Mazagin Dock Share Price Target Tomorrow 2025 To 2030

Mazagon Dock Shipbuilders Limited (MDL) is a leading Indian defense shipyard specializing in building warships and submarines for the Indian Navy. As a government-owned company, it plays a crucial role in India’s defense sector. The stock has gained investor attention due to its strong order book, increasing defense spending, and export opportunities. Mazagin Dock Share Price on NSE as of 17 March 2025 is 2,285.75 INR.

Current Market overview of Mazagin Dock Share Price

- Open: 2,320.00

- High: 2,348.00

- Low: 2,281.10

- Previous Close: 2,316.00

- Volume: 1,217,824

- Value (Lacs): 27,855.29

- VWAP: 2,315.04

- Mkt Cap (Rs. Cr.): 92,265

- Face Value: 5

- UC Limit: 2,779.20

- LC Limit: 1,852.80

- 52 Week High: 2,930.00

- 52 Week Low: 910.55

Mazagin Dock Share Price Target Tomorrow 2025 To 2030

| Mazagin Dock Share Price Target Years | Mazagin Dock Share Price |

| 2025 | INR 2930 |

| 2026 | INR 4267 |

| 2027 | INR 5473 |

| 2028 | INR 6358 |

| 2029 | INR 7294 |

| 2030 | INR 8565 |

Mazagin Dock Share Price Chart

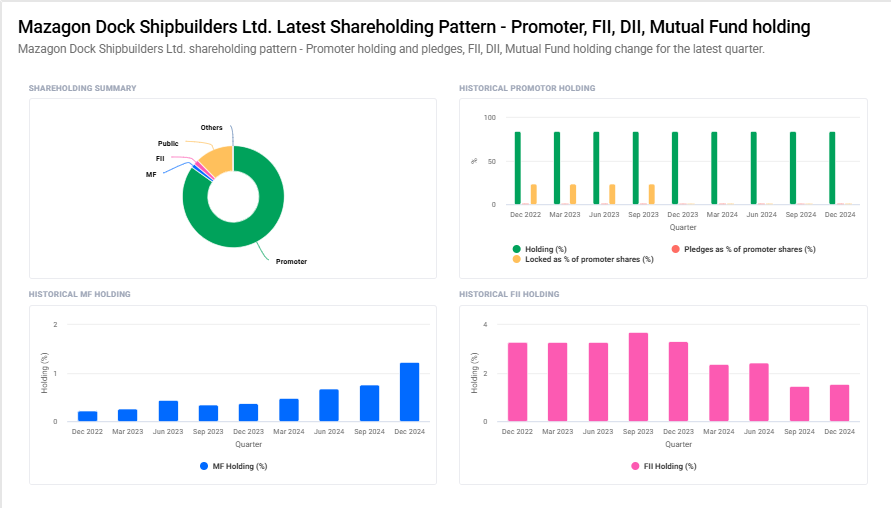

Mazagin Dock Shareholding Pattern

- Promoter: 84.8%

- FII: 1.6%

- DII: 1.5%

- Public: 12.2%

Key Factors Affecting Mazagin Dock Share Price Growth

-

Strong Order Book & New Contracts

Mazagon Dock, a key defense shipbuilding company in India, benefits from a strong order book, especially for submarines and warships. Any new government contracts or export orders can drive significant growth in its share price. -

Government Defense Spending

Since Mazagon Dock is a government-owned entity, its growth depends on India’s defense budget. Higher defense allocations and initiatives like “Atmanirbhar Bharat” (self-reliant India) can boost its revenues and share value. -

Expansion into Export Markets

The company is actively looking to expand its footprint in international defense markets. Successful export deals and collaborations with global defense firms can enhance investor confidence and push share prices higher. -

Technological Advancements & Modernization

Investment in new technologies like stealth submarines and advanced warships strengthens Mazagon Dock’s competitive edge. The ability to deliver modern defense solutions attracts long-term growth and investor interest. -

Timely Execution of Projects

Efficient delivery of warships and submarines as per schedule is crucial for growth. Any delays or cost overruns could impact financial performance, while smooth execution boosts credibility and stock performance. -

Strategic Partnerships & Collaborations

Joint ventures and partnerships with foreign defense firms for technology transfer and expertise sharing can improve its technical capabilities, increasing business opportunities and positively affecting stock prices. -

Government Policy & Regulations

Favorable policies such as increased FDI in defense, ease of doing business, and incentives for domestic manufacturing can support long-term growth, while strict regulations or policy changes could pose challenges.

Risks and Challenges for Mazagin Dock Share Price

-

Dependence on Government Contracts

Mazagon Dock relies heavily on orders from the Indian government, especially the Navy. Any reduction in defense budgets or policy shifts could slow down project allocations, affecting revenue and stock performance. -

Project Delays & Cost Overruns

Large defense projects often face delays due to technical complexities, regulatory approvals, or supply chain issues. Delays in warship and submarine deliveries could impact earnings and investor sentiment. -

Global Competition & Export Challenges

While the company is expanding into exports, it faces competition from established global shipbuilders. Additionally, international defense deals involve strict regulations, approvals, and long negotiation periods, which can slow growth. -

Raw Material & Supply Chain Risks

Shipbuilding requires specialized raw materials and components, some of which are imported. Disruptions in the supply chain, rising costs, or import restrictions could affect profitability and production timelines. -

Technology & Innovation Pressure

The defense industry is evolving rapidly with advanced technologies. If Mazagon Dock fails to adopt the latest innovations or improve efficiency, it may struggle to stay competitive, impacting future contracts and earnings. -

Regulatory & Policy Uncertainties

Being a government-owned entity, the company is subject to strict regulations and policies. Any changes in defense procurement rules, taxation, or foreign direct investment (FDI) norms could create uncertainties for investors. -

Geopolitical & Economic Risks

Global conflicts, diplomatic tensions, or economic downturns can impact defense budgets and international collaborations. Additionally, any adverse geopolitical events may affect Mazagon Dock’s potential export opportunities and financial stability.

Read Also:- Airtel Share Price Target Tomorrow 2025 To 2030