Doms Share Price Target Tomorrow 2025 To 2030

DOMS Industries is a leading stationery and art supply brand known for products like pencils, erasers, crayons, and sketch pens. The company has a strong market presence in India and is expanding globally. With a focus on quality, innovation, and affordability, DOMS competes with both local and international brands. Doms Share Price on NSE as of 29 March 2025 is 2,866.20 INR.

Current Market overview of Doms Share Price

- Open: 2,823.95

- High: 2,895.00

- Low: 2,801.10

- Previous Close: 2,812.30

- Volume: 93,747

- Value (Lacs): 2,697.34

- VWAP: 2,867.90

- Mkt Cap (Rs. Cr.): 17,461

- Face Value: 10

- UC Limit: 3,374.75

- LC Limit: 2,249.85

- 52 Week High: 3,115.00

- 52 Week Low: 1,560.05

Doms Share Price Target Tomorrow 2025 To 2030

| Doms Share Price Target Years | Doms Share Price |

| 2025 | INR 3115 |

| 2026 | INR 4210 |

| 2027 | INR 5440 |

| 2028 | INR 6370 |

| 2029 | INR 7500 |

| 2030 | INR 8630 |

Doms Share Price Chart

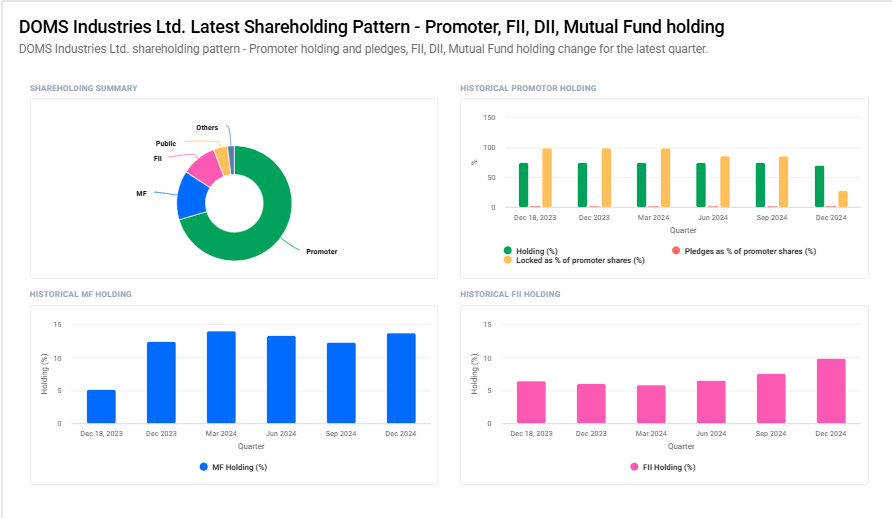

Doms Shareholding Pattern

- Promoter: 70.4%

- FII: 10%

- DII: 15.7%

- Public: 5%

Key Factors Affecting Doms Share Price Growth

-

Revenue Growth and Profitability

-

DOMS Industries has demonstrated significant revenue growth, with a 56.5% increase over the past three years, and a notable profit growth of 139.06% during the same period. Consistent financial performance can boost investor confidence and positively influence the share price.

-

-

Product Innovation and Market Expansion

-

The company’s focus on research and development has led to the introduction of new products catering to both students and professionals. Expanding its product portfolio and entering new markets, including Tier 2 and Tier 3 cities, can drive sales and support share price appreciation.

-

-

Export Opportunities

-

DOMS Industries is exploring export opportunities to strengthen its presence in international markets, focusing on regions with increasing demand for quality yet affordable stationery. Success in global markets can contribute to revenue diversification and enhance the company’s valuation.

-

-

Brand Visibility and Marketing Initiatives

-

Investing in marketing initiatives that resonate with its target audience, particularly students and young professionals, can enhance brand visibility. Collaborations with educational institutions and retailers can ensure wider reach and brand loyalty, potentially leading to increased sales and a higher share price.

-

-

Operational Efficiency and Supply Chain Management

-

Leveraging technology to enhance operational efficiency, reduce costs, and improve supply chain management can boost profitability. Efficient operations can lead to better financial performance, which is often reflected in the company’s stock valuation.

-

-

Financial Metrics and Shareholder Value

-

Maintaining robust revenue growth and sustainable margins can increase shareholder value. The company’s efforts to improve financial metrics, even amid changes in promoter shareholding, can instill confidence among investors and support share price growth.

-

-

Sustainable Practices and Eco-Friendly Products

-

Focusing on sustainable practices, such as developing eco-friendly product lines, aligns with growing consumer preferences and regulatory trends. Emphasizing sustainability can enhance the company’s reputation and appeal to environmentally conscious investors, potentially boosting the share price.

-

Risks and Challenges for Doms Share Price

-

Market Competition

-

The stationery and art supplies industry is highly competitive, with strong domestic and international players. Established brands and low-cost alternatives can impact DOMS’ market share, making it challenging to sustain long-term growth.

-

-

Raw Material Price Fluctuations

-

The cost of raw materials like wood, plastic, and pigments directly affects production expenses. Any significant price increase or supply chain disruption could impact profit margins and put pressure on the share price.

-

-

Dependence on Domestic Demand

-

A large portion of DOMS’ revenue comes from the Indian market. If consumer demand slows due to economic downturns or changing consumer preferences, it may affect sales and stock performance.

-

-

Regulatory and Environmental Challenges

-

Increasing environmental regulations on plastic use and sustainable manufacturing could lead to higher compliance costs. Adapting to such regulations may require additional investment, affecting profitability.

-

-

Dependence on Educational Sector

-

A significant portion of DOMS’ sales come from school and college students. Any disruptions in the education sector, such as prolonged online learning or policy changes, could impact product demand and revenue.

-

-

Promoter and Shareholder Activity

-

Changes in promoter holdings or large-scale selling of shares by major investors can affect stock sentiment. If investors lose confidence due to such moves, the share price may see volatility.

-

-

Economic Slowdowns and Inflation

-

High inflation rates can increase production costs and reduce consumer spending power. Economic slowdowns may also affect the overall demand for non-essential stationery and art supplies, putting pressure on revenue growth and stock performance.

-

Read Also:- BPCL Share Price Target Tomorrow 2025 To 2030