IndusInd Bank Share Price Target Tomorrow 2025 To 2030

IndusInd Bank Share represents ownership in IndusInd Bank, one of India’s leading private sector banks. Known for its strong retail and corporate banking services, the bank has shown steady growth over the years. Investors are attracted to its expanding loan portfolio, digital banking innovations, and improving asset quality. IndusInd Bank Share Price on NSE as of 15 March 2025 is 672.65 INR.

Current Market overview of IndusInd Bank Share Price

- Open: 690.00

- High: 706.90

- Low: 667.65

- Previous Close: 684.70

- Volume: 31,592,987

- Value (Lacs): 212,415.45

- VWAP: 683.32

- Mkt Cap (Rs. Cr.): 52,379

- Face Value: 10

- UC Limit: 753.15

- LC Limit: 616.25

- 52 Week High: 1,576.35

- 52 Week Low: 606.00

IndusInd Bank Share Price Target Tomorrow 2025 To 2030

| IndusInd Bank Share Price Target Years | IndusInd Bank Share Price |

| 2025 | INR 1580 |

| 2026 | INR 2040 |

| 2027 | INR 2563 |

| 2028 | INR 3050 |

| 2029 | INR 3584 |

| 2030 | INR 4062 |

IndusInd Bank Share Price Chart

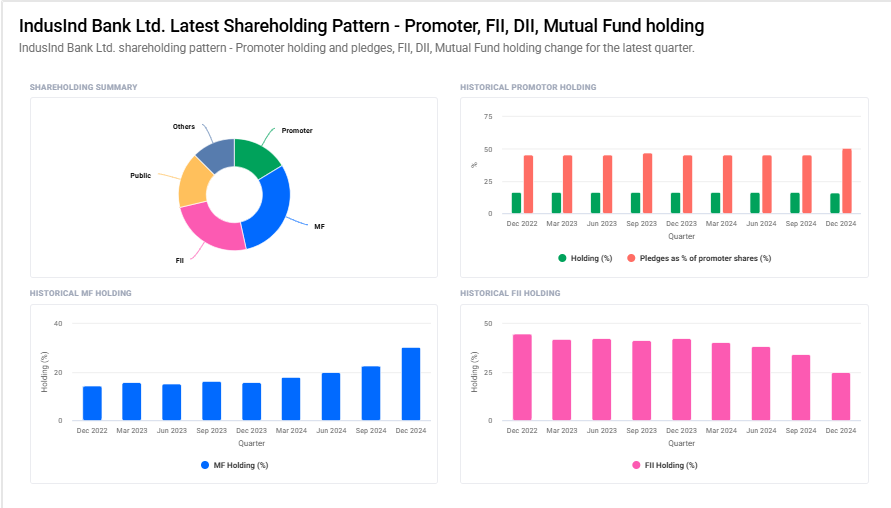

IndusInd Bank Shareholding Pattern

- Promoter: 16.3%

- FII: 24.7%

- DII: 42.8%

- Public: 16.2%

Key Factors Affecting IndusInd Bank Share Price Growth

-

Strong Loan Growth – IndusInd Bank’s expanding loan book, especially in retail and corporate lending, boosts revenue and profitability, positively impacting its stock price.

-

Improving Asset Quality – A decline in non-performing assets (NPAs) and effective risk management strengthen investor confidence and support share price growth.

-

Interest Rate Movements – Higher interest rates generally improve the bank’s net interest margin (NIM), increasing earnings and making the stock more attractive to investors.

-

Expansion and Digital Initiatives – The bank’s focus on digital banking, branch network expansion, and new financial products drives customer growth and enhances financial performance.

-

Strong Economic Environment – A growing economy supports higher credit demand and lower default rates, contributing to better financial health and stock price appreciation.

-

Regulatory Support – Favorable banking regulations, government policies, and RBI’s monetary stance play a crucial role in determining the bank’s profitability and stock valuation.

-

Institutional and Foreign Investments – Increased investments by foreign institutional investors (FIIs) and domestic institutions indicate strong market confidence, positively influencing share price movement.

Risks and Challenges for IndusInd Bank Share Price

-

Rising Non-Performing Assets (NPAs) – If the bank faces an increase in bad loans due to defaults, it can weaken profitability and investor confidence, negatively impacting the stock price.

-

Regulatory Uncertainties – Changes in RBI guidelines, banking sector regulations, or compliance requirements can create operational challenges, affecting business growth and stock performance.

-

Interest Rate Fluctuations – A sudden decline in interest rates may reduce the bank’s net interest margin (NIM), impacting revenue and overall profitability.

-

Economic Slowdown – A weak economy can reduce loan demand and increase credit risks, leading to lower earnings and affecting investor sentiment toward the stock.

-

Competition in the Banking Sector – Rising competition from private and public sector banks, as well as fintech firms, may pressure IndusInd Bank’s market share and profitability.

-

Stock Market Volatility – Fluctuations in the broader market, geopolitical tensions, or global financial crises can trigger sharp movements in the bank’s share price, affecting short-term stability.

-

Cybersecurity and Digital Risks – As the bank expands its digital banking services, cybersecurity threats and data breaches could damage its reputation and lead to financial losses, impacting stock performance.

Read Also:- ITC Share Price Target Tomorrow 2025 To 2030