Hyundai Motor Share Price Target Tomorrow 2025 To 2030

Hyundai Motor is one of the world’s leading automobile manufacturers, known for its wide range of vehicles, including electric and hybrid models. The company’s shares reflect its strong global presence, innovation in electric mobility, and focus on sustainability. Hyundai’s stock performance is influenced by factors such as vehicle sales, technological advancements, competition, and market trends. Hyundai Motor Share Price on NSE as of 12 March 2025 is 1,98,200 KRW.

Current Market overview of Hyundai Motor Share Price

- Open: 1,678.95

- High: 1,684.60

- Low: 1,642.60

- Previous Close: 1,663.00

- Volume: 236,300

- Value (Lacs): 3,906.04

- VWAP: 1,655.77

- Mkt Cap (Rs. Cr.): 134,313

- Face Value: 10

- UC Limit: 1,829.30

- LC Limit: 1,496.70

- 52 Week High: 1,970.00

- 52 Week Low: 1,610.65

Hyundai Motor Share Price Target Tomorrow 2025 To 2030

| Hyundai Motor Share Price Target Years | Hyundai Motor Share Price |

| 2025 | KRW 2,99,500 |

| 2026 | KRW 3,50,500 |

| 2027 | KRW 4,00,500 |

| 2028 | KRW 4,50,500 |

| 2029 | KRW 4,95,500 |

| 2030 | KRW 5,40,500 |

Hyundai Motor Share Price Chart

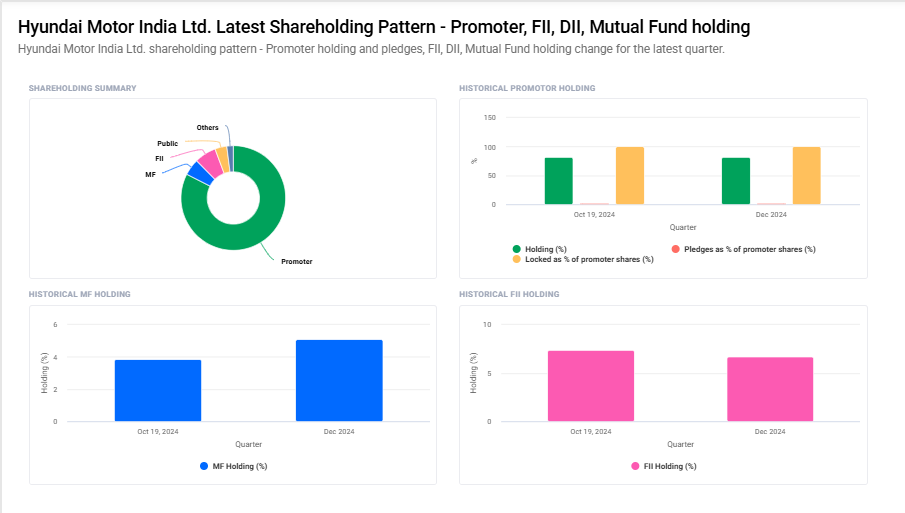

Hyundai Motor Shareholding Pattern

- Promoter: 82.5%

- FII: 6.7%

- DII: 7.1%

- Public: 3.7%

Key Factors Affecting Hyundai Motor Share Price Growth

-

Electric Vehicle (EV) Expansion

Hyundai is investing heavily in EV technology, launching new models under its Ioniq brand. Strong EV sales and government incentives for clean energy vehicles can boost its market position and share price growth. -

Global Automobile Demand

The company’s performance depends on global car sales. Economic recovery, consumer spending, and demand for fuel-efficient vehicles influence Hyundai’s revenue and stock performance. -

Innovation and Technology

Hyundai is focusing on autonomous driving, hydrogen fuel cells, and AI-powered vehicle features. Advancements in these areas can enhance its brand value and attract long-term investors. -

Market Expansion and Partnerships

Expanding in emerging markets like India, Southeast Asia, and Africa, along with strategic collaborations with tech companies, can drive revenue growth and positively impact its share price. -

Raw Material and Production Costs

Steel, semiconductor chips, and battery costs affect production expenses. Efficient cost management and stable supply chains are key to maintaining profitability and stock stability. -

Brand Strength and Consumer Perception

Hyundai’s reputation for quality, safety, and affordability plays a crucial role in its sales. Positive customer feedback and high satisfaction ratings can strengthen investor confidence. -

Government Regulations and Trade Policies

Emission norms, trade tariffs, and policies related to automobile manufacturing can impact Hyundai’s operations. Favorable policies in key markets can support share price growth.

Risks and Challenges for Hyundai Motor Share Price

-

Global Economic Slowdown

A weak economy can lower consumer spending on vehicles, reducing Hyundai’s sales and profitability. Inflation, interest rate hikes, and economic recessions can also impact demand. -

Supply Chain Disruptions

Shortages of key components like semiconductor chips and raw materials can delay production and increase costs, affecting Hyundai’s revenue and market performance. -

Intense Competition

Hyundai faces strong competition from global automakers like Toyota, Tesla, and Volkswagen, as well as rising Chinese EV brands. Losing market share can impact its stock performance. -

Fluctuating Fuel and Raw Material Prices

Rising prices of essential raw materials such as steel, aluminum, and lithium (for EV batteries) can increase manufacturing costs, putting pressure on Hyundai’s profit margins. -

Regulatory and Policy Changes

Stricter emission regulations and evolving government policies in different countries can increase compliance costs. Trade restrictions and tariffs can also affect exports and profitability. -

Shifts in Consumer Preferences

A rapid change in consumer demand toward EVs, self-driving technology, or new mobility solutions could challenge Hyundai if it fails to adapt quickly. Any delay in innovation may impact stock growth. -

Currency Exchange Rate Volatility

Since Hyundai operates globally, fluctuations in currency exchange rates can affect its revenue and profits. A weaker Korean won or unfavorable forex conditions can impact earnings.

Read Also:- Varun Beverages Share Price Target Tomorrow 2025 To 2030