Lemon Tree Share Price Target Tomorrow 2025 To 2030

Lemon Tree Hotels is one of India’s leading mid-priced hotel chains, known for its budget-friendly yet premium-quality accommodations. The company operates hotels across major cities, catering to business and leisure travelers. Its share price is influenced by factors like tourism demand, expansion plans, competition, and economic conditions. Lemon Tree Share Price on NSE as of 18 March 2025 is 131.61 INR.

Current Market overview of Lemon Tree Share Price

- Open: 129.88

- High: 131.96

- Low: 128.80

- Previous Close: 128.52

- Volume: 1,561,099

- Value (Lacs): 2,060.03

- VWAP: 130.42

- Mkt Cap (Rs. Cr.): 10,454

- Face Value: 10

- UC Limit: 154.22

- LC Limit: 102.81

- 52 Week High: 162.40

- 52 Week Low: 112.29

Lemon Tree Share Price Target Tomorrow 2025 To 2030

| Lemon Tree Share Price Target Years | Lemon Tree Share Price |

| 2025 | INR 165 |

| 2026 | INR 180 |

| 2027 | INR 200 |

| 2028 | INR 215 |

| 2029 | INR 230 |

| 2030 | INR 250 |

Lemon Tree Share Price Chart

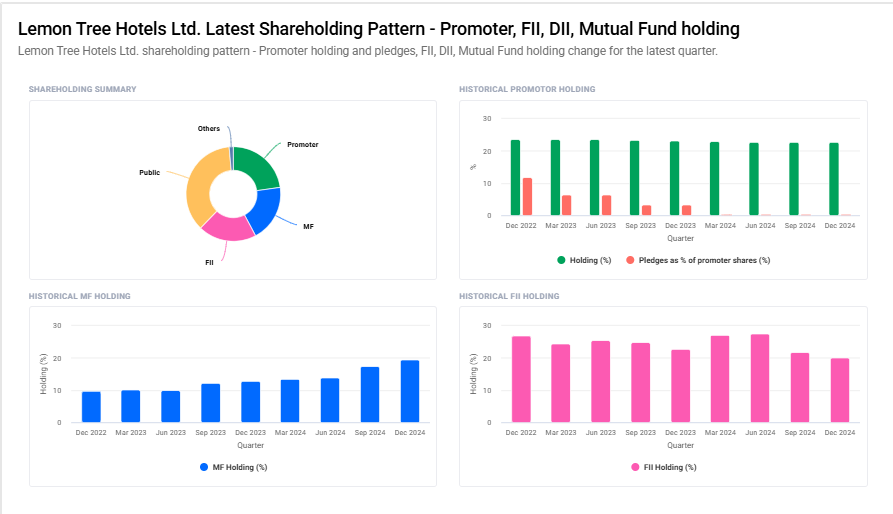

Lemon Tree Shareholding Pattern

- Promoter: 22.8%

- FII: 20%

- DII: 20.8%

- Public: 36.4%

Key Factors Affecting Lemon Tree Share Price Growth

-

Expansion of Hotel Chain

Lemon Tree Hotels is consistently expanding its presence in India and international markets. More hotels and rooms mean increased revenue potential, positively impacting the company’s share price. -

Tourism and Hospitality Industry Growth

The demand for hotels rises with increasing domestic and international travel. Government initiatives promoting tourism and business travel can significantly boost Lemon Tree’s revenue and stock performance. -

Occupancy Rates and Revenue Per Available Room (RevPAR)

Higher occupancy rates and strong RevPAR indicate better profitability. If Lemon Tree manages to maintain strong bookings and premium pricing, its share price is likely to grow. -

Strategic Partnerships and Acquisitions

Collaborations with global hospitality brands, airline companies, or online travel platforms can enhance Lemon Tree’s brand visibility and revenue, attracting investor interest and driving stock growth. -

Financial Performance and Debt Management

Consistent revenue growth, profitability, and effective debt management are key drivers of stock price appreciation. Investors prefer companies with strong financial health and sustainable earnings. -

Government Policies and Tax Benefits

Supportive policies, such as tax reductions, infrastructure development, and incentives for the hospitality sector, can lower operational costs and increase profitability, benefiting Lemon Tree’s stock. -

Brand Recognition and Customer Loyalty

A strong brand image and a loyal customer base help in maintaining steady revenue growth. If Lemon Tree continues to enhance customer experience and brand trust, it can positively influence its share price.

Risks and Challenges for Lemon Tree Share Price

-

Dependence on Tourism and Travel Industry

Lemon Tree’s revenue is directly linked to the tourism and hospitality sector. Any decline in travel demand due to economic downturns, pandemics, or geopolitical tensions can negatively impact the company’s earnings and share price. -

High Competition in the Hotel Industry

The hospitality industry is highly competitive, with strong players like Taj, Marriott, and Radisson. If Lemon Tree fails to attract and retain customers, it could struggle to maintain market share, affecting its stock performance. -

Operational Costs and Rising Expenses

Increasing costs for property rentals, employee wages, and utilities can put pressure on profitability. If operational expenses rise faster than revenue, it may reduce earnings and weaken investor confidence. -

Debt and Financial Stability

The company has taken loans to fund expansion plans. High debt levels increase financial risk, and any difficulty in repayment due to lower revenue could impact the stock price negatively. -

Regulatory and Taxation Changes

Changes in government policies, tax rates, or regulations related to the hotel industry can affect profitability. Unexpected policy shifts may lead to higher costs and operational challenges. -

Seasonal and Economic Fluctuations

Hotel businesses often face seasonal demand variations. Economic slowdowns or inflation can reduce consumer spending on travel, leading to lower occupancy rates and declining revenue. -

Natural Disasters and Health Crises

Events like pandemics, natural disasters, or unforeseen crises can significantly disrupt the hospitality industry. If such events occur, Lemon Tree’s operations and stock value could see a sharp decline.

Read Also:- PC Jewellers Share Price Target Tomorrow 2025 To 2030