IREDA Share Price Target Tomorrow 2025 To 2030

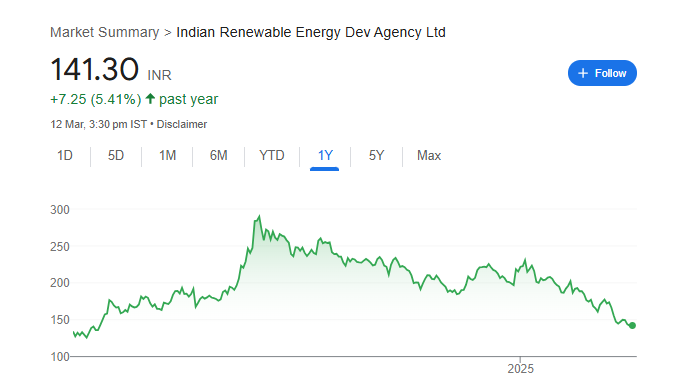

IREDA (Indian Renewable Energy Development Agency) is a government-owned financial institution that funds renewable energy projects in India. The company plays a key role in supporting clean energy initiatives, including solar, wind, and hydro projects. With the rising demand for green energy and strong government backing, IREDA shares have gained investor interest. IREDA Share Price on NSE as of 12 March 2025 is 141.30 INR.

Current Market overview of IREDA Share Price

- Open: 143.00

- High: 144.39

- Low: 140.15

- Previous Close: 141.98

- Volume: 7,642,541

- Value (Lacs): 10,795.85

- VWAP: 141.71

- Mkt Cap (Rs. Cr.): 37,967

- Face Value: 10

- UC Limit: 156.17

- LC Limit: 127.78

- 52 Week High: 310.00

- 52 Week Low: 121.05

IREDA Share Price Target Tomorrow 2025 To 2030

| IREDA Share Price Target Years | IREDA Share Price |

| 2025 | INR 310 |

| 2026 | INR 530 |

| 2027 | INR 670 |

| 2028 | INR 800 |

| 2029 | INR 940 |

| 2030 | INR 1070 |

IREDA Share Price Chart

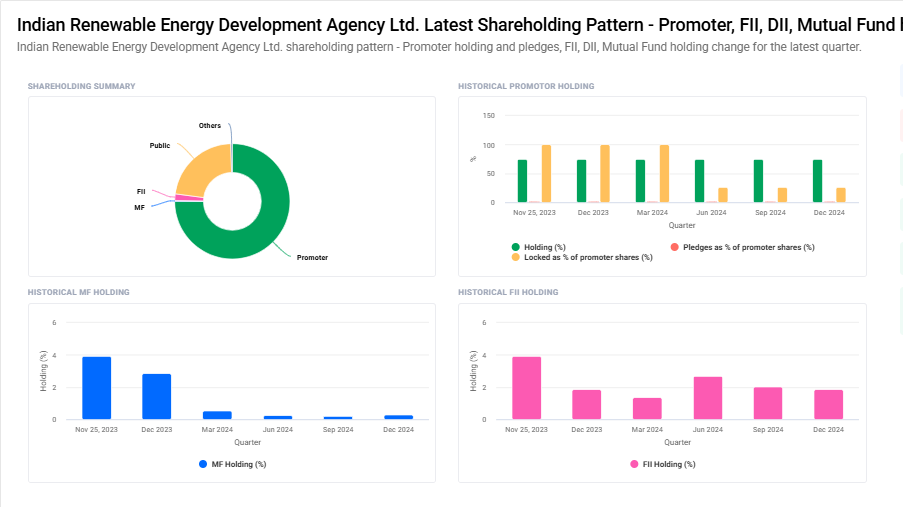

IREDA Shareholding Pattern

- Promoter: 75%

- FII: 1.9%

- DII: 0.6%

- Public: 22.5%

Key Factors Affecting IREDA Share Price Growth

-

Government Support for Renewable Energy – As a government-backed entity, IREDA benefits from India’s strong push towards renewable energy. Favorable policies, incentives, and funding support can drive its business growth and positively impact the share price.

-

Expansion of Green Energy Projects – The rising demand for clean energy projects, including solar, wind, and hydroelectric power, creates more lending opportunities for IREDA. This expansion fuels revenue growth and strengthens investor confidence.

-

Financial Performance and Profitability – Consistent growth in revenue, net profit, and asset quality will play a crucial role in boosting IREDA’s share price. Investors will closely monitor loan disbursements, repayment rates, and overall financial health.

-

Interest Rate Movements – As a financial institution, IREDA’s profitability depends on borrowing and lending rates. Lower interest rates improve lending opportunities, while higher rates may impact its profit margins and stock performance.

-

Global and Domestic Investment Trends – Increased foreign and domestic investments in India’s renewable sector can enhance IREDA’s funding sources, allowing it to expand its financing capacity and improve its market position.

-

Competition in Renewable Energy Financing – The entry of private and global financial institutions in the renewable energy space could affect IREDA’s market share. Competitive lending rates and better financial services may challenge its growth.

-

Regulatory and Environmental Policies – Changes in government regulations, environmental policies, or carbon credit initiatives can directly influence IREDA’s business model. Supportive policies will drive growth, while unfavorable changes may pose risks to future expansion.

Risks and Challenges for IREDA Share Price

-

Policy and Regulatory Uncertainty – While the government strongly supports renewable energy, any changes in policies, subsidies, or tax benefits could impact IREDA’s growth. Stricter regulations or delays in policy implementation may create uncertainty for investors.

-

Rising Interest Rates – As a financing company, IREDA relies on borrowing funds to provide loans. If interest rates rise, its cost of capital increases, affecting profit margins and potentially slowing down loan disbursements.

-

Credit Risk and Loan Defaults – IREDA provides funding to renewable energy companies, but some projects may face financial difficulties or delays, leading to loan defaults. A higher percentage of non-performing assets (NPAs) can negatively impact investor confidence.

-

Market Competition – With private and global financial institutions entering the renewable energy financing sector, IREDA faces growing competition. Competitors offering better interest rates or flexible loan terms could reduce its market share.

-

Dependence on Government Support – Being a government-backed entity, IREDA’s business operations are closely tied to government funding and initiatives. Any reduction in support or budget allocation could impact its financial stability and stock performance.

-

Slowdown in Renewable Energy Sector – If the adoption of renewable energy slows due to economic challenges, infrastructure issues, or reduced investor interest, IREDA’s growth prospects may be affected, leading to weaker stock performance.

-

Global Economic Uncertainty – Fluctuations in global markets, inflation, and geopolitical tensions can impact investment flows into India’s renewable energy sector. A slowdown in global economic growth may reduce foreign investments in green projects, indirectly affecting IREDA’s business and share price.

Read Also:- Jaiprakash Power Share Price Target Tomorrow 2025 To 2030