Coal India Share Price Target Tomorrow 2025 To 2030

Coal India Limited (CIL) is the largest coal mining company in India and a key supplier of coal to the power and industrial sectors. Being a government-owned company, it plays a crucial role in India’s energy security. The company benefits from strong domestic demand and a monopoly in the sector. Coal India Share Price on NSE as of 19 March 2025 is 395.80 INR.

Current Market overview of Coal India Share Price

- Open: 390.05

- High: 397.00

- Low: 388.80

- Previous Close: 389.30

- Volume: 3,226,685

- Value (Lacs): 12,766.38

- VWAP: 393.86

- Mkt Cap (Rs. Cr.): 243,828

- Face Value: 10

- UC Limit: 428.20

- LC Limit: 350.40

- 52 Week High: 543.55

- 52 Week Low: 349.25

Coal India Share Price Target Tomorrow 2025 To 2030

| Coal India Share Price Target Years | Coal India Share Price |

| 2025 | INR 550 |

| 2026 | INR 650 |

| 2027 | INR 750 |

| 2028 | INR 850 |

| 2029 | INR 950 |

| 2030 | INR 1050 |

Coal India Share Price Chart

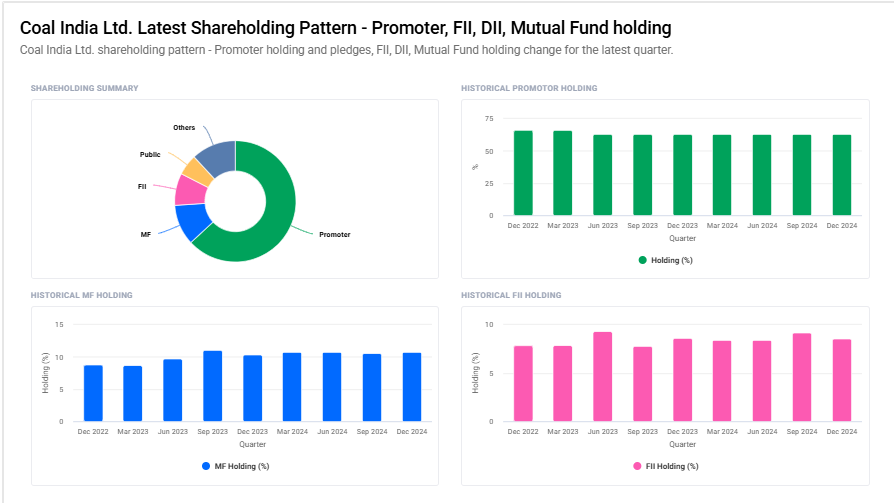

Coal India Shareholding Pattern

- Promoter: 63.1%

- FII: 8.6%

- DII: 22.7%

- Public: 5.6%

Key Factors Affecting Coal India Share Price Growth

-

Coal Production and Supply

Coal India’s ability to meet production targets and ensure a steady supply to power plants and industries directly impacts its revenue and share price. Higher output and consistent supply boost investor confidence. -

Government Policies and Regulations

Being a state-owned company, Coal India’s operations are influenced by government policies on coal mining, pricing, and environmental norms. Supportive policies can drive growth, while stricter regulations may pose challenges. -

Global and Domestic Demand for Coal

The demand for coal from power plants, steel industries, and other sectors plays a crucial role in the company’s financial performance. Strong demand leads to higher sales and better profitability, pushing share prices up. -

Coal Prices and Profit Margins

Fluctuations in coal prices affect the company’s earnings. If prices remain high due to increased demand or supply constraints, it benefits Coal India’s profitability, leading to share price growth. -

Expansion and Modernization Plans

Investments in new mines, better technology, and infrastructure improvements can enhance efficiency and production capacity. Investors look at these developments as a positive sign for future growth. -

Dividends and Financial Performance

Coal India is known for paying attractive dividends, making it a preferred choice for income-seeking investors. Strong financial results and consistent dividends support share price appreciation. -

Environmental and Sustainability Initiatives

The shift towards renewable energy sources and environmental concerns about coal usage impact the long-term demand for coal. If Coal India adapts to sustainable practices, it can maintain investor confidence and secure long-term growth.

Risks and Challenges for Coal India Share Price

-

Declining Demand for Coal

With the global push towards renewable energy and cleaner alternatives, the demand for coal is gradually decreasing. This shift could impact Coal India’s long-term growth and profitability. -

Government Regulations and Policies

Being a state-owned company, Coal India is highly influenced by government policies. Stricter environmental regulations, changes in coal pricing policies, or unexpected government interventions can create uncertainty for investors. -

Operational and Mining Challenges

Coal mining involves significant risks, including land acquisition issues, labor strikes, and logistical challenges. Any disruptions in operations can lead to production shortfalls and affect revenue, impacting share prices. -

Environmental Concerns and Legal Issues

Increasing awareness about climate change and pollution has led to stronger environmental laws. Legal battles and protests against coal mining projects can slow down expansion and affect investor confidence. -

Fluctuations in Global Coal Prices

Even though Coal India primarily serves the domestic market, global coal price volatility can influence its profitability. If international coal prices drop, domestic buyers may prefer cheaper imports, reducing Coal India’s sales. -

Competition from Private and International Players

The entry of private coal miners and imports from other countries can create competitive pressure. If Coal India fails to improve efficiency and cost-effectiveness, it may lose market share, affecting its financial performance. -

High Dependence on Power Sector

A major portion of Coal India’s revenue comes from power generation companies. Any slowdown in the power sector or shift to alternative energy sources could significantly impact its coal sales and share price performance.

Read Also:- Lemon Tree Share Price Target Tomorrow 2025 To 2030