IRCTC Share Price Target Tomorrow 2025 To 2030

IRCTC (Indian Railway Catering and Tourism Corporation) is a government-owned company that manages online railway ticket bookings, catering services, and tourism packages for Indian Railways. It holds a monopoly in railway ticketing, making it a unique stock in the Indian market. The company benefits from India’s growing travel sector and digitalization. IRCTC Share Price on NSE as of 19 March 2025 is 719.80 INR.

Current Market overview of IRCTC Share Price

- Open: 711.00

- High: 720.90

- Low: 707.40

- Previous Close: 705.90

- Volume: 581,805.00

- Value (Lacs): 4,175.91

- VWAP: 715.63

- Mkt Cap (Rs. Cr.): 57,420

- Face Value: 2.00

- UC Limit: 776.45

- LC Limit: 635.35

- 52 Week High: 1,138.90

- 52 Week Low: 656.05

IRCTC Share Price Target Tomorrow 2025 To 2030

| IRCTC Share Price Target Years | IRCTC Share Price |

| 2025 | INR 1140 |

| 2026 | INR 1250 |

| 2027 | INR 1350 |

| 2028 | INR 1450 |

| 2029 | INR 1550 |

| 2030 | INR 1650 |

IRCTC Share Price Chart

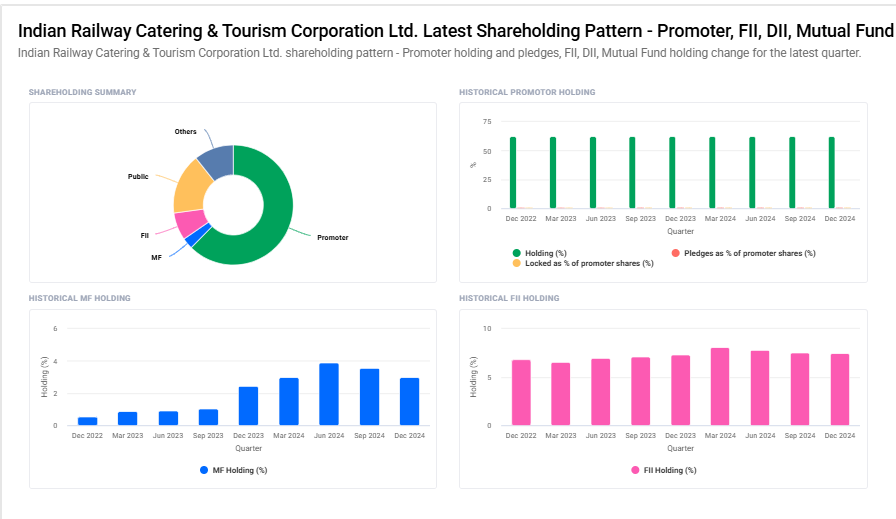

IRCTC Shareholding Pattern

- Promoter: 62.4%

- FII: 7.5%

- DII: 13.7%

- Public: 16.4%

Key Factors Affecting IRCTC Share Price Growth

-

Strong Monopoly in Railway Services

IRCTC has exclusive rights to online railway ticketing, catering, and packaged drinking water for Indian Railways. This monopoly gives it a stable and growing revenue stream, positively impacting its share price. -

Rising Demand for Travel & Tourism

With increasing domestic and international travel in India, IRCTC benefits from higher ticket bookings and tourism packages. A surge in railway passengers can lead to revenue growth, supporting the stock price. -

Digitalization and Tech Advancements

The company’s focus on improving its digital platforms, including its user-friendly website and mobile app, enhances customer experience. Increased online bookings can drive higher revenues and boost investor confidence. -

Revenue Diversification

Apart from ticketing, IRCTC earns from catering, tourism, and selling packaged water (Rail Neer). Expansion into new business areas can strengthen its financial position and lead to share price appreciation. -

Government Policies & Privatization Plans

Being a government-owned company, policy changes related to railway privatization, ticket pricing, or tourism promotion can influence IRCTC’s financial performance and stock growth prospects. -

Economic Growth and Infrastructure Development

As India invests more in railway modernization and infrastructure, improved facilities and faster trains can increase passenger numbers, benefiting IRCTC’s ticketing and tourism business. -

Consistent Profitability & Strong Fundamentals

IRCTC maintains high-profit margins with a strong balance sheet and no debt. Its consistent earnings and dividend payouts attract long-term investors, positively affecting its stock price over time.

Risks and Challenges for IRCTC Share Price

-

Government Regulations & Policy Changes

IRCTC is a government-controlled entity, and any policy changes regarding ticket pricing, revenue sharing, or privatization of railway services can impact its earnings and stock performance. -

Dependence on Indian Railways

Since IRCTC primarily operates within the railway sector, its business growth is directly linked to Indian Railways’ operations. Any disruptions in railway services, slow infrastructure development, or policy shifts could affect revenue. -

Competition from Private Players

The Indian government is opening up the railway sector for private players, which could lead to increased competition in catering, tourism, and ticketing services, potentially reducing IRCTC’s market dominance. -

Revenue Dependence on Ticketing & Tourism

A significant portion of IRCTC’s revenue comes from online ticket booking and tourism. Any slowdown in travel demand due to economic downturns, pandemics, or safety concerns could negatively impact financial performance. -

Service Quality and Customer Satisfaction

Complaints about poor catering services, website glitches, or slow customer support can affect IRCTC’s reputation. A decline in service quality may lead to reduced customer trust, impacting revenue and stock value. -

Stock Volatility Due to Government Stake Sales

The Indian government periodically sells its stake in IRCTC to raise funds. These divestments can lead to stock price fluctuations and impact investor sentiment, causing short-term volatility. -

Regulatory Control Over Pricing

IRCTC cannot freely set ticket prices or catering charges as they are regulated by Indian Railways. This limitation on pricing power can restrict revenue growth and affect long-term profitability.

Read Also:- PCBL Share Price Target Tomorrow 2025 To 2030