Gensol Engineering Share Price Target Tomorrow 2025 To 2030

Gensol Engineering Share represents a company focused on renewable energy solutions, primarily in solar power. It provides engineering, procurement, and construction (EPC) services for solar projects, catering to both commercial and government clients. As the demand for clean energy grows, Gensol has positioned itself as a key player in India’s green energy transition. Gensol Engineering Share Price on NSE as of 15 March 2025 is 262.25 INR.

Current Market overview of Gensol Engineering Share Price

- Open: 266.00

- High: 270.00

- Low: 262.25

- Previous Close: 276.05

- Volume: 993,601

- Value (Lacs): 2,605.72

- VWAP: 264.55

- Mkt Cap (Rs. Cr.): 996

- Face Value: 10

- UC Limit: 289.85

- LC Limit: 262.25

- 52 Week High: 1,124.90

- 52 Week Low: 262.25

Gensol Engineering Share Price Target Tomorrow 2025 To 2030

| Gensol Engineering Share Price Target Years | Gensol Engineering Share Price |

| 2025 | INR 1130 |

| 2026 | INR 1653 |

| 2027 | INR 2147 |

| 2028 | INR 2675 |

| 2029 | INR 3284 |

| 2030 | INR 3762 |

Gensol Engineering Share Price Chart

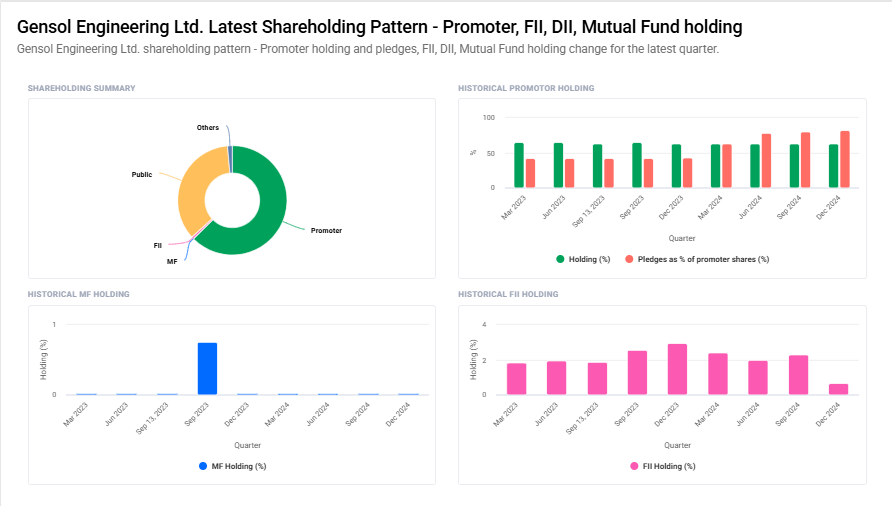

Gensol Engineering Shareholding Pattern

- Promoter: 62.7%

- FII: 0.6%

- DII: 1.4%

- Public: 35.3%

Key Factors Affecting Gensol Engineering Share Price Growth

-

Renewable Energy Demand – As the world shifts towards clean energy, Gensol Engineering, specializing in solar power and renewable solutions, is likely to benefit from increasing demand, positively impacting its share price.

-

Government Policies & Incentives – Supportive policies like subsidies, tax benefits, and incentives for renewable energy projects can boost Gensol’s growth, making its stock attractive to investors.

-

Expansion & New Projects – Gensol’s expansion into international markets, new solar projects, and innovative engineering solutions can contribute to revenue growth, positively influencing its share value.

-

Technological Advancements – The company’s adoption of advanced solar technologies, energy storage solutions, and electric mobility can drive its competitive edge and improve financial performance.

-

Strong Order Book & Contracts – Securing long-term contracts and a robust project pipeline ensures revenue stability, which can enhance investor confidence and support share price growth.

-

Financial Performance – Healthy revenue growth, profitability, and efficient cost management play a crucial role in determining stock performance and long-term investor interest.

-

Global Energy Market Trends – Factors like rising fuel costs, climate change awareness, and global investments in green energy can further drive demand for Gensol’s services, strengthening its stock potential.

Risks and Challenges for Gensol Engineering Share Price

Read Also:- IndusInd Bank Share Price Target Tomorrow 2025 To 2030