IFCI Share Price Target Tomorrow 2025 To 2030

IFCI (Industrial Finance Corporation of India) is a government-backed financial institution that provides funding for industrial and infrastructure projects. Established as one of India’s oldest development finance institutions, it plays a key role in supporting businesses and economic growth.

The share price of IFCI is influenced by government policies, loan recoveries, interest rates, and overall financial performance. The company faces competition from banks and other financial firms, making efficiency in lending and risk management crucial for its success. IFCI Share Price on NSE as of 22 March 2025 is 45.38 INR.

Current Market overview of IFCI Share Price

- Open: 43.42

- High: 46.24

- Low: 43.28

- Previous Close: 43.42

- Volume: 11,714,861

- Value (Lacs): 5,306.83

- VWAP: 45.25

- Mkt Cap (Rs. Cr.): 12,205

- Face Value: 10

- UC Limit: 52.10

- LC Limit: 34.73

- 52 Week High: 91.40

- 52 Week Low: 38.55

IFCI Share Price Target Tomorrow 2025 To 2030

| IFCI Share Price Target Years | IFCI Share Price |

| 2025 | INR 95 |

| 2026 | INR 102 |

| 2027 | INR 108 |

| 2028 | INR 115 |

| 2029 | INR 121 |

| 2030 | INR 127 |

IFCI Share Price Chart

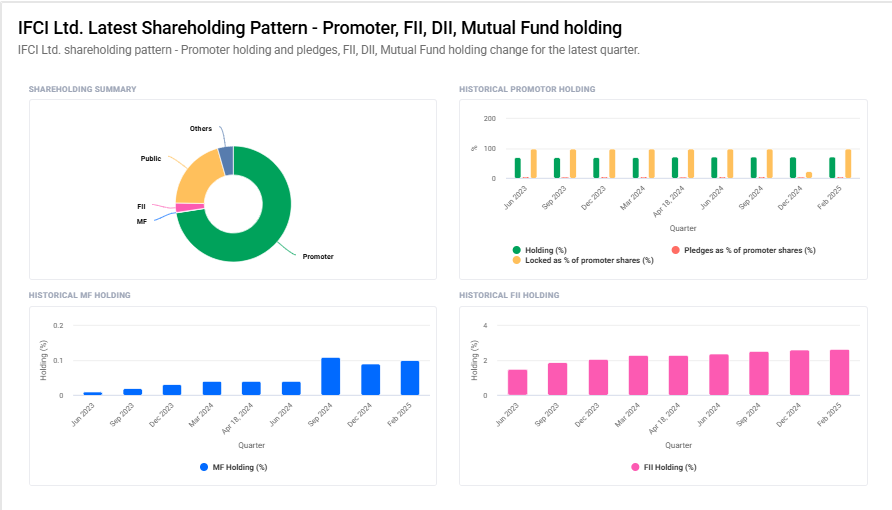

IFCI Shareholding Pattern

- Promoter: 72.6%

- FII: 2.6%

- DII: 4.5%

- Public: 20.3%

Key Factors Affecting IFCI Share Price Growth

-

Government Support and Policies

IFCI, being a government-backed financial institution, benefits from various policy measures and financial assistance. Any positive government initiative, such as capital infusion or new lending programs, can boost investor confidence and drive share price growth. -

Financial Performance and Profitability

Strong quarterly and annual financial results, including higher revenue, profitability, and reduction in non-performing assets (NPAs), can positively impact IFCI’s stock price by attracting more investors. -

Interest Rate Movements

As a financial institution, IFCI is affected by interest rate changes set by the Reserve Bank of India (RBI). Lower interest rates make borrowing cheaper, boosting lending activities and improving earnings, which can drive share price growth. -

Asset Quality and NPA Management

Investors closely monitor IFCI’s non-performing assets (NPAs). A decrease in bad loans and improved asset quality indicate better financial stability, leading to positive market sentiment and potential share price appreciation. -

Expansion of Lending and Investment Portfolio

Growth in IFCI’s loan book, strategic investments, and diversification into profitable sectors can enhance its long-term earnings potential. A well-managed expansion strategy often leads to higher stock valuations. -

Market Sentiment and Economic Conditions

Overall market trends, economic growth, and investor sentiment toward the financial sector impact IFCI’s stock price. A bullish market and a strong economy generally favor higher share valuations. -

Stakeholder and Institutional Interest

Increased investments from mutual funds, foreign investors, and institutional stakeholders can improve liquidity and boost IFCI’s stock price. Positive news about stake purchases or strategic partnerships often drives growth.

Risks and Challenges for IFCI Share Price

-

High Non-Performing Assets (NPAs)

IFCI, like other financial institutions, faces risks from bad loans. If the company struggles to recover outstanding loans, NPAs increase, which can weaken investor confidence and negatively impact the share price. -

Dependence on Government Support

Since IFCI is a government-backed financial institution, its growth often depends on policy decisions and capital support. Any reduction in government assistance can affect its financial stability and stock performance. -

Economic Slowdown and Market Volatility

A weak economy, high inflation, or recession can impact lending activities, reducing IFCI’s profitability. Stock market volatility and unfavorable financial conditions can lead to fluctuations in its share price. -

Regulatory Changes and Compliance Risks

The financial sector is highly regulated, and any changes in RBI guidelines, banking norms, or new financial policies may create operational challenges for IFCI. Regulatory hurdles can slow down growth and affect investor sentiment. -

Rising Interest Rates

If the Reserve Bank of India (RBI) increases interest rates, borrowing costs for businesses and individuals may rise. This can reduce the demand for IFCI’s financial services, impacting its earnings and share price. -

Limited Business Diversification

Compared to private financial companies, IFCI has limited diversification in its business model. If it fails to expand into new revenue streams, it may face slower growth, which could lead to lower stock valuations. -

Competitive Pressure from Private Lenders

The financial sector is highly competitive, with strong private lenders and NBFCs offering similar services. If IFCI struggles to maintain its market position against more agile and innovative competitors, its growth potential may be limited, affecting share performance.

Read Also:- NMDC Share Price Target Tomorrow 2025 To 2030