IDFC First Bank Share Price Target Tomorrow 2025 To 2030

IDFC First Bank is a growing private sector bank in India, known for its strong focus on retail banking and digital services. The bank has been expanding its loan book, especially in retail and MSME segments, while also improving asset quality. With a customer-first approach, innovative banking solutions, and steady financial performance, IDFC First Bank has gained investor interest. IDFC First Bank Share Price on NSE as of 12 March 2025 is 54.63 INR.

Current Market overview of IDFC First Bank Share Price

- Open: 55.50

- High: 55.79

- Low: 54.12

- Previous Close: 55.36

- Volume: 35,637,579

- Value (Lacs): 19,461.68

- VWAP: 54.75

- Mkt Cap (Rs. Cr.): 39,983

- Face Value: 10

- UC Limit: 60.89

- LC Limit: 49.82

- 52 Week High: 86.10

- 52 Week Low: 54.12

IDFC First Bank Share Price Target Tomorrow 2025 To 2030

| IDFC First Bank Share Price Target Years | IDFC First Bank Share Price |

| 2025 | INR 90 |

| 2026 | INR 120 |

| 2027 | INR 150 |

| 2028 | INR 180 |

| 2029 | INR 210 |

| 2030 | INR 240 |

IDFC First Bank Share Price Chart

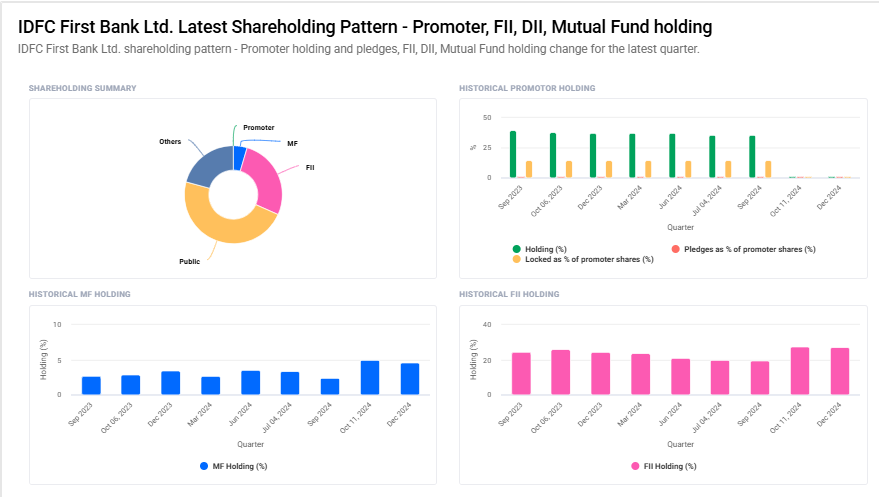

IDFC First Bank Shareholding Pattern

- Promoter: 0%

- FII: 27.1%

- DII: 25.3%

- Public: 47.6%

Key Factors Affecting IDFC First Bank Share Price Growth

-

Strong Loan Growth – IDFC First Bank is expanding its loan portfolio, especially in retail lending, which can drive revenue and profitability, positively influencing its share price.

-

Improved Asset Quality – A decline in non-performing assets (NPAs) and better loan recovery can boost investor confidence and strengthen the bank’s financial position.

-

Expansion of Digital Banking – Investments in digital banking, fintech partnerships, and technology-driven services can enhance customer experience and attract more users, supporting long-term growth.

-

Rising Interest Income – With an increase in interest rates, the bank’s net interest margin (NIM) may improve, leading to higher earnings and a potential rise in its stock value.

-

Strong Deposit Growth – A steady increase in deposits and a low-cost funding base can help IDFC First Bank maintain liquidity and fund business expansion efficiently.

-

Positive Economic Conditions – Economic growth, rising consumer spending, and a stable banking sector create favorable conditions for the bank’s operations and share price performance.

-

Strategic Business Initiatives – Expansion into new financial products, stronger corporate lending, and innovative banking solutions can drive profitability and long-term stock growth.

Risks and Challenges for IDFC First Bank Share Price

-

High Competition in Banking Sector – IDFC First Bank faces tough competition from well-established private and public sector banks, which could impact its market share and profitability.

-

Asset Quality Risks – If the bank struggles with rising non-performing assets (NPAs) or bad loans, it could lead to financial instability and a negative impact on its stock price.

-

Interest Rate Fluctuations – Changes in interest rates can affect the bank’s net interest margin (NIM), potentially reducing profitability and investor confidence.

-

Regulatory and Policy Changes – Banking regulations, RBI policies, and government decisions can influence the bank’s operations, which may pose challenges to its growth and stock performance.

-

Economic Slowdown – A slowdown in the economy can lead to lower credit demand, higher loan defaults, and reduced profitability, negatively affecting the share price.

-

Dependence on Retail Lending – A significant portion of IDFC First Bank’s business comes from retail loans. If consumer demand weakens, it could impact the bank’s revenue and stock value.

-

Technology and Cybersecurity Risks – As the bank expands its digital services, it faces risks related to cybersecurity threats, data breaches, and technology failures, which could impact customer trust and financial stability.

Read Also:- Varun Beverages Share Price Target Tomorrow 2025 To 2030