any sudden policy changes, new restrictions, or increased compliance costs can impact trading volumes and reduce profitability. -

Competition from Other Exchanges

Growing competition from other commodity and stock exchanges, such as NSE and BSE, can affect MCX’s market share. If traders shift to alternative platforms, MCX may face challenges in maintaining its trading volumes. -

Dependence on Commodity Market Performance

MCX’s revenue heavily depends on trading in commodities like gold, silver, and crude oil. If global commodity prices become stable with low volatility, trading activity may decline, affecting the company’s earnings and share price. -

Technology and Cybersecurity Risks

As a digital trading platform, MCX is vulnerable to cyberattacks, technical failures, or hacking incidents. Any security breach or system downtime can damage investor trust and impact business operations. -

Global Economic Slowdown

If the global or domestic economy weakens, commodity demand may decline, leading to lower trading volumes on MCX. Economic uncertainties can also reduce investor participation in commodity markets. -

Liquidity and Institutional Investment Risks

If institutional investors withdraw their holdings or reduce exposure to MCX due to unfavorable market conditions, the stock price may face downward pressure. Low liquidity can also increase volatility in share prices. -

Legal and Compliance Issues

Any legal disputes, penalties, or allegations of non-compliance with SEBI regulations can harm MCX’s reputation. Legal challenges can lead to financial penalties, stricter oversight, and negative sentiment in the stock market.

Read Also:- Berger Paints Share Price Target Tomorrow 2025 To 2030