CreditAccess Grameen Share Price Target Tomorrow 2025 To 2030

CreditAccess Grameen is a leading microfinance company in India, focused on providing small loans to rural borrowers, especially women entrepreneurs. The company plays a key role in financial inclusion by offering credit for business, agriculture, and household needs.

Its share price is influenced by factors like loan growth, rural economy conditions, interest rates, and regulatory policies. CreditAccess Grameen Share Price on NSE as of 29 March 2025 is 947.25 INR.

Current Market overview of CreditAccess Grameen Share Price

- Open: 985.00

- High: 992.80

- Low: 940.00

- Previous Close: 985.65

- Volume: 751,798

- Value (Lacs): 7,156.74

- VWAP: 958.86

- Mkt Cap (Rs. Cr.): 15,200

- Face Value: 10

- UC Limit: 1,182.75

- LC Limit: 788.55

- 52 Week High: 1,551.95

- 52 Week Low: 750.20

CreditAccess Grameen Share Price Target Tomorrow 2025 To 2030

| CreditAccess Grameen Share Price Target Years | CreditAccess Grameen Share Price |

| 2025 | INR 1555 |

| 2026 | INR 2050 |

| 2027 | INR 2545 |

| 2028 | INR 3060 |

| 2029 | INR 3574 |

| 2030 | INR 4056 |

CreditAccess Grameen Share Price Chart

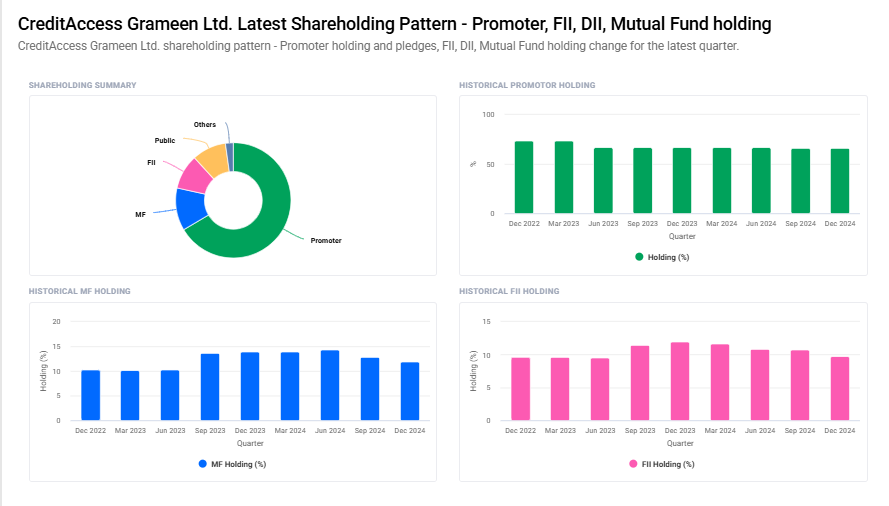

CreditAccess Grameen Shareholding Pattern

- Promoter: 66.5%

- FII: 9.8%

- DII: 14.2%

- Public: 9.6%

Key Factors Affecting CreditAccess Grameen Share Price Growth

-

Growth in Microfinance Sector

CreditAccess Grameen operates in the microfinance industry, which is growing due to increasing financial inclusion in rural areas. A strong demand for small loans can drive the company’s revenue and positively impact its share price. -

Loan Portfolio Expansion

The company’s ability to expand its loan book while maintaining low defaults is crucial. A larger, well-managed portfolio can improve earnings, boosting investor confidence and share price growth. -

Interest Rate Trends

Lower interest rates make borrowing cheaper for microfinance institutions, improving profitability. Favorable interest rate policies can help CreditAccess Grameen grow, leading to potential share price appreciation. -

Government Policies and Regulations

Supportive government initiatives for rural finance and small businesses can benefit the company. However, strict regulatory changes can impact growth and lending practices, influencing share price movements. -

Asset Quality and NPA Levels

Maintaining low non-performing assets (NPAs) is essential for financial stability. If the company successfully controls bad loans, it can improve investor trust and enhance share price performance. -

Rural Economic Growth

Since CreditAccess Grameen serves rural borrowers, the overall economic conditions in villages, including agriculture and small business development, play a significant role in its performance. Economic growth in these areas can drive loan demand and profitability. -

Foreign and Institutional Investments

Strong interest from institutional investors and foreign funds indicates confidence in the company. Increased investments in CreditAccess Grameen can drive share prices higher due to higher liquidity and demand in the stock market.

Risks and Challenges for CreditAccess Grameen Share Price

-

High Dependence on Rural Economy

CreditAccess Grameen’s business is focused on rural areas, making it vulnerable to agricultural distress, monsoon failures, and economic slowdowns in villages. If rural borrowers struggle financially, loan repayments may decline, affecting the company’s growth and share price. -

Regulatory Changes and Compliance Risks

The microfinance sector is strictly regulated, and any sudden changes in government policies, interest rate caps, or lending restrictions can impact the company’s operations. Regulatory uncertainty can create volatility in its share price. -

Loan Defaults and Rising NPAs

Since the company lends to small borrowers with limited financial stability, there is always a risk of higher non-performing assets (NPAs). If defaults increase, profitability will decline, which may negatively impact the share price. -

Competition from Banks and Fintechs

Large banks and digital lending platforms are entering the microfinance space, offering easier and faster credit. Increased competition may reduce CreditAccess Grameen’s market share and put pressure on its earnings, affecting its stock performance. -

Interest Rate Fluctuations

If interest rates rise, borrowing costs for microfinance institutions increase, which can reduce profit margins. Higher rates can also make traditional banking more attractive to borrowers, impacting loan demand and the company’s growth. -

Global and Domestic Economic Slowdowns

Economic downturns, inflation, or job losses can affect borrowers’ ability to repay loans. A weaker economy could result in higher defaults, lower credit demand, and reduced investor confidence, leading to share price fluctuations. -

Limited Access to Capital

The company relies on external funding, including loans and investments, to expand its lending operations. If access to funds becomes expensive or limited due to market conditions, it may slow down business growth and affect stock performance.

Read Also:- REC Share Price Target Tomorrow 2025 To 2030