HAL Share Price Target Tomorrow 2025 To 2030

Hindustan Aeronautics Limited (HAL) is India’s leading aerospace and defense company, known for manufacturing fighter jets, helicopters, and aircraft components. Founded in 1940, HAL plays a key role in strengthening India’s defense sector by supplying aircraft and maintenance services to the Indian Armed Forces. The company is at the heart of the government’s ‘Make in India’ initiative, focusing on indigenous defense production. HAL Share Price on NSE as of 10 March 2025 is 3,451.45 INR.

Current Market overview of HAL Share Price

- Open: 3,452.05

- High: 3,538.95

- Low: 3,428.40

- Previous Close: 3,452.05

- Volume: 1,701,592

- Value (Lacs): 58,725.34

- VWAP: 3,484.04

- Mkt Cap (Rs. Cr.): 230,807

- Face Value: 5

- UC Limit: 3,797.25

- LC Limit: 3,106.85

- 52 Week High: 5,674.75

- 52 Week Low: 2,913.60

HAL Share Price Target Tomorrow 2025 To 2030

| HAL Share Price Target Years | HAL Share Price |

| 2025 | ₹5680 |

| 2026 | ₹6030 |

| 2027 | ₹6472 |

| 2028 | ₹6850 |

| 2029 | ₹7365 |

| 2030 | ₹7845 |

HAL Share Price Chart

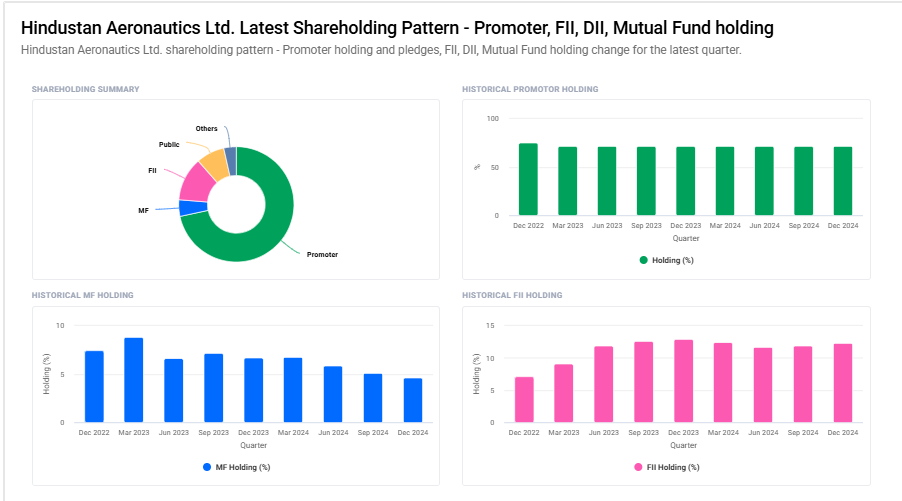

HAL Shareholding Pattern

- Promoter: 71.6%

- FII: 12.3%

- DII: 8.2%

- Public: 8%

Key Factors Affecting HAL Share Price Growth

Here are seven key factors affecting Hindustan Aeronautics Limited (HAL) share price growth:

-

Government Defense Contracts – HAL is a major supplier of aircraft and defense equipment to the Indian government. New defense deals and long-term contracts can drive revenue growth and boost investor confidence.

-

Increased Defense Budget – A higher allocation to defense in the Union Budget can benefit HAL, as it secures more orders for fighter jets, helicopters, and aircraft maintenance services, positively impacting its stock price.

-

Exports and Global Expansion – Expanding into international markets and securing export orders from foreign governments can open new revenue streams, strengthening HAL’s growth potential.

-

Indigenization and ‘Make in India’ Push – The government’s focus on reducing dependence on foreign defense imports and promoting local manufacturing benefits HAL, increasing its market dominance.

-

New Technological Developments – Advancements in defense technology, including the development of indigenous fighter jets, drones, and next-generation aircraft, can enhance HAL’s reputation and financial performance.

-

Joint Ventures and Collaborations – Partnerships with global aerospace companies for technology transfer and manufacturing agreements can help HAL stay competitive and expand its capabilities.

-

Strong Order Book and Deliveries – A steady pipeline of new orders and timely execution of existing projects ensure consistent revenue growth, which positively influences HAL’s stock price.

Risks and Challenges for HAL Share Price

Here are seven key risks and challenges for Hindustan Aeronautics Limited (HAL) share price:

-

Dependence on Government Orders – HAL relies heavily on orders from the Indian government for defense equipment. Any delays, budget cuts, or policy changes could impact revenue and stock performance.

-

Global Competition in Defense Sector – HAL faces competition from international defense manufacturers offering advanced technologies. If HAL fails to keep up with innovation, it may lose potential contracts.

-

Project Delays and Cost Overruns – Large-scale defense projects often face delays due to technical challenges or supply chain disruptions. Delays in production and delivery could impact financial performance.

-

Regulatory and Policy Risks – Changes in government policies related to defense procurement, foreign collaborations, or export restrictions could affect HAL’s operations and future growth.

-

Geopolitical Uncertainty – Tensions between countries, trade restrictions, or diplomatic issues could impact HAL’s international deals, exports, and overall business stability.

-

Technological Advancements and R&D Costs – Investing in new aerospace technology is expensive, and failure to keep up with evolving defense needs could reduce HAL’s competitiveness. High R&D costs can also impact profitability.

-

Stock Volatility and Market Sentiment – HAL’s share price may fluctuate based on defense sector news, government decisions, and overall market conditions, making it sensitive to external factors.

Read Also:- Reliance Power Share Price Target Tomorrow 2025 To 2030