HBL Power Share Price Target Tomorrow 2025 To 2030

HBL Power Systems is an Indian company specializing in batteries and power electronics, serving industries like defense, railways, and telecom. Its share price depends on demand for industrial batteries, government contracts, and advancements in battery technology. Growth in sectors like renewable energy and electric mobility can positively impact the stock. HBL Power Share Price on NSE as of 26 March 2025 is 474.25 INR.

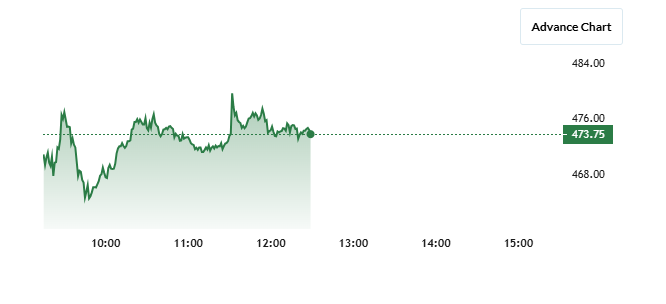

Current Market overview of HBL Power Share Price

- Open: 473.15

- High: 479.95

- Low: 463.00

- Previous Close: 472.50

- Volume: 1,131,717

- Value (Lacs): 5,363.21

- VWAP: 472.88

- Mkt Cap (Rs. Cr.): 13,136

- Face Value: 1

- UC Limit: 567.00

- LC Limit: 378.00

- 52 Week High: 739.65

- 52 Week Low: 405.00

HBL Power Share Price Target Tomorrow 2025 To 2030

| HBL Power Share Price Target Years | HBL Power Share Price |

| 2025 | INR 740 |

| 2026 | INR 850 |

| 2027 | INR 950 |

| 2028 | INR 1050 |

| 2029 | INR 1150 |

| 2030 | INR 1250 |

HBL Power Share Price Chart

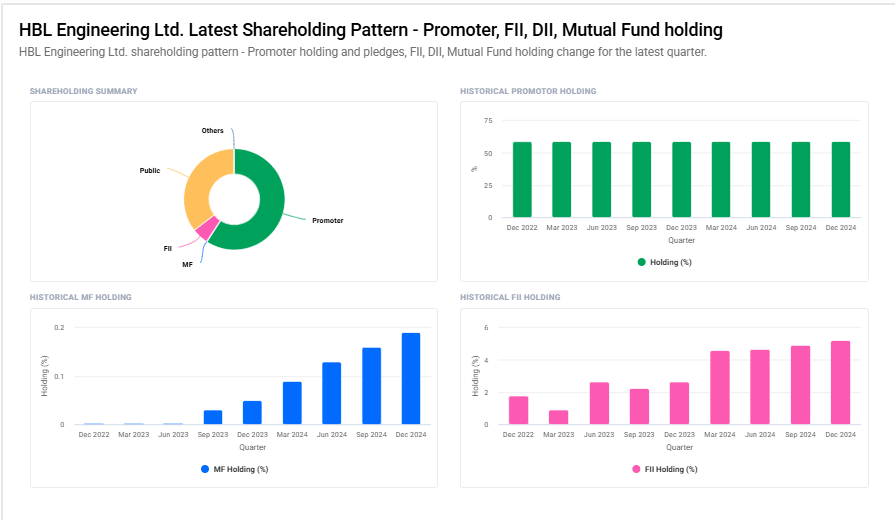

HBL Power Shareholding Pattern

- Promoter: 59.1%

- FII: 5.2%

- DII: 0.4%

- Public: 35.3%

Key Factors Affecting HBL Power Share Price Growth

-

Growing Demand for Energy Storage

HBL Power specializes in batteries and power solutions, and with the rising need for energy storage in telecom, defense, and renewable sectors, the company stands to benefit. Increased demand for reliable energy storage solutions can drive its revenue and share price growth. -

Government Policies and Support

Policies promoting clean energy, electric vehicles (EVs), and battery manufacturing in India can boost HBL Power’s business. Incentives and subsidies for battery manufacturers may help the company expand and improve profitability. -

Expansion in Defense and Aerospace Sector

HBL Power supplies batteries to defense and aerospace industries. If the company secures more government contracts or partnerships in these sectors, it could enhance revenue streams and positively impact the share price. -

Technological Advancements

Innovations in battery technology, including lithium-ion and advanced lead-acid batteries, can give HBL Power a competitive edge. Developing cost-efficient and high-performance batteries can help the company capture a larger market share. -

Financial Performance and Profitability

Steady revenue growth, strong profit margins, and controlled expenses are key drivers of share price appreciation. Investors closely watch quarterly earnings, debt levels, and cash flow for signs of financial stability and future growth potential. -

Growth in Electric Vehicles (EVs) and Renewable Energy

The increasing adoption of electric vehicles and solar energy storage solutions can boost the demand for HBL Power’s battery products. If the company successfully enters these high-growth markets, it could strengthen its stock performance. -

Strategic Partnerships and Global Expansion

Collaborations with international players, expansion into new markets, and joint ventures can help HBL Power grow its business. A strong global presence can reduce dependency on a single market and improve overall revenue, supporting share price growth.

Risks and Challenges for HBL Power Share Price

-

Raw Material Price Volatility

The cost of key materials like lead, lithium, and other battery components fluctuates based on global supply and demand. If raw material prices rise significantly, it can increase production costs and reduce profit margins, impacting the share price. -

Competition from Established Players

HBL Power faces strong competition from both domestic and global battery manufacturers. Larger companies with advanced technology and higher production capacity could limit HBL Power’s market share and growth potential. -

Slow Adoption of New Technologies

While the battery industry is evolving rapidly, a delay in adopting new technologies like lithium-ion or solid-state batteries could put HBL Power at a disadvantage. Competitors offering more advanced solutions may capture a larger market, affecting future revenues. -

Dependence on Specific Sectors

The company relies heavily on the telecom, defense, and railways sectors for business. Any slowdown in these industries, reduced government orders, or policy changes could directly impact HBL Power’s revenue and stock performance. -

Regulatory and Environmental Risks

Strict government regulations regarding battery production, recycling, and environmental impact can increase compliance costs. Any failure to meet these regulations could result in fines or operational restrictions, negatively affecting the company’s growth. -

Financial Performance and Debt Levels

If HBL Power struggles with high debt, declining profits, or inconsistent financial performance, investor confidence may weaken. Poor earnings reports can lead to stock price volatility and lower market valuations. -

Global Economic Uncertainty

Economic downturns, inflation, or supply chain disruptions could impact HBL Power’s business. A weak global economy may reduce industrial demand for batteries, affecting sales and putting pressure on the company’s share price.

Read Also:- Power Grid Share Price Target Tomorrow 2025 To 2030