IRFC Share Price Target Tomorrow 2025 To 2030

Indian Railway Finance Corporation (IRFC) is a government-owned financial company that provides funding for Indian Railways. Established in 1986, IRFC helps finance railway projects, including new trains, infrastructure, and modernization efforts. It plays a crucial role in the growth of India’s railway network. Since IRFC operates under government support, it enjoys stable revenue, but its performance depends on railway expansion, interest rates, and government policies. IRFC Share Price on NSE as of 10 March 2025 is 121.19 INR.

Current Market overview of IRFC Share Price

- Open: 124.10

- High: 125.42

- Low: 120.77

- Previous Close: 123.42

- Volume: 13,941,269

- Value (Lacs): 16,889.85

- VWAP: 121.93

- Mkt Cap (Rs. Cr.): 158,324

- Face Value: 10

- UC Limit: 135.76

- LC Limit: 111.07

- 52 Week High: 229.00

- 52 Week Low: 108.04

IRFC Share Price Target Tomorrow 2025 To 2030

| IRFC Share Price Target Years | IRFC Share Price |

| 2025 | ₹230 |

| 2026 | ₹270 |

| 2027 | ₹300 |

| 2028 | ₹340 |

| 2029 | ₹370 |

| 2030 | ₹400 |

IRFC Share Price Chart

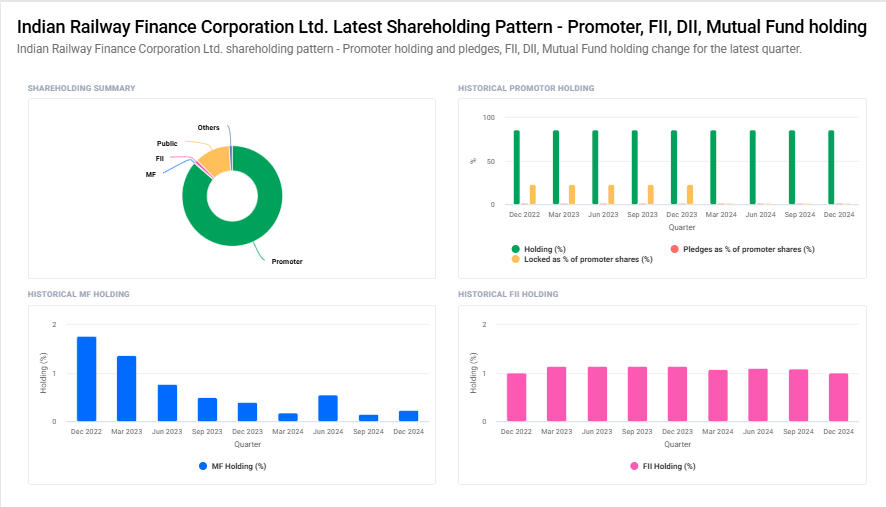

IRFC Shareholding Pattern

- Promoter: 86.4%

- FII: 1%

- DII: 1.2%

- Public: 11.4%

Key Factors Affecting IRFC Share Price Growth

Here are seven key factors affecting IRFC (Indian Railway Finance Corporation) share price growth:

-

Indian Railways Expansion – IRFC plays a key role in financing railway projects. Growth in railway infrastructure, electrification, and modernization will boost demand for IRFC’s funding services, positively impacting its share price.

-

Government Support and Policies – Since IRFC is backed by the Indian government, favorable policies, budget allocations, and increased railway spending can strengthen its financial position and share value.

-

Interest Rate Movements – As a financing company, IRFC’s profitability depends on interest rates. Lower interest rates reduce borrowing costs, improving margins and making the stock more attractive.

-

Steady Revenue and Profit Growth – IRFC generates consistent revenue through lease agreements with Indian Railways. Growth in its loan book and stable profits can enhance investor confidence and support stock price growth.

-

Debt Management and Credit Ratings – Effective management of debt and maintaining a strong credit rating will help IRFC secure funds at lower costs, improving financial performance and stock growth potential.

-

Public-Private Partnerships (PPPs) – Increased collaboration between Indian Railways and private players in infrastructure projects can create more financing opportunities for IRFC, driving business expansion.

-

Market Sentiment and Economic Conditions – Positive investor sentiment, strong economic growth, and confidence in government-backed companies can attract more investment in IRFC stock, influencing its price movement.

Risks and Challenges for IRFC Share Price

Here are seven key risks and challenges for IRFC (Indian Railway Finance Corporation) share price:

-

Dependence on Indian Railways – IRFC’s entire business is linked to Indian Railways. Any slowdown in railway expansion, policy changes, or budget cuts can directly impact its revenue and growth.

-

Regulatory and Government Policy Risks – Being a government-backed entity, IRFC is affected by policy changes, interest rate regulations, and government decisions that could impact its financial operations.

-

Interest Rate Fluctuations – Since IRFC primarily funds railway projects, rising interest rates can increase borrowing costs, affecting profitability and investor sentiment.

-

Limited Revenue Diversification – Unlike private lenders, IRFC has a restricted client base (Indian Railways), which limits growth opportunities and exposes it to sector-specific risks.

-

Stock Liquidity and Volatility – As a PSU (Public Sector Undertaking), IRFC’s stock may experience lower trading volumes and higher price fluctuations compared to private financial firms.

-

Economic Slowdowns and Inflation – A weak economy, rising inflation, or global financial instability could reduce railway spending and increase funding costs, affecting IRFC’s financial performance.

-

Credit Risk and Debt Burden – IRFC raises funds through debt financing. If its debt levels increase significantly or its credit rating is downgraded, investor confidence may decline, impacting the share price.

Read Also:- UltraTech, Ambuja, ACC & Others: Profitability in FY26 Hinges on Cement Pricing, Says India Ratings